Self Employed Deductions Canada, How To Save Taxes For The Self Employed In Canada Youtube

Self employed deductions canada Indeed recently is being sought by users around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about Self Employed Deductions Canada.

- The Be All End All List Of Small Business Tax Deductions

- How To Get Tax Return In Canada Your Complete Guide

- Part Vii Business Income And Expenses The Basic Format For Reporting Income And Expenses Of Any Business Is The Same Pdf Free Download

- Business Plan Small Expense Spreadsheet Expenses Suyhi Margarethaydon Com For Income And Free Tax Canada Tracking Rainbow9

- Your Bullsh T Free Guide To Canadian Tax For Working Holidaymakers

- Income Taxes Ppt Download

Find, Read, And Discover Self Employed Deductions Canada, Such Us:

- Lxis3euwexiysm

- The Be All End All List Of Small Business Tax Deductions

- Home Office Deductions For Self Employed And Employed Taxpayers 2020 Turbotax Canada Tips

- Retireware Retirement Planning Software Online Tools And Content

- What Are Some Self Employed Tax Deductions In Canada

If you are searching for The Furlough Scheme Rules you've reached the right place. We ve got 102 graphics about the furlough scheme rules adding pictures, photos, photographs, backgrounds, and more. In such webpage, we also have variety of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Its also important to develop a system to file and track your receipts and expenses so that you are organized when it comes to tax time.

The furlough scheme rules. The cpp can provide basic benefits when you retire or if you become disabled. Tax season is upon us and its hardly an event that people anticipate with pleasure. Treat the value of the inventory as a purchase of goods for resale and include it in the calculation of cost of goods sold in your income statement at the end of the year.

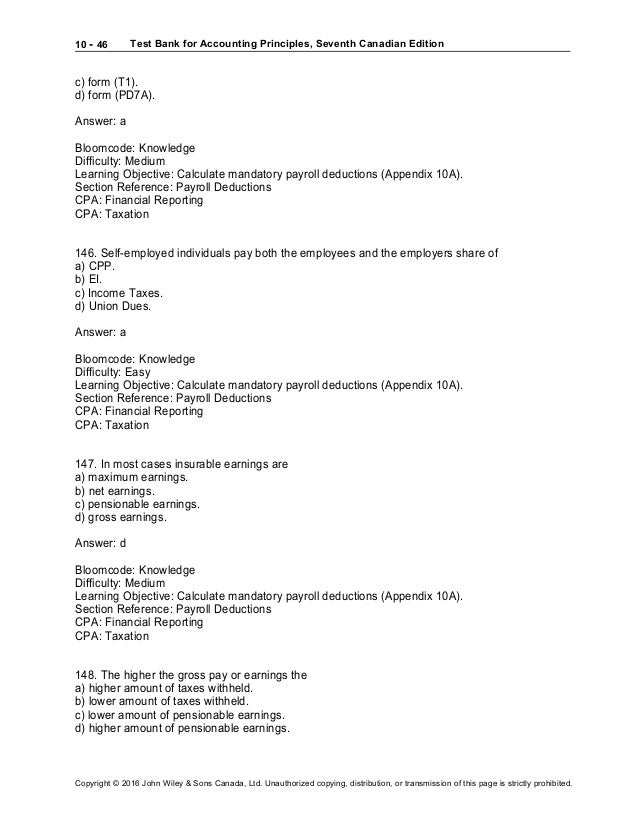

Employers employees and most self employed individuals must contribute to the cpp. Business operating expenses any money you spend running your business is considered. These expenses offset your income lowering your profits on paper and reducing your tax burden.

Employment under the self. For more information see chapter 5 eligible capital expenditures in guide t4002 self employed business professional commission farming and fishing income. There are times when the canada revenue agency might consider you an employee rather than self employed.

Self employed tax deductions in canada. For more information see guide t4002 self employed business professional commission farming and fishing income. Make sure taxman sees you as self employed.

Self employment leads to so many advantages so many expenses you can claim against your earnings as long as those expenses contributed to your business says investment advisor mallory saugeen from st. If youre doing. Employee or self employed worker.

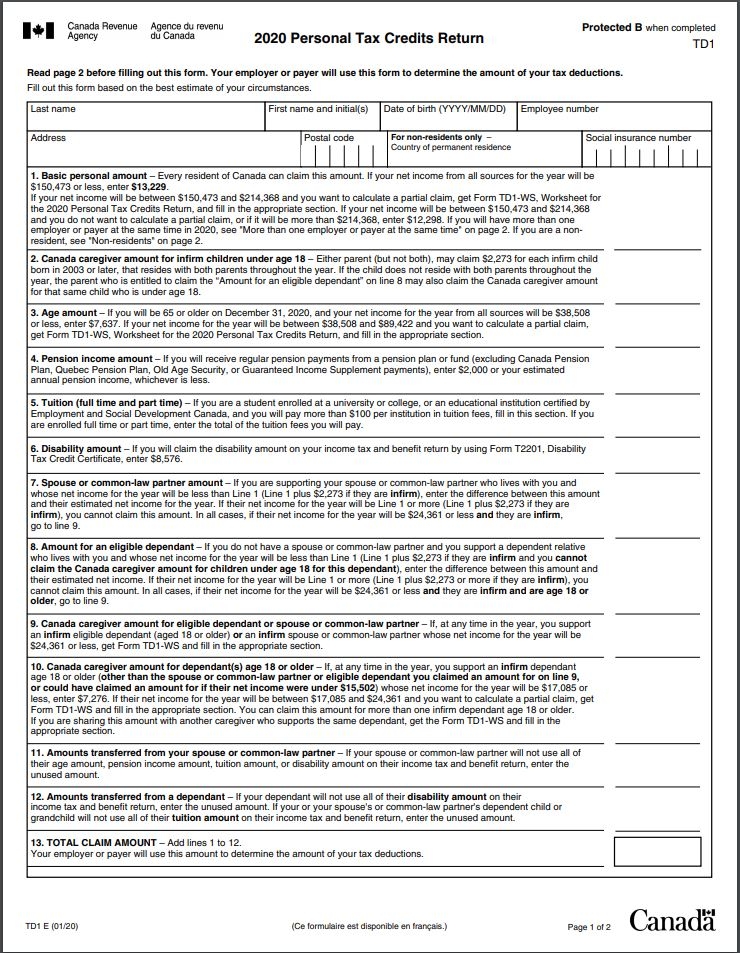

Despite the headache filing taxes is a straightforward process and you can do it on your own. The statement of business or professional activities form t2125 walks you through all categories of self employed expenses. Use the self employment part of your musical instrument expenses to calculate the net self employment income you report on line 13700 of your income tax and benefit return.

If youre self employed its important to take the time to fully understand self employment tax deductions so you dont miss deductions that could significantly lower your tax bill. If you are self employed the canada revenue agency allows you to deduct a range of business expenses. By david in guide and tips tags financial tips september 2 2020september 3 2020.

Here is a look at the main deductions you can claim.

More From The Furlough Scheme Rules

- Government Policy Makers Often Must Decide How To Balance

- Furlough Scheme Uk September 2020

- Furlough Scheme Extended Uk

- Government Company Logo

- Extension Of Furlough Uk

Incoming Search Terms:

- Quickbooks Self Employed Review 2020 Pricing Ratings Features Extension Of Furlough Uk,

- Quickbooks Self Employed Review 2020 Pricing Ratings Features Extension Of Furlough Uk,

- Maximizing Tax Deductions For The Self Employed Mileiq Canada Extension Of Furlough Uk,

- Coronavirus Covid 19 Canada Resources For Landlords And Tenants Extension Of Furlough Uk,

- 8 2 3 Main Groups Of Income Canada Ca Extension Of Furlough Uk,

- Turbotax Self Employed Online 2019 Turbotax 2020 Canada Extension Of Furlough Uk,