State Government Taxes In Nigeria, Tax Administration And Revenue Generation Of Lagos State Government Nigeria Nigeria Corruption

State government taxes in nigeria Indeed recently has been hunted by consumers around us, perhaps one of you personally. Individuals are now accustomed to using the net in gadgets to see image and video data for inspiration, and according to the title of this post I will talk about about State Government Taxes In Nigeria.

- Types Of Taxes In Nigeria

- Top 10 States In Nigeria With Highest Tax Revenue In 2019

- Pdf Impact Of Tax Reforms And Economic Growth Of Nigeria A Time Series Analysis Mustapha Nasir Usman Academia Edu

- Doc The Ethics Of Tax Evasion Perceptual Evidence From Nigeria Docx Accountants Connect Academia Edu

- Tax Administration And Revenue Generation Of Lagos State Government Nigeria Semantic Scholar

- Nigerian Taxation Research Papers Academia Edu

Find, Read, And Discover State Government Taxes In Nigeria, Such Us:

- Tax Matters Nigeria September 2019

- An Assessment Of Revenue Generation Drive Of Lagos State Government T

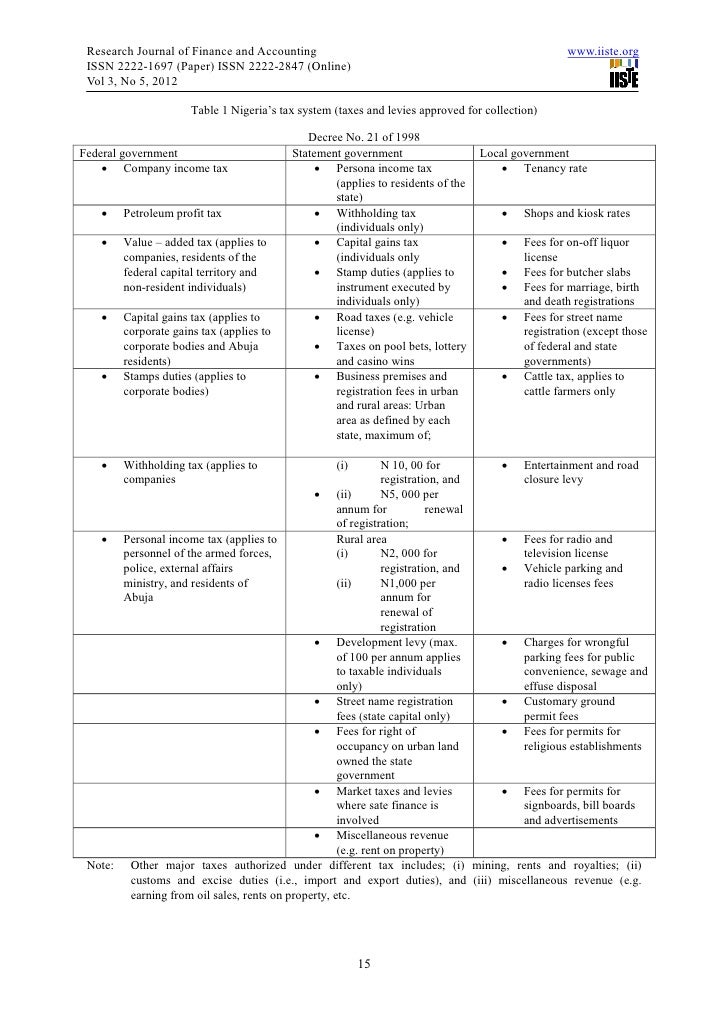

- Tax Jurisdiction In Nigeria Download Table

- Nigeria Mobilizing Resources To Invest In People

- Qitmeer Public Chain Solution For Tax Reformation And Transparency In Nigeria Business Development Qitmeer Talk

If you re searching for What Is Furlough Based On you've arrived at the right location. We have 100 images about what is furlough based on including images, photos, photographs, wallpapers, and more. In these webpage, we also have variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Calameo Tax Management At Bp Holdings Expert Says Use Of Consultants For Tax Collection By All Tiers What Is Furlough Based On

The state government is the second tier of government in nigeria.

What is furlough based on. Before going into the types of taxes in nigeria its good to know that taxation is affected by the individuals and institutions of a country to the government. There are 36 states in nigeria the taxes they collect are. The local government collects taxes through the local government revenue committee.

The law is enacted to regulate the administration of and unify the levies and taxes collected by lgcs and lcdas within lagos state the state. According to federal inland revenue service firs. Types of taxes in nigeria 1.

I personal income tax. The body in charge of tax regulations in nigeria there are nine 9 types of taxes in nigeria. Ii road taxes iii pools betting and lotteries.

They are responsible for the assessment and collection of all taxes fines and rates under its jurisdiction and account for all revenue collected to the chairman of the local government. The law is to be cited as local government levies approved collection list law 2010 the law. Companies income taxes cit cit is one of the major types of taxes collected by firs.

A tax is a compulsory financial contribution made by private individuals groups and institutions towards the expenditure of the government. Iv business premises registration v development levy. In nigeria the local government is the last tier of government.

See below a schedule of taxes and rates due to local government authority. While competitive enough to bolster the countrys appeal to foreign investors and skilled expats nigerias tax system is also tasked with the responsibility of providing the government with enough resources to finance the countrys development company tax and petroleum royalties in fact account for the primary source of government revenue. Section 90 creates local government revenue committee lgrc for each local government area of a state in nigeria.

Steps in paying taxes in nigeria. Nigerias tax system is tasked with the responsibility of providing the government with enough resources to finance the countrys development company tax and petroleum royalties in fact account for the primary source of government revenue. It is the government that is closer to the people.

More From What Is Furlough Based On

- Government Unemployment Stimulus Package

- Government Guidelines For Masks In Offices

- Perbedaan Government Dan Governance

- Self Employed Nail Technician

- Government College University Lahore Uniform

Incoming Search Terms:

- Doc Arguement By Tax Professionals As To Personal Income Tax Contributes Least Among The Taxes Collected By The States And The Comparity Between Pit And Other Tax In Yobe State Muhammad Government College University Lahore Uniform,

- Approved Taxes And Levies Collection By The Nigerian Federal State Local Government Government College University Lahore Uniform,

- Faac Fg States Lgas Share N769 52bn For July Check More At Https Xtremenaija Com Faac Fg States Lgas Share N769 Accounting Scholarships Local Government Government College University Lahore Uniform,

- An Assessment Of Revenue Generation Drive Of Lagos State Government T Government College University Lahore Uniform,

- The Increase In The Price Of Bread In United State And Nigeria Market Equilibrium And Tax Imposed Microeconomic Individual Assignment Government College University Lahore Uniform,

- Government Spending Wikipedia Government College University Lahore Uniform,