Self Employed Health Insurance Deduction Basis Limitation, Shop Affordable Self Employed Health Insurance In All 50 States

Self employed health insurance deduction basis limitation Indeed recently is being hunted by users around us, maybe one of you. Individuals now are accustomed to using the net in gadgets to view video and image data for inspiration, and according to the name of this post I will talk about about Self Employed Health Insurance Deduction Basis Limitation.

- Solved Can A 2 Sub S Owner Deduct Health Ins On A Family Plan On 1040 Line 29 If His Wife Also Has A Sub S With A Health Plan Can Either Ever

- Deducting Health Insurance Premiums If You Re Self Employed Turbotax Tax Tips Videos

- Shop Affordable Self Employed Health Insurance In All 50 States

- Breaking Down The Self Employed Health Insurance Deduction Eric Nisall

- Publication 590 A 2019 Contributions To Individual Retirement Arrangements Iras Internal Revenue Service

- Rules For Tax Deductibility Of Long Term Care Insurance

Find, Read, And Discover Self Employed Health Insurance Deduction Basis Limitation, Such Us:

- Acct321 Chapter 06

- Https Www Cdc Gov Nchs Data Misc Hincov Pdf

- Breaking Down The Self Employed Health Insurance Deduction Eric Nisall

- Maximizing Premium Tax Credits For Self Employed Individuals

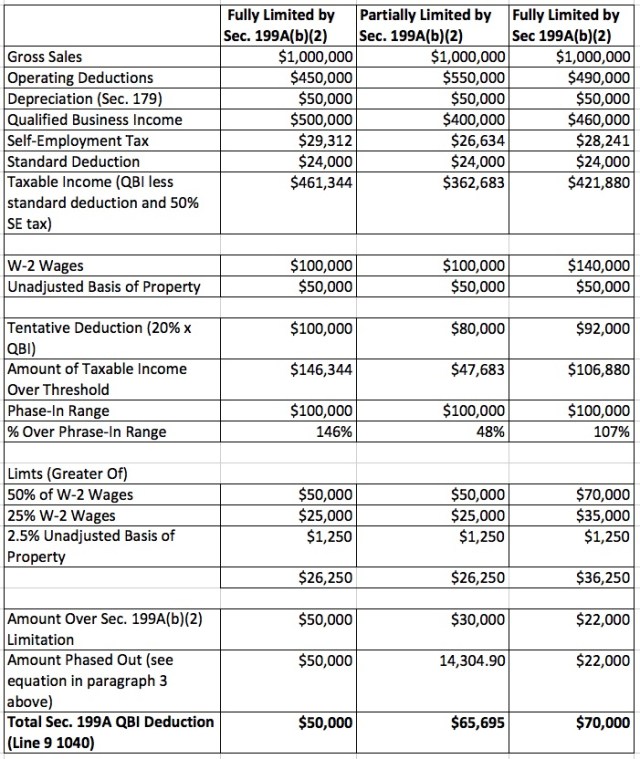

- The 199a Qbi Deduction Production Income Strategy

If you re searching for Government Spending Chart 2019 you've arrived at the perfect location. We have 100 images about government spending chart 2019 adding images, photos, pictures, backgrounds, and more. In these webpage, we also provide number of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Self employed people who cant get subsidized health insurance through a spouse can deduct premiums.

Government spending chart 2019. In a nutshell the self employed health insurance deduction allows eligible self employed folks to deduct up to 100 of health dental and long term care insurance premiums for themselves and for their spouses dependents and non dependent children under age 27. It is a special personal deduction you take on the first page of your form 1040 as self employed health insurance. There are a couple of catches to this deduction.

This health insurance write off is entered on page 1 of form 1040 which means you benefit whether or not you itemize your deductions. Long term care insurance is allowed as a deduction subject to a dollar limitation. Do i have to itemize deductions to take this deduction.

If you have medicare coverage you may deduct your medicare premiums as part of this deductionthis includes all medicare parts not just part b. If you are self employed you may be eligible to deduct premiums that you pay for medical dental and qualifying long term care insurance coverage for yourself your spouse and your dependents. A business deduction reduces the amount of your income subject to self employment taxes.

It can also cover your children under age 27 who may not be your dependents. Your self employment income is calculated on schedule c or f and it must be equal to or exceed the amount of your health insurance deduction. However you can deduct the full cost of certain meals.

For example you can deduct the full cost of the following meals. The plan can cover you your spouse and your dependents. When both the self employed health insurance deduction and the premium tax credit are involved in a return there situations where the circular calculation that this involves does not converge to amount that is within 1.

You can deduct self employed health insurance premiums directly on line 28 of form 1040. Medical insurance is allowed as a deduction subject to a dollar limitation. You can only take the 12000.

Life insurance is allowed as a deduction. This is not a business deduction. You can generally deduct only 50 of the cost of furnishing meals to your employees.

Deduction limit on meals. This means it doesnt reduce your business income for self employment tax purposes. Claiming the self employed health insurance deduction with the premium tax credit.

The cost of insurance for dependent children. Who can my self employed health insurance plan cover. For example if your business earned 12000 but premiums cost you 15000 you cant claim the entire 15000.

If you qualify this deduction will reduce your adjusted gross income agi. Which of the following is true about the self employed health insurance deduction.

More From Government Spending Chart 2019

- Furlough Extension England

- Is Uk Furlough Scheme A Loan

- The Furlough Scheme Cannot Be Extended Without First Being Fixed

- Market Failure And Government Intervention Essay

- Self Employed Contractor Invoice Template

Incoming Search Terms:

- Maximizing Premium Tax Credits For Self Employed Individuals Self Employed Contractor Invoice Template,

- Section 106 Health Insurance Tax Deduction For Employer Groups Self Employed Contractor Invoice Template,

- 2 Self Employed Contractor Invoice Template,

- Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2 Self Employed Contractor Invoice Template,

- Navigating Through 199a And Under The Radar Irs Guidance On Qbi Accounting Today Self Employed Contractor Invoice Template,

- The 411 On The Self Employed Health Insurance Deduction Taxact Blog Self Employed Contractor Invoice Template,