Self Employed Tax Form 1040, Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

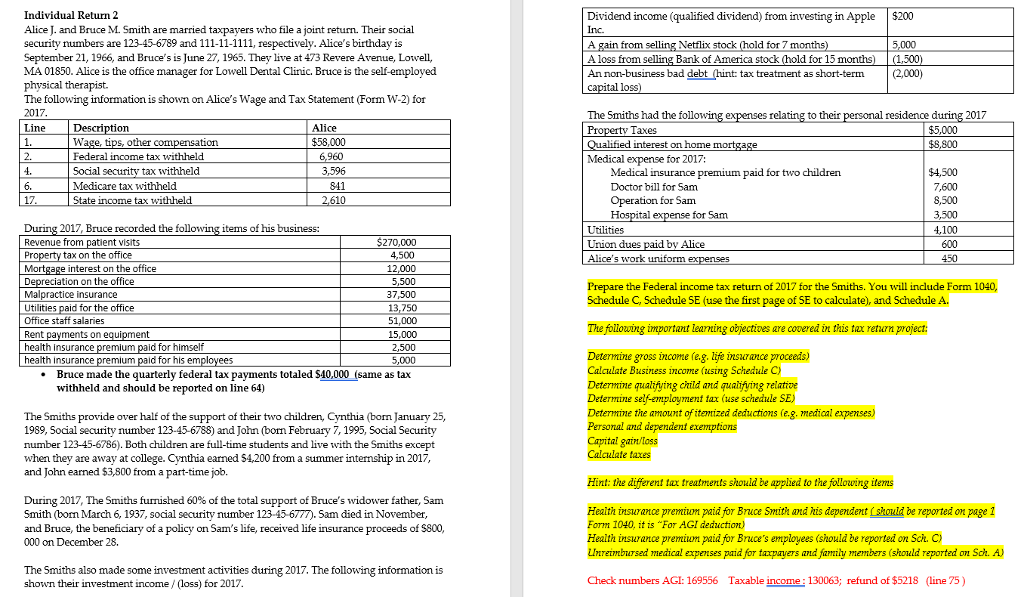

Self employed tax form 1040 Indeed lately has been sought by users around us, perhaps one of you. People now are accustomed to using the net in gadgets to view video and image data for inspiration, and according to the name of this article I will talk about about Self Employed Tax Form 1040.

- A Look At The Proposed New Form 1040 And Schedules Don T Mess With Taxes

- 2019 Form Irs 1040 Schedule C Fill Online Printable Fillable Blank Pdffiller

- Who S Required To Fill Out A Schedule C Irs Form

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrkeioaygqk31pbtx8ajvjwrrk7hgul Zfzejrqorgy7u0dvzll Usqp Cau

- Is New 1040 Tax Form Deceptively Simple Or Just Deceptive Sfchronicle Com

- Https Www Guidestone Org Media Guidestone Corporate Ministry Tools Mintaxguide 2112 Mintaxguidesec4 Pdf La En

Find, Read, And Discover Self Employed Tax Form 1040, Such Us:

- Self Employed

- 1040 Schedule 2 Drake18 And Drake19 Schedule2

- Everything Old Is New Again As Irs Releases Form 1040 Draft

- 1040 Schedule 4 Drake18 Schedule4 Schedulese

- Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

If you re searching for Government E Marketplace Png you've arrived at the right place. We ve got 104 graphics about government e marketplace png adding pictures, photos, pictures, backgrounds, and much more. In such page, we also have variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

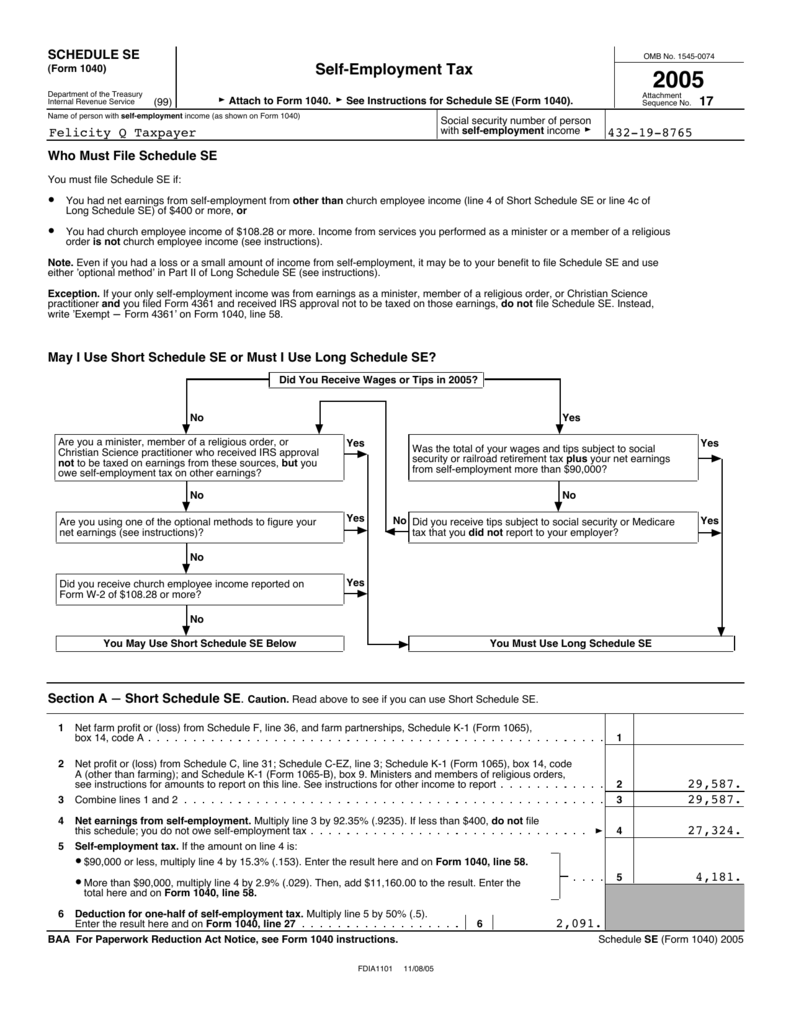

This tax applies no matter how old you are and even if you are already getting social security or medicare benefits.

Government e marketplace png. Self employment tax return including the additional child tax credit for bona fide residents of puerto rico form 1065 schedule k 1 partners share of income deductions credits etc. Self employment tax and estimated tax payments all about filling out schedule c the main tax form for the self employed business assets depreciation and the section 179 deduction. When the end of the tax year rolls around the process of trying to figure out taxes can be frustrating overwhelming and time consuming.

The goal for most is to get in get out and move on as quickly as possible. Use this form to pay tax on income that is not subject to withholding ie earnings from self employment rents etc 1040 or 1040 sr se self employment tax. In general you must pay self employment tax if.

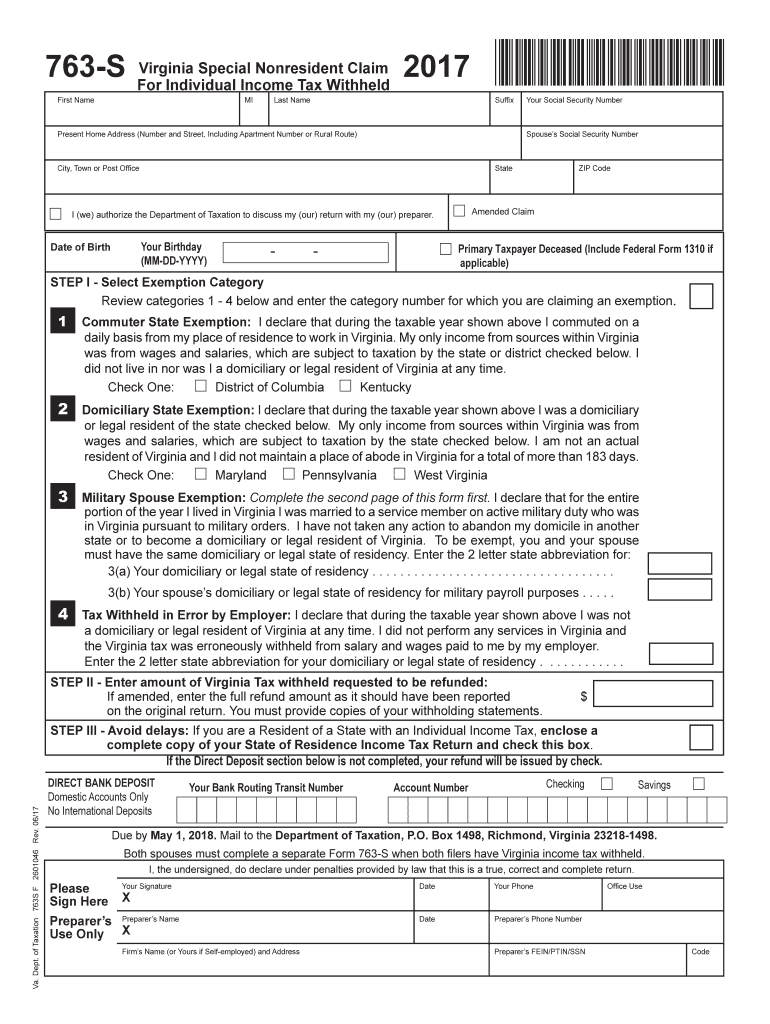

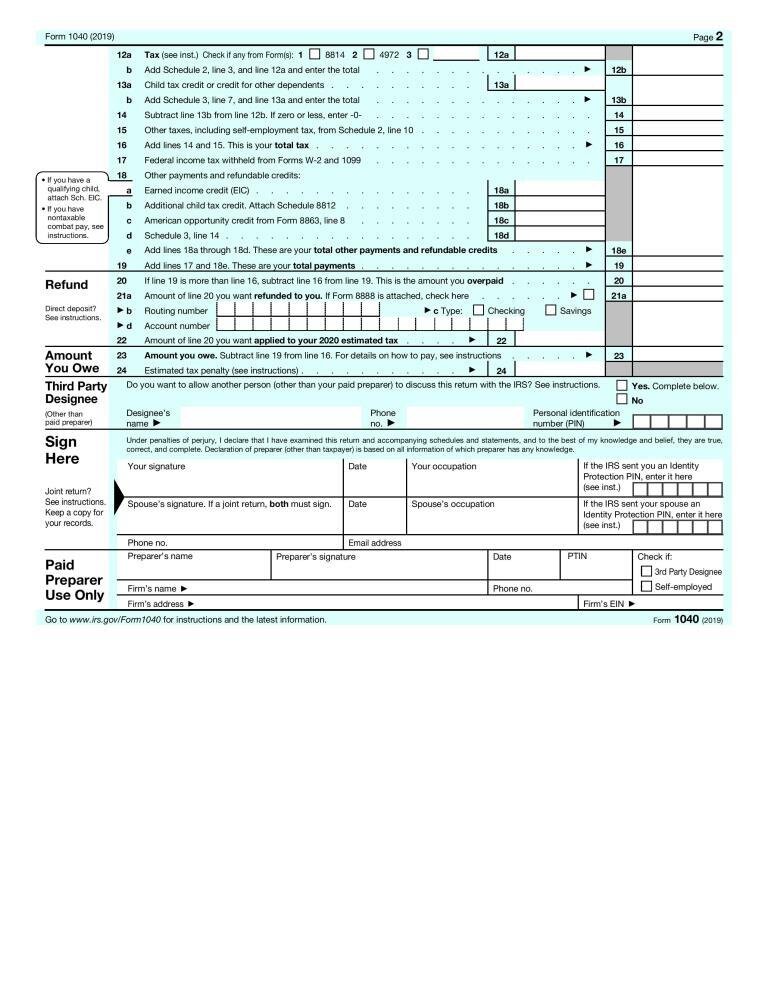

1040 es estimated tax for individuals. Use schedule se form 1040 or 1040 sr to figure the tax due on net earnings from self employment. Use schedule se form 1040 or 1040 sr to figure the tax due on net earnings from self employment.

Those complex form 1040 instructions can be an especially large headache for small business owners and the self employed. You will need your prior years annual tax return in order to fill out form 1040 es. While you are a debtor in a chapter 11 bankruptcy case your net profit or loss from self employment for example from schedule c or schedule f will not be included in your form 1040 income.

Your net earnings from self employment were 400 or more or. You had church employee income of 10828 or more. The social security administration uses the information from schedule se to figure your benefits under the social security program.

Who must pay self employment tax. Form 1040 es contains a worksheet that is similar to form 1040 or 1040 sr. Use the worksheet found in form 1040 es estimated tax for individuals to find out if you are required to file quarterly estimated tax.

Form 1040 is required for individuals who are self employed because it accounts for the self employment tax. Your payment of social security and medicare taxes is called self employment tax. Instead it will be included on the income tax return form 1041 of the bankruptcy estate.

More From Government E Marketplace Png

- Government To Government E Commerce Examples

- List Of Government Grants For Individuals

- How Will Self Employed Furlough Be Calculated

- Types Of Government Chart Worksheet

- Punjab Government New Number Plate

Incoming Search Terms:

- Self Employed Estimated Tax Payments Explained Punjab Government New Number Plate,

- Fill Free Fillable Self Employment Tax Form 1040 Schedule Se Pdf Form Punjab Government New Number Plate,

- How Much Is Self Employment Tax How Do You Pay It Punjab Government New Number Plate,

- The New 2019 Form 1040 Sr U S Tax Return For Seniors Generally Mirrors 2019 Form 1040 Conejo Valley Guide Conejo Valley Events Punjab Government New Number Plate,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctw7rwjhqvgpuzhoimbk04bp1 H 6gjv1nh Btkch8o6odh0gpz Usqp Cau Punjab Government New Number Plate,

- Form 1040 Gets A Makeover For 2018 Insights Blum Punjab Government New Number Plate,