1040 Tax Form For Self Employed, Fillable Online 2017 Form 1040 Pr Self Employment Tax Form Puerto Rico Spanish Version Fax Email Print Pdffiller

1040 tax form for self employed Indeed lately has been hunted by users around us, maybe one of you personally. People now are accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the title of this article I will discuss about 1040 Tax Form For Self Employed.

- How To File Taxes As An Independent Contractor A Guide Benzinga

- How To Report And Pay Taxes On 1099 Income

- How To File 2019 Schedule C Tax Form 1040 Tax Form Everlance Blog

- Irs Form 1040 Ss Download Fillable Pdf Or Fill Online U S Self Employment Tax Return Including The Additional Child Tax Credit For Bona Fide Residents Of Puerto Rico 2019 Templateroller

- Blank Irs Federal Tax Form Schedule 2 For Reporting Additional Taxes Stock Photo Alamy

- Form 1040 Ss U S Self Employment Tax Return Form 2014 Free Download

Find, Read, And Discover 1040 Tax Form For Self Employed, Such Us:

- Irs Form 1040 1040 Sr Schedule Se Download Fillable Pdf Or Fill Online Self Employment Tax 2019 Templateroller

- How To Do Self Employed Taxes

- The Ins And Outs Of Form 1040 The Individual Taxpayer S Tax Return

- Form 1040 Gets An Overhaul Under Tax Reform Putnam Wealth Management

- A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

If you are looking for Government Laptop Scheme For Students you've reached the perfect place. We ve got 104 images about government laptop scheme for students including pictures, photos, pictures, backgrounds, and much more. In such web page, we also have number of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

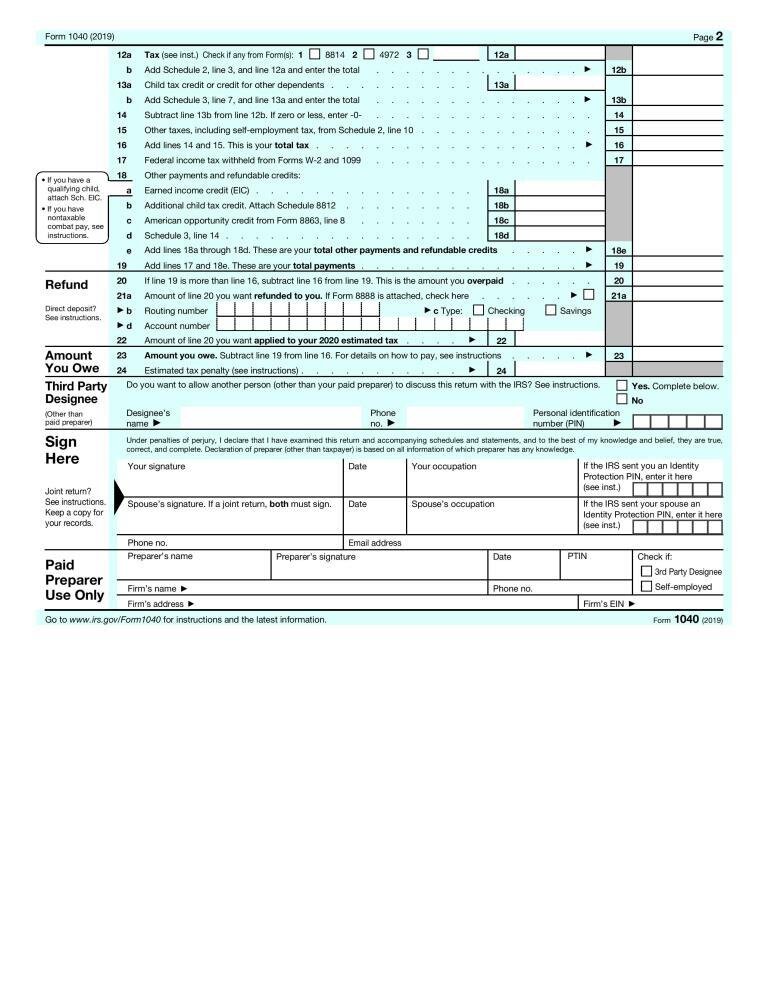

Form 1040 es contains a worksheet that is similar to form 1040 or 1040 sr.

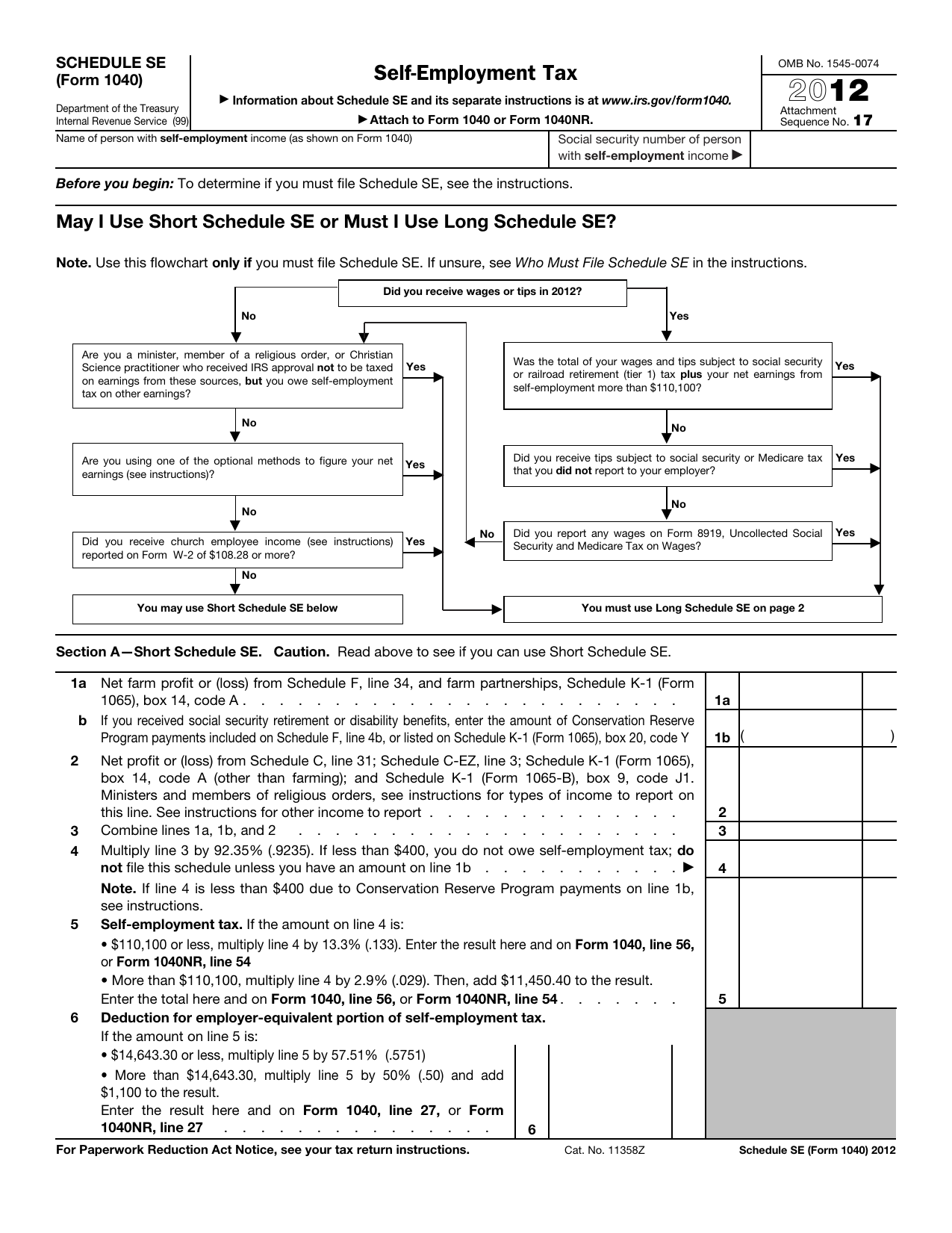

Government laptop scheme for students. Information about schedule se form 1040 self employment tax including recent updates related forms and instructions on how to file. Schedule 1 form 1040 or 1040 sr line 14 or. Enter the result here and on.

Schedule se form 1040 2018. Who must pay self employment tax. For paperwork reduction act notice see your tax return instructions.

Multiply line 5 by 50 050. Schedule se form 1040 is used by self employed persons to figure the self employment tax due on net earnings. Your net earnings from self employment were 400 or more or.

You will need your prior years annual tax return in order to fill out form 1040 es. You had church employee income of 10828 or more. Form 1040nr line 55.

Schedule se form 1040 or 1040 sr self employment tax pdf instructions for schedule se form 1040 or 1040 sr self employment tax pdf schedule k 1 form 1065 partners share of income credits deductions etc. In general you must pay self employment tax if. Those complex form 1040 instructions can be an especially large headache for small business owners and the self employed.

Self employment tax and estimated tax payments all about filling out schedule c the main tax form for the self employed business assets depreciation and the section 179 deduction. When the end of the tax year rolls around the process of trying to figure out taxes can be frustrating overwhelming and time consuming. 6 deduction for one half of self employment tax.

Multiply line 5 by 50 050. This form shall be attached to either forms 1040 1040nr or 1041. The goal for most is to get in get out and move on as quickly as possible.

Form 1040 line 57 or. Form 1040 is required for individuals who are self employed because it accounts for the self employment tax. A self employed sole proprietor has to declare in schedule c of form 1040 any income gain or loss from work.

6 deduction for one half of self employment tax. Your payment of social security and medicare taxes is called self employment tax. On schedule c report your income or losses from a business you operated or a profession you practiced as a sole proprietor or freelancerif you accrued expenses of 5000 or less you might be eligible for the schedule c ez short form.

Schedule se form 1040 or 1040. Form 1040nr line 27. Form 1040 nr line 27.

Use the worksheet found in form 1040 es estimated tax for individuals to find out if you are required to file quarterly estimated tax. Enter the result here and on. This form shall be attached to either forms 1040 1040nr or 1041.

Form 1040 nr line 55.

More From Government Laptop Scheme For Students

- Government Of India Act 1909 Upsc

- Self Employed Furlough Scheme Uk

- Government Corruption Artwork

- Domestic Affairs Government

- E Government Adalah

Incoming Search Terms:

- How To Fill Out Your Tax Return Like A Pro The New York Times E Government Adalah,

- Self Employment Tax The Benefit Bank Self E Government Adalah,

- Self Employed Estimated Tax Payments Explained E Government Adalah,

- Irs 1040 Schedule Se 2010 Fill Out Tax Template Online Us Legal Forms E Government Adalah,

- Form 1040 Ss U S Self Employment Tax Return Form 2014 Free Download E Government Adalah,

- How To Fill Out Schedule Se Irs Form 1040 Youtube E Government Adalah,