Self Employed Tax, Calculating Your Tax With Self Employment Tax Calculator Is Safe Providing Details Is Just What People Need To Do Every Self Employment Employment Income Tax

Self employed tax Indeed recently has been sought by users around us, perhaps one of you personally. Individuals are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the title of the post I will talk about about Self Employed Tax.

- Calculating Your Tax With Self Employment Tax Calculator Is Safe Providing Details Is Just What People Need To Do Every Self Employment Employment Income Tax

- The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax Services Business Tax Deductions Business Tax Small Business Bookkeeping

- Gig Workers Self Employed Disregarded Llc

- How To Calculate Self Employment Tax In The U S With Pictures

- Do You Constantly Debate The Employed V Self Employed Argument Plus Accounting

- What Is The Self Employment Tax In 2020 Thestreet

Find, Read, And Discover Self Employed Tax, Such Us:

- How Do I Pay Tax On Self Employed Income Low Incomes Tax Reform Group

- A Simple Guide To Being A Freelancer And Self Employed Business Clan

- The Epic Cheat Sheet To Deductions For Self Employed Rockstars

- Do You Constantly Debate The Employed V Self Employed Argument Plus Accounting

- 1

If you re searching for Korean Government Scholarship Program Indonesia you've reached the ideal location. We ve got 104 graphics about korean government scholarship program indonesia including pictures, photos, pictures, wallpapers, and more. In such page, we additionally provide variety of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

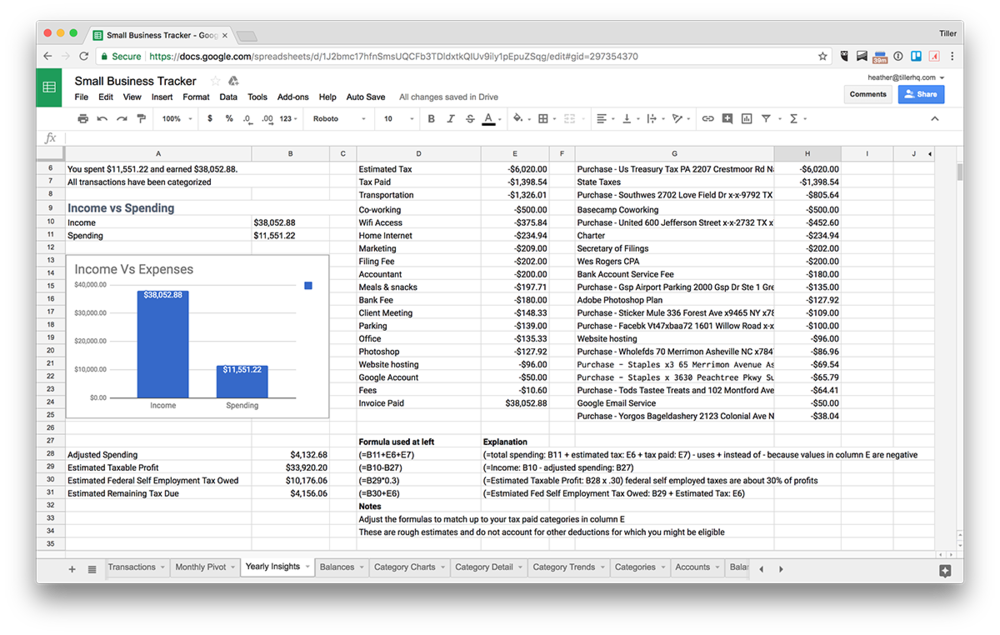

How to calculate self employment tax.

Korean government scholarship program indonesia. The medicare tax rate is 29. Total self employment tax rate is therefore 124 29 153 for both 2019 and 2020. Yes most self employed people pay class 2 nics if your profits are at least 6475 during the 202021 tax year or 6365 in the 201920 tax year.

Se tax is a social security and medicare tax primarily for individuals who work for themselves. The 153 self employment tax is composed of a 124 social security tax on the first 137700 of net self employment income for the year 2020 142800 in 2021 and a medicare tax of 29 on all net self employment income. You will pay an additional 09 medicare tax on the amount that your annual income exceeds 200000 for single filers 250000 for married filing jointly.

The self employment tax rate is 153. A self employed person having net income of exactly 132900 in. If youre a church worker your church employee income should be at least 10828 before you are required to file self employed tax.

What is self employment tax. It is similar to the social security and medicare taxes withheld from the pay of most wage earners. On 23 july 2020 the government announced the introduction of a new once off income tax relief measure.

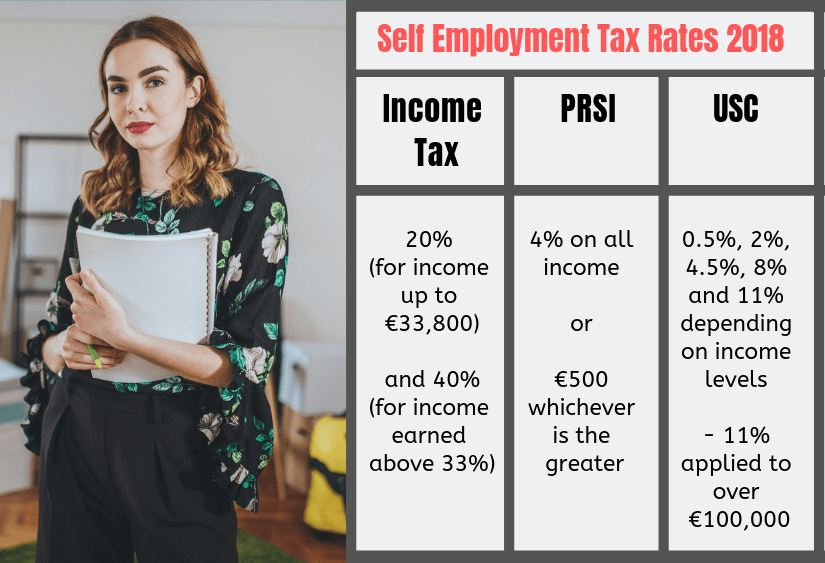

You are required to pay self employed tax if you earned 400 and above. Self employed facing prsi hike from 4pc to over 11pc self employed workers face four successive prsi budget hikes under proposals by a high level advisory body to the government. That rate is the sum of a 124 for social security and 29 for medicare.

Self employed individuals generally must pay self employment tax se tax as well as income tax. If youre over this limit you will pay 3 a week or 156 a year for the 201920 tax year and 305 a week or 15860 a year for the 202021 tax year. To pay self employed taxes you are required to have a social security number and an individual taxpayer identification number.

Self employment tax applies to net earnings what. The self employment tax is a tax paid by individuals who are their own bosses either through owning businesses being contractors or working as freelancers.

Budget 2017 Tax Rise For Self Employed What It Means Korean Government Scholarship Program Indonesia

More From Korean Government Scholarship Program Indonesia

- What Is Furlough Percentage For September

- Government Consulting Jobs Dc

- Government Regulated Monopoly Graph

- Has Furlough Been Extended In Scotland

- Furlough Extended Till End Of June

Incoming Search Terms:

- Free 6 Sample Self Employment Tax Forms In Pdf Furlough Extended Till End Of June,

- Self Employed Tax Codes What You Need To Know Furlough Extended Till End Of June,

- Self Employed Tax Changes 2020 21 Furlough Extended Till End Of June,

- What Are Some Self Employed Tax Deductions In Canada Furlough Extended Till End Of June,

- Self Employment Tax Will Crush America By 2020 When 40 Percent Will Be Freelancers Bobsullivan Net Furlough Extended Till End Of June,

- Self Employment Robergtaxsolutions Com Furlough Extended Till End Of June,