Self Employed Tax Brackets 2020, How Scandinavian Countries Pay For Their Government Spending

Self employed tax brackets 2020 Indeed recently is being sought by users around us, maybe one of you personally. People are now accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the name of the article I will talk about about Self Employed Tax Brackets 2020.

- Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

- Tax In A Changing World Of Work

- State Income Tax Wikipedia

- Publication 505 2020 Tax Withholding And Estimated Tax Internal Revenue Service

- Budget2017 Self Employment Tax Changes

- Income Tax Calculator Calculate Taxes Online Fy 2019 20

Find, Read, And Discover Self Employed Tax Brackets 2020, Such Us:

- Top Individual Income Tax Rates In Europe Tax Foundation

- An Overview Of Canada S Tax Brackets 2020 Turbotax Canada Tips

- Self Employment Tax Calculator 2020 Zrivo

- Listentotaxman Mobile Uk Salary Tax Calculator 2020 2021 Hmrc

- Ontario Tax Calculator The 2020 Income Tax Guide Kalfa Law

If you re searching for Gov Uk Furlough Scheme Self Employed you've come to the right place. We ve got 104 graphics about gov uk furlough scheme self employed adding pictures, photos, photographs, wallpapers, and much more. In such web page, we additionally have variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

On 23 july 2020 the government announced the introduction of a new once off income tax relief measure.

Gov uk furlough scheme self employed. When it comes to paying income tax there arent any differences in the tax rates you pay compared to employees. What are the self employed income tax rates for 2020 21. Here are some of the most common at a glance figures you might find useful for the next tax year.

The 202021 tax year in the uk runs from 6th april 2020 to 5th april 2021. In general these tax breaks are not specific to 2020 but are available in any year. You can use our 2020 21 income tax calculator to find out how much youll pay.

The self employment tax rate is 153. Self employed national insurance threshold rise. What is self employment tax.

Tax rates chargeable income from to rate subtract. Income tax loss relief for self employed. Both employed workers and self employed workers who pay class 4 contributions will be able to earn up to 9500 in 2020 21 up from 8632 in 2019 20 before they have to pay.

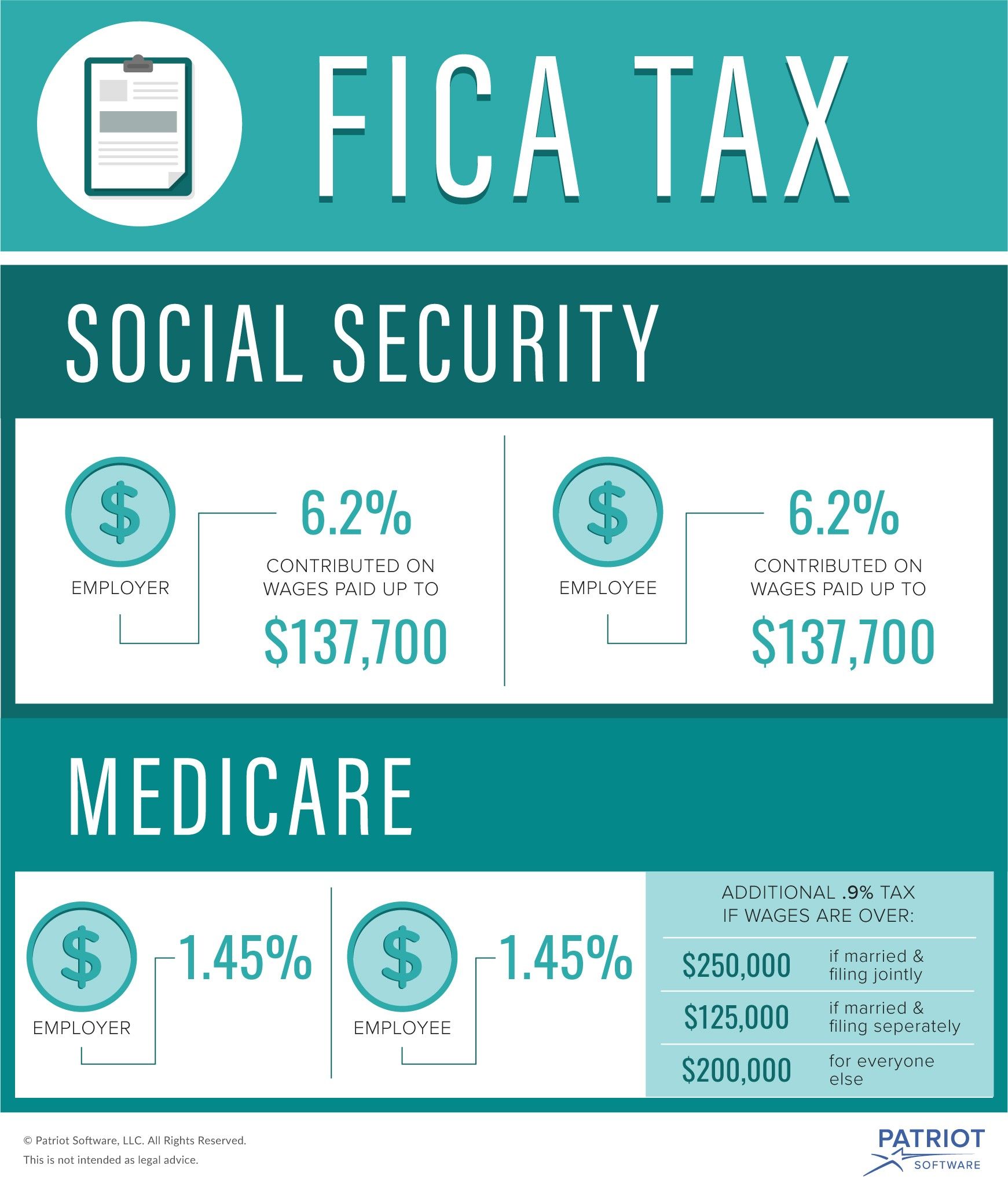

The self employed tax calculator is a quick tool based on internal revenue code 1401 to help a freelancer or self employed taxpayer to compute two taxes the social security tax and medicare tax. In the 2020 21 tax year self employed and employees pay. Businesses are generally allowed to deduct the costs of carrying on the trade or business.

Published on 5 january 2020. As part of the 2020 budget chancellor rishi sunak announced that the national insurance contribution nic thresholds for the 2020 21 tax year will rise. That rate is the sum of a 124 for social security and 29 for medicare.

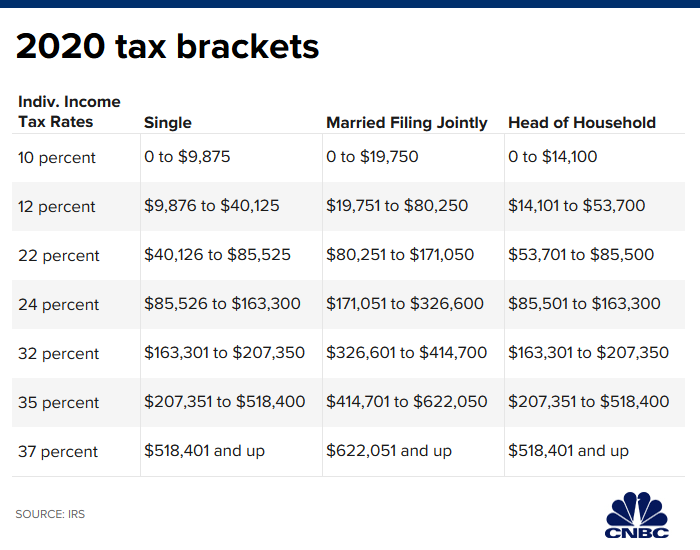

Brackets are assigned based on taxable income and applied at each bracket. Uk self employed tax rates 202021 at a glance. Since youre paying both portions for employer and employee of social security and medicare the rate breaks down as follows.

If youre self employed or working in the sharing economy you may be wondering which tax bracket you are in since any profits or losses from your sharing economy work is going. Tax returns for this tax year are generally due by 31st january 2022. For 2020 the self employment tax rate is 153 on the first 137700 worth of net income plus 29 on net income over 137700.

It is intended to benefit self employed people who were profitable in 2019 but as a result of the covid 19 pandemic will make a loss in 2020. Consider the general rules. Self employment tax applies to net earnings what.

These taxes must be paid by every individual carrying on business or profession on his employment income if such an income is more is 400 or moreor heshe earns 10828 or more in income.

More From Gov Uk Furlough Scheme Self Employed

- Government Tyranny Ancient Greece

- Today Government Vacancies

- New Furlough Scheme For Self Employed

- Printable Self Employed Invoice Template Excel

- Government Consulting Internships

Incoming Search Terms:

- 3 Government Consulting Internships,

- An Overview Of Canada S Tax Brackets 2020 Turbotax Canada Tips Government Consulting Internships,

- Uk Tax Rates For Employers Small Businesses And The Self Employed In 2020 21 The Accountancy Partnership Government Consulting Internships,

- Train Law 2020 Income Tax Tables In The Philippines Pinoy Money Talk Government Consulting Internships,

- What S The Income Tax System In Montenegro Tax Types And Tax Rates In Montenegro Government Consulting Internships,

- New Income Tax Table 2020 Philippines Government Consulting Internships,