What Is My Furlough Pay Based On, Covid 19 Furlough Under Job Retention Scheme Faqs Make Uk

What is my furlough pay based on Indeed recently is being hunted by users around us, maybe one of you. Individuals now are accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the title of this post I will discuss about What Is My Furlough Pay Based On.

- Job Retention Scheme Furlough Faqs Covid 19 Accounting 4 Contractors

- Yq9tuocrq28b6m

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrllokkqm Qff5qbqurbrwk9u3hyefq3ttsjlrnqmw Usqp Cau

- Holiday Entitlement Pay And Furlough What Are My Employees Entitled To Howell Jones

- Furlough Fraud Investigations What Should My Business Do Fsb The Federation Of Small Businesses

- Furloughed Workers Moneysoft

Find, Read, And Discover What Is My Furlough Pay Based On, Such Us:

- During A Pandemic An Unanticipated Problem Out Of Work Health Workers The New York Times

- Hmrc Confirms Compulsory Commission Can Be Paid To Furloughed Sales Staff Car Dealer Magazine

- Furloughed Vs Laid Off Advantages Disadvantages And Differences Workest

- Y S6hendcie7gm

- Holiday Entitlement Pay And Furlough What Are My Employees Entitled To Howell Jones

If you are searching for Local Lockdown Furlough Scheme you've come to the perfect location. We have 104 graphics about local lockdown furlough scheme including pictures, photos, photographs, wallpapers, and more. In these page, we additionally provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

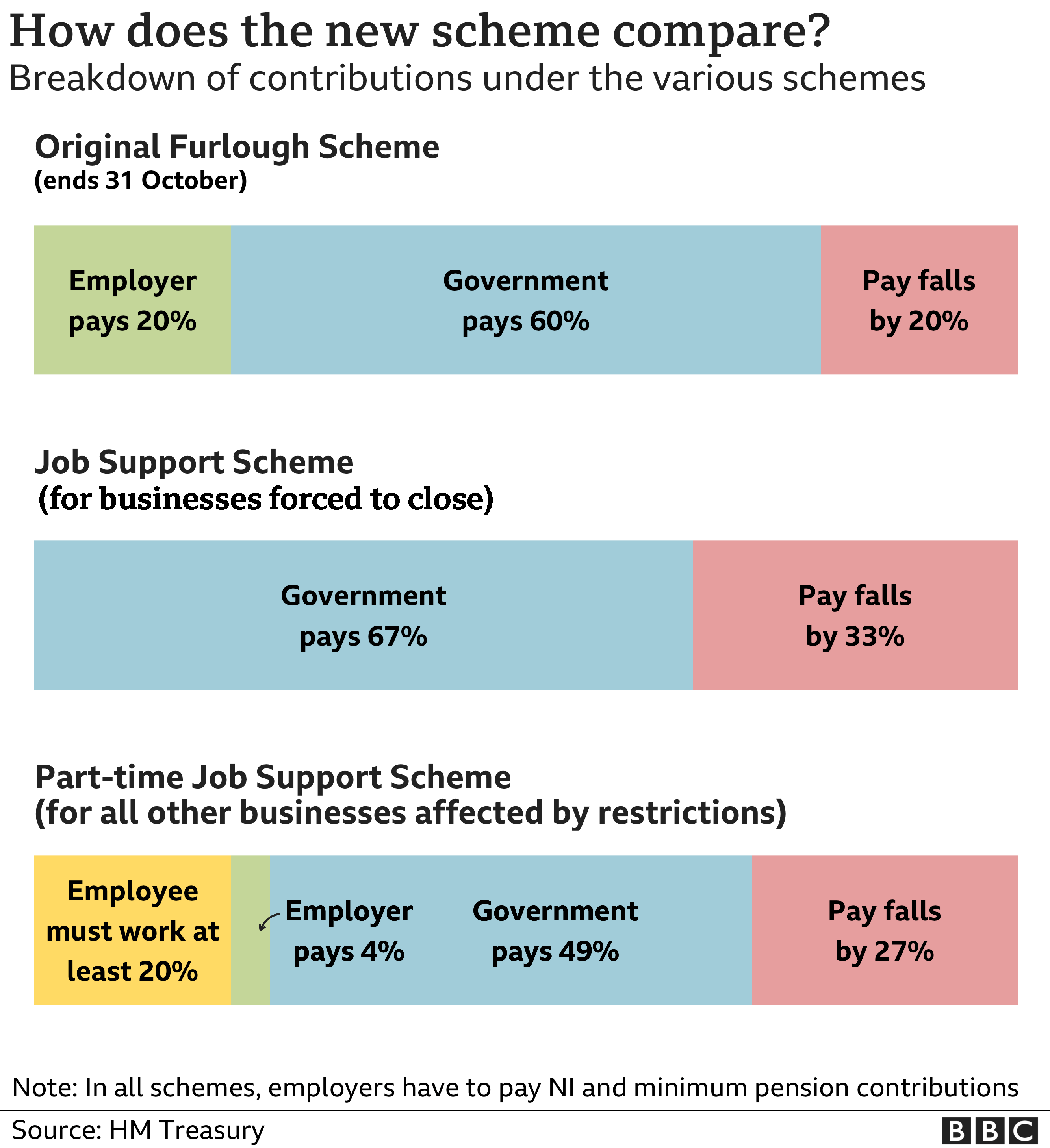

As the government amount is capped at 2500 high earners will need to keep in.

Local lockdown furlough scheme. So to work out 80 of your wage your employer will start with what you got paid in the last pay period before 19 march divide by the total number of days in that pay period multiply by the number of. Cut off only employees which were on the payroll on 28 february 2020 can be furloughed. Will my furlough pay be based on my old minimum wage rate or the new one.

The maximum statutory redundancy payout is 16140. Your employer can claim up to 80 per cent of your wages to a cap of 2500 a month. You can claim these as holiday pay.

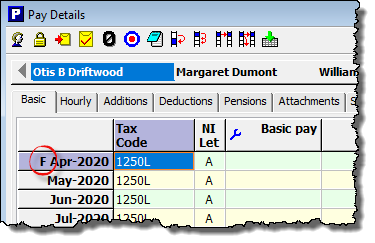

Guidance has been issued and a summary might help. The weekly pay is based on your full pay not furloughed pay and capped at 538 for each complete year worked. As the employee is on fixed pay and the claim period is again the full pay period the maximum wage amount and 80 of usual wage will be the same amounts so the furlough pay is again based on.

You can find the date it was published under the title. This is a news story and may not be up to date. Here well take a dive into how much of that youll take home.

How is my furlough pay calculated. April 20 2020 3 min read. Days off that you received furlough pay for rather than your full salary do not count against your annual leave entitlement.

The government will pay up to 80 of furloughed workers salaries up to 2500. For workers paid a fixed full or part time salary furlough pay is based on what was earned during the last paid period before 19 march 2020. How is my furlough pay calculated.

Furlough pay is done on your pre tax salary so youll be expected to pay tax and national insurance as normal. Our tax guides feature the latest up to date tax information and guidance. Salaried employees where an employee is.

Calculating what an employee on furlough needs to be paid has led to a number of queries. For workers paid a fixed full or part time salary furlough pay is based on what was earned during their last paid period. That means that anyone who earns over 30000 a month could see more than.

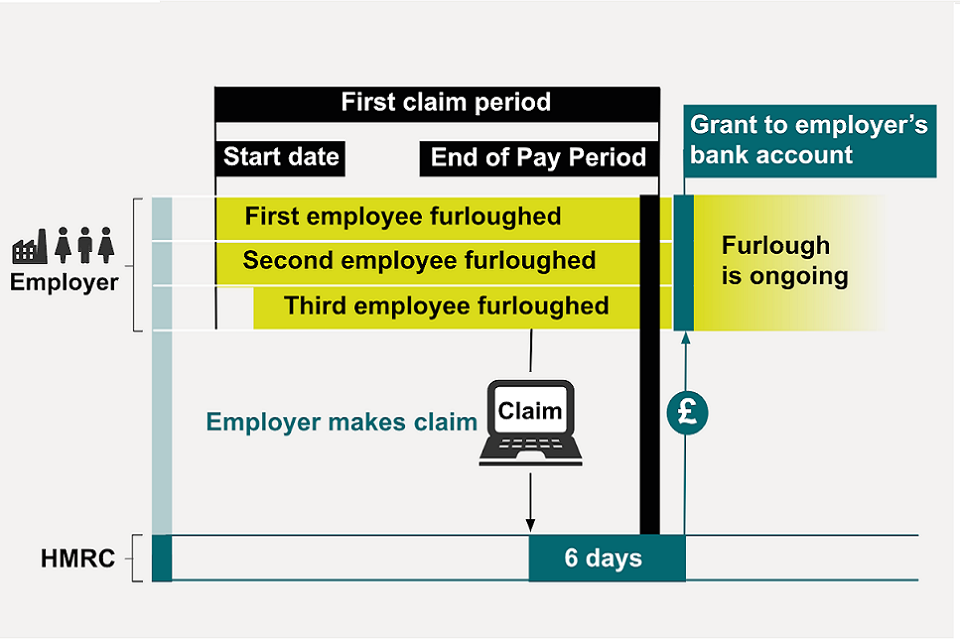

Steps To Take Before Calculating Your Claim Using The Coronavirus Job Retention Scheme Gov Uk Local Lockdown Furlough Scheme

More From Local Lockdown Furlough Scheme

- Sri Lanka Government Gazette 2020 August 07

- Government Exams 2020 In Tamil Nadu Notification

- Government Official Letter Format Pdf

- Government Intervention Examples Australia

- Us Government Printing Office Pueblo Colorado

Incoming Search Terms:

- Https Www2 Ljworld Com Weblogs Town Talk 2020 Mar 29 What You Need To Know About Getting Unemployment Payments From The State Of Kansas Us Government Printing Office Pueblo Colorado,

- Furlough And Commission Will Fees Bonuses And Commission Be Paid On Furlough Personal Finance Finance Express Co Uk Us Government Printing Office Pueblo Colorado,

- Furlough Meaning What Does Furlough Mean How Do I Claim My Pay From The Government Personal Finance Finance Express Co Uk Us Government Printing Office Pueblo Colorado,

- The Coronavirus Job Retention Scheme Qandas For Employers Ashurst Us Government Printing Office Pueblo Colorado,

- Support In Payroll For Furloughed Workers Freeagent Us Government Printing Office Pueblo Colorado,

- First Furlough Payments Start Hitting Bank Accounts Of Businesses Us Government Printing Office Pueblo Colorado,