Self Employed Income Worksheet Fannie Mae, Fannie Mae Rental Income Worksheet Fill Online Printable Fillable Blank Pdffiller

Self employed income worksheet fannie mae Indeed recently has been sought by users around us, maybe one of you. Individuals now are accustomed to using the net in gadgets to view image and video data for inspiration, and according to the title of the post I will discuss about Self Employed Income Worksheet Fannie Mae.

- Mortgage News Digest I Need Income Computation Training Means I Don T Understand Self Employment

- Mortgage News Digest I Need Income Computation Training Means I Don T Understand Self Employment

- 2

- Conventional Loans Fannie Mae And Freddie Mac Realty 101 Blog

- Self Employed Income Analysis Worksheet Iphone Guide Solutions Jhijdv2108 Gotdns Ch

- Fannie Mae Home Ready Overview Naihbr

Find, Read, And Discover Self Employed Income Worksheet Fannie Mae, Such Us:

- Fannie Self Employed Worksheet Printable Worksheets And Activities For Teachers Parents Tutors And Homeschool Families

- Https New Content Mortgageinsurance Genworth Com Documents Training Course Seb1084 Pt1 Presentation 1019 Pdf

- Fannie Mae Income Worksheet Printable Worksheets And Activities For Teachers Parents Tutors And Homeschool Families

- 1120 Income Calculation Blueprint

- Https Singlefamily Fanniemae Com Media 6526 Display

If you are searching for Hm Government Logo Png White you've reached the perfect place. We have 100 graphics about hm government logo png white including pictures, photos, photographs, backgrounds, and much more. In such web page, we additionally have number of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

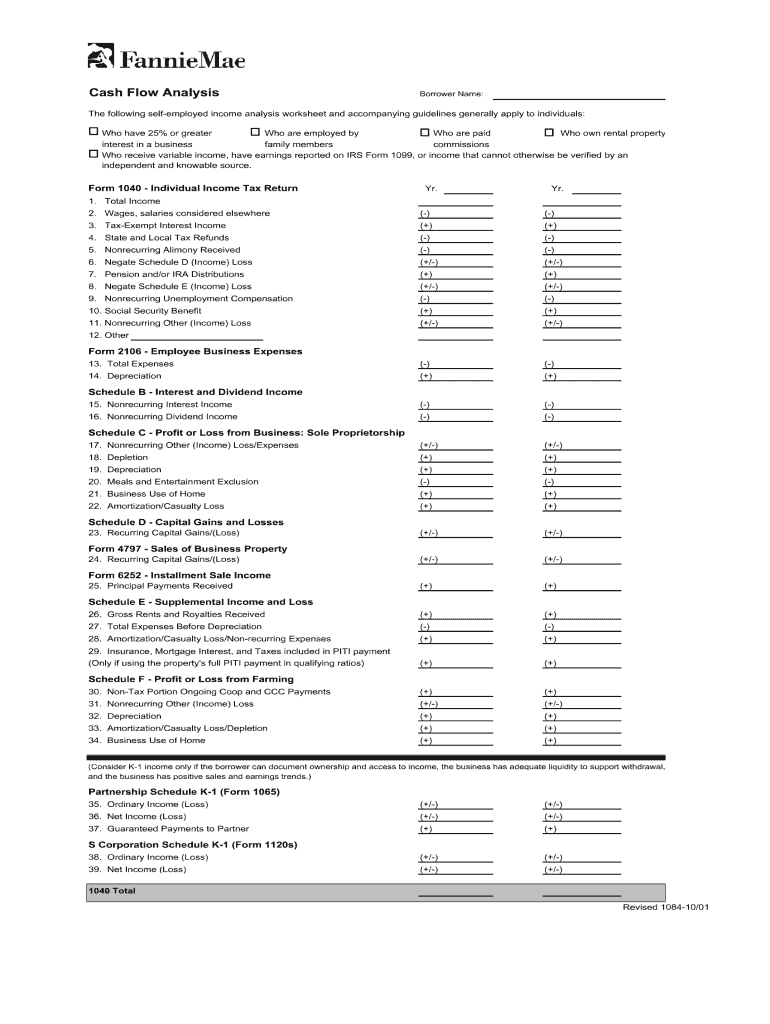

Confirming the tax returns reflect at least 12 months of self employment income and completing fannie maes cash flow analysis.

Hm government logo png white. Any individual who has a 25 or greater ownership interest in a business is considered to be self employed. Use fannie mae rental income worksheets form 1037 or form 1038 to evaluate individual rental income loss reported on schedule e. June 20th 2018 determining a self employed borrower s income isn t always straightforward calculate cash flow analysis to help you complete fannie mae form 1084 guide form instructions form instructions are appended to june 21st 2018 76269f fannie mae form 1084 excel guide form instructions form instructions are appended to the back of each.

This includes but is not limited to business review and analysis. The new enhancement allows lenders to experience a consistent and reliable process to calculate self employment income that is aligned with fannie maes selling guide. Form to calculate individual rental income loss reported on schedule e.

Lenders can benefit from a new process to calculate income for self employed borrowers through loanbeams fnma sei 1084 workbook. A lender may use fannie mae rental income worksheets form 1037 or form 1038 or a comparable. Selfemployed borrowers business only to support its determination of the stability or continuance of the borrowers income.

Appendix q to part 1026 to 12 cfr 1026 eregulations notes. Factors to consider for a self employed borrower. The stability of the borrowers income the location and nature of the borrowers business.

The self employed income analysis form 1084a or 1084b should be used to determine the borrowers share or a corporations after tax income and non cash expenses after obligations that are payable in less than one year have been deducted from the corporate tax returns. Underwriting factors and documentation for a self employed borrower for additional information about waiving the business return requirement and for required forms and calculations. They provide suggested guidance only and do not replace fannie mae or freddie mac instructions or applicable guidelines.

A self employed borrowers share of partnership or s corporation earnings can only be considered if the lender obtains. Debt to income spreadsheet laobingkaisuocom fannie mae income calculation worksheet. Mortgage income calculation worksheet free worksheets library.

The following factors must be analyzed before approving a mortgage for a self employed borrower. We offer a valuable collection of downloadable calculators and reference guides to help you with calculating and analyzing the average monthly income of self employed borrowers. The borrowers percentage of ownership can usually be determined.

A copy of the written analysis.

More From Hm Government Logo Png White

- Furlough Scheme Uk In July

- Self Employed Quickbooks Online Login

- Expenses Self Employed Small Business Bookkeeping Template

- Telangana Government Employee Id Card

- Template Excel Blank Self Employed Printable Invoice Template

Incoming Search Terms:

- Loanbeam Enhancements Release 10 22 2018 Loanbeam Help Center Template Excel Blank Self Employed Printable Invoice Template,

- Https Newrezcorrespondent Com Media 1561280 Annc 2020 073 06112020 Conventional Self Employed Updates Corr Pdf Template Excel Blank Self Employed Printable Invoice Template,

- Loanbeam Enhancements Release 10 22 2018 Loanbeam Help Center Template Excel Blank Self Employed Printable Invoice Template,

- Evaluating The Self Employed Borrower Template Excel Blank Self Employed Printable Invoice Template,

- Https Singlefamily Fanniemae Com Media 6526 Display Template Excel Blank Self Employed Printable Invoice Template,

- Fannie Mae Rental Income Worksheet Fill Online Printable Fillable Blank Pdffiller Template Excel Blank Self Employed Printable Invoice Template,