Self Employed Health Insurance Deduction Irs, Tax Deductible Expenses For Self Employed Expats International Living

Self employed health insurance deduction irs Indeed lately has been hunted by consumers around us, maybe one of you. People now are accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the title of this post I will discuss about Self Employed Health Insurance Deduction Irs.

- Self Employed Health Insurance Deduction What To Know Credit Karma Tax

- Https Www Cumortgagedirect Com Globalresources Mortappdocs Selfemployedincome Pdf

- Shop Affordable Self Employed Health Insurance In All 50 States

- I M Self Employed Can We Deduct My Husband S Medicare Premiums Healthinsurance Org

- Http Www Thetaxbook Com Updates Thetaxbook 2014 Pages 20150113 Update Page 4 3 Pdf

- Self Employment Tax Deductions Reducing Your Tax Liability

Find, Read, And Discover Self Employed Health Insurance Deduction Irs, Such Us:

- Irs Issues Long Term Care Premium Deductibility Limits For 2020

- The Best Self Employed Health Insurance Options

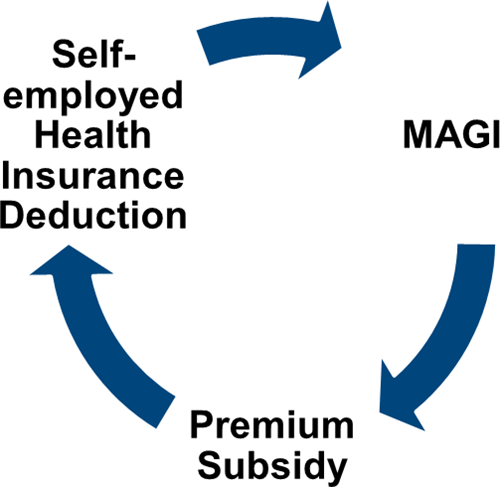

- Maximizing Premium Tax Credits For Self Employed Individuals

- Small Business Hra Strategy Guide

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctnksu1wkyndbghyghnd3ezseffntdo Ww Ab1ioiivm50lp7kj Usqp Cau

If you are searching for Government Gazette 2020 October 2 you've reached the ideal place. We have 104 graphics about government gazette 2020 october 2 including pictures, photos, pictures, wallpapers, and much more. In such web page, we additionally have variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

2014 41 this revenue procedure provides guidance that a taxpayer may use to compute the deduction under 162 of the internal revenue code for health insurance costs for self employed individuals and the premium tax credit allowed under 36b.

Government gazette 2020 october 2. Self employed health insurance deduction. Self employed people who cant get subsidized health insurance through a spouse can deduct premiums. This is another above the line adjustment to income.

Self employed health insurance deduction worksheet legal guidance rev. Self employed persons can take a deduction for health insurance premiums they pay for themselves and their dependents directly on line 16 of the 2020 schedule 1. Self employed health insurance deduction worksheet.

It can be equal to 100 percent of what you pay in premiums and its an adjustment to income so it lowers your agi helping you to qualify for still other advantageous tax breaks. You can then transfer the total of part 2 of schedule 1 to line 10a on your 2020 tax return. The self employed health insurance tax deduction is one of the better tax breaks available if you qualify for it.

Qualified long term care insurance contract. Qualified long term care services. Qualified long term care insurance.

The self employed health insurance deduction is a tax deduction that covers medical dental and long term care insurance premiums for those who are self employed. If you qualify the deduction for self employed health insurance premiums is a valuable tax break. You may be able to deduct the amount you paid for health insurance for yourself your spouse and your dependents.

Self employed health insurance deduction. Effect on self employment tax. The deduction applies to your premiums and those of your spouse and dependents.

Deducting health insurance premiums if youre self employed accessed dec. Self employed individuals who meet certain criteria may be able to deduct their health insurance premiums even if their expenses do not exceed the 10 threshold. With the rising cost of health insurance a tax deduction can help you pay at least a portion of the premium cost.

And that will help to keep you healthyand happyin 2020 and beyond. Self employed individuals calculating your own retirement plan contribution and deduction accessed. Effect on itemized deductions.

If youre self employed.

More From Government Gazette 2020 October 2

- Non Government Organization Meaning

- Government Procurement Card Rules

- Who Is Furlough Extended For

- Government Intervention Example

- Government Relations Cover Letter

Incoming Search Terms:

- 1 Government Relations Cover Letter,

- Self Employed Health Insurance Deduction What To Know Credit Karma Tax Government Relations Cover Letter,

- I M Self Employed Can I Have An Hsa Starship Government Relations Cover Letter,

- Are Health Insurance Premiums Tax Deductible Government Relations Cover Letter,

- S Corporation Reminder Before You Finalize Your Year End Payroll Don T Forget To Include Shareholder Medical Insurance Premiums In W 2 Wages Wegner Cpas Government Relations Cover Letter,

- 2021 Tax Benefit Amounts For Long Term Care Insurance Announced By Irs Ltc News Government Relations Cover Letter,

/1095-BHealthCoverage-1-c2b35a65cb7046028b47940d68f4260c.png)