Government Loans For Small Businesses Uk, Small Business Start Up Loans Uk Financeviewer

Government loans for small businesses uk Indeed recently is being sought by consumers around us, maybe one of you personally. Individuals now are accustomed to using the net in gadgets to view image and video information for inspiration, and according to the name of the post I will talk about about Government Loans For Small Businesses Uk.

- Our List Of The Best Small Business Grants For Women Salesforce Uk Blog

- Bounce Back Loans How Where To Apply Tech News Chronicle

- How Uk Companies Can Access State Covid 19 Bailout Funds Free To Read Financial Times

- Uk Smes Offered Government Loans Of Up To 50 000 Business Leader News

- Uk Government Unveils Bounce Back Loans For Smes Fintech Direct

- Government Grants For Small Business Start Ups Cpca Growth Hub

Find, Read, And Discover Government Loans For Small Businesses Uk, Such Us:

- Small Business Grants Here Are 32 You Can Apply For In 2020 Digital Com

- Billion Pound Support Package For Innovative Firms Hit By Coronavirus Gov Uk

- Uk Government To Guarantee Covid 19 Loans Of Up To 50 000 To Smes The National

- How To Get Government Grants For Small Businesses Startups Grants Dns Accountants

- A Closer Look Which Uk Government Financial Scheme Is Most Fit For Your Business

If you re looking for Self Employed Pl Self Employed Profit And Loss Statement Template you've arrived at the perfect place. We ve got 103 images about self employed pl self employed profit and loss statement template including images, photos, pictures, wallpapers, and more. In such web page, we also have number of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Small Businesses Struggling To Access Coronavirus Loan Scheme Haber For The Uk S Turkish Speaking Communities Self Employed Pl Self Employed Profit And Loss Statement Template

4 10 000 Grants To Small Businesses Uk In Saudi Arabia Facebook Self Employed Pl Self Employed Profit And Loss Statement Template

Businesses will be able to borrow between 2000 and 50000 with the cash arriving within days.

Self employed pl self employed profit and loss statement template. Fixed 6 interest pa. Unlike a business loan this is an unsecured personal loan. Your business must be based in a property to get the award.

The small business grant fund offers a one off 10000 grant to eligible small businesses. Meanwhile whats needed to receive the grant varies depending on which country in the uk your business resides. Government startup loans company.

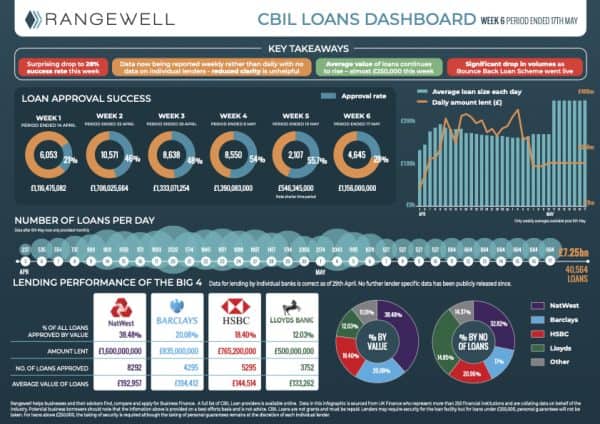

The government backed loans introduced to support small retailers and other small businesses amid the covid 19 pandemic have reportedly topped 35 billion. Small business owners complained that banks were trying to steer them into standard interest bearing loans rather than the juicy government backed cbils product that is interest free for 12. Coronavirus bounce back loans bbls on 27 april the uk government announced a new loan scheme for small businesses affected by the coronavirus pandemic designed to offer quick and easy finance.

Apply for a government backed start up loan of 500 to 25000 to start or grow your business. The bounce back loan scheme bbls provides loans between 2000 and 50000 with the government giving accredited lenders a 100 per cent guarantee for the loans they pay out. 1 year to 5 years government loans are loans that are funded by government backed organisations who usually offer either regional or national businesses different loans depending on their location.

Under the bounce back loan scheme businesses can apply for a loan of up to 50000 or 25 of turnover. A full range of business support measures have been made available to uk businesses. Small business grant fund.

Small businesses will be able to apply for quick and easy to access loans from today. Government loan loan amount. 500 25000 interest.

Support for small and medium sized businesses. Youll get free support and guidance.

Government Loans Available For Uk Medium Small Businesses Move Your Money Self Employed Pl Self Employed Profit And Loss Statement Template

More From Self Employed Pl Self Employed Profit And Loss Statement Template

- Self Employed Resume Template

- Fillable Self Employed Profit And Loss Statement Template

- New Furlough Scheme The Sun

- Federal Government Budget 2020 Tax Cuts

- Government College University Lahore

Incoming Search Terms:

- Small Business Start Up Loans Uk Financeviewer Government College University Lahore,

- Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus Government College University Lahore,

- Uk Banks Not Lending Government Backed Emergency Loans To Small Businesses Up To A Million May Go Under Yonews Government College University Lahore,

- Advice And Ideas For Uk Small Businesses Government College University Lahore,

- Small Businesses Struggling To Access Coronavirus Loan Scheme Haber For The Uk S Turkish Speaking Communities Government College University Lahore,

- Government Updates Guidance On Small Business And Retail Sector Grant Schemes Knights Lowe Government College University Lahore,