Self Employed Health Insurance Deduction Irs Instructions, 2

Self employed health insurance deduction irs instructions Indeed lately has been sought by consumers around us, maybe one of you personally. Individuals are now accustomed to using the net in gadgets to view image and video information for inspiration, and according to the name of the post I will talk about about Self Employed Health Insurance Deduction Irs Instructions.

- Https Dor Mo Gov Forms Mo Shc 2018 Pdf

- Taxation Of Individuals And Business Entities 2018 Edition 9th Editio

- Maximizing Premium Tax Credits For Self Employed Individuals

- Gig Workers Self Employed Disregarded Llc

- For The First Five Months Of The Year Jose Was Em Chegg Com

- How To File Taxes As An Independent Contractor A Guide Benzinga

Find, Read, And Discover Self Employed Health Insurance Deduction Irs Instructions, Such Us:

- 2

- Publication 17 2019 Your Federal Income Tax Internal Revenue Service

- Maximizing Premium Tax Credits For Self Employed Individuals

- How The New Form 1040 Could Save You Money On Tax Day Marketwatch

- What Is Self Employment Tax And Schedule Se Stride Blog

If you are looking for How Does The New Furlough Scheme Work you've reached the right location. We ve got 104 images about how does the new furlough scheme work adding images, pictures, photos, backgrounds, and more. In these page, we additionally provide variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Https Www Cumortgagedirect Com Globalresources Mortappdocs Selfemployedincome Pdf How Does The New Furlough Scheme Work

2017 self employed health insurance deduction worksheet.

How does the new furlough scheme work. Effect on itemized deductions. Most self employed taxpayers can deduct health insurance premiums including age based premiums for long term care coverage. Qualified long term care insurance.

Effect on self employment tax. Write offs are available whether or not you itemize if you meet the requirements. You can only take the 12000.

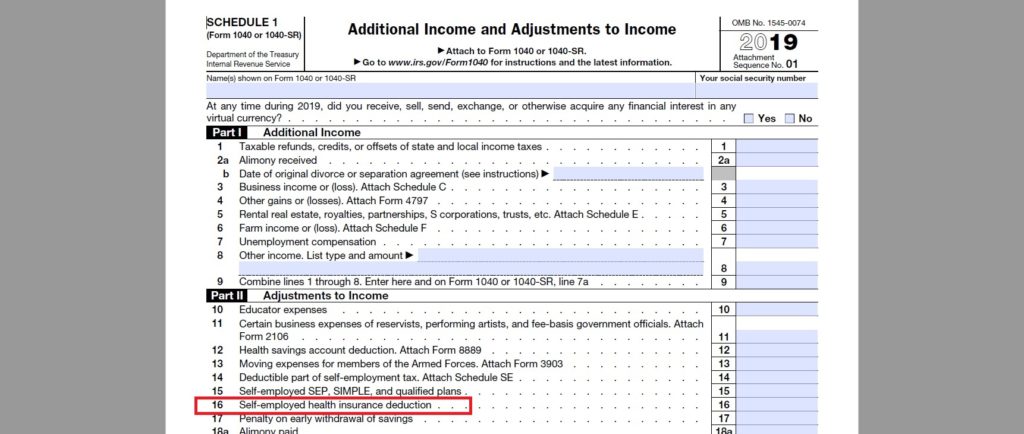

Qualified long term care services. Line 16 self employed health insurance deduction. Line 16 self employed health insurance deduction.

You also must pay se tax on your share of certain partnership income and your guaranteed payments. The insurance also can cover your child who was under age 27 at the end of 2019 even if the child wasnt your dependent. You must pay se tax if you had net earnings of 400 or more as a self employed person.

You may be able to deduct the amount you paid for health insurance for yourself your spouse. Self employed health insurance deduction worksheet. For example if your business earned 12000 but premiums cost you 15000 you cant claim the entire 15000.

Your self employment income is calculated on schedule c or f and it must be equal to or exceed the amount of your health insurance deduction. Self employed health insurance deduction worksheet form 1040 instructions html. Self employed taxpayers who wish to take the ptc and the self employed health insurance deduction.

This publication also provides additional information to help you determine if your health care coverage is minimum essential coverage mec. Per the irs instructions for form 1040 starting on page 85. You may be able to deduct the amount you paid for health insurance for yourself your spouse and your dependents.

If you are completing the selfemployed health insurance deduction worksheet in your tax return instructions and you were an eligible trade adjustment assistance taa recipient alternative taa ataa recipient reemployment taa rtaa recipient or pension benefit guaranty corporation pbgc payee you must complete form 8885 before completing that worksheet. Self employed health insurance deduction worksheet form 1040 instructions page 33. Self employed health insurance deduction.

If you are in business farm or nonfarm for yourself you are self employed.

What Is The Qualified Business Income Deduction Tom Copeland S Taking Care Of Business How Does The New Furlough Scheme Work

More From How Does The New Furlough Scheme Work

- Party Whips Government

- Furlough Scheme Uk Deadline

- Self Employed Personal Loan Hdfc Bank

- Limited Government Picture And Meaning

- Government Canada Logo

Incoming Search Terms:

- Self Employed Health Insurance Deduction What To Know Credit Karma Tax Government Canada Logo,

- 2 Government Canada Logo,

- Preparation Calculating Correct Entries For Self E Chegg Com Government Canada Logo,

- Https Www Irs Gov Pub Irs Dft P502 Dft Pdf Government Canada Logo,

- How To Fill Out The Schedule C Government Canada Logo,

- Draft Instructions To 2019 Form 8995 Contain More Informal Irs Guidance On Computing Qbi Current Federal Tax Developments Government Canada Logo,

:max_bytes(150000):strip_icc()/ScheduleC-22b719c014fd419b89315bb420243dcf.jpg)