Self Employed Tax Rates Malta, Self Employed In Malta Ultimate Step By Step Guide 2019 Soho Office

Self employed tax rates malta Indeed recently is being hunted by consumers around us, perhaps one of you personally. Individuals are now accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the title of the article I will discuss about Self Employed Tax Rates Malta.

- Australia Global Payroll And Tax Information Guide Payslip

- Employment Statistics Within National Accounts Statistics Explained

- New Austrian Government Revamps Tax Reform Plans

- Oecd Ilibrary Home

- Taxes In Malta

- Estonian Taxes And Tax Structure As Of 1 January 2016

Find, Read, And Discover Self Employed Tax Rates Malta, Such Us:

- Oecd Tax Database Oecd

- Self Employment In Malta Small Start Up Business Activities In By Fairwinds Management Limited Medium

- Oecd Tax Database Oecd

- Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

- Sweden Taxing Wages 2020 Oecd Ilibrary

If you are searching for Functions Of Local Government In Zambia you've reached the right place. We ve got 100 graphics about functions of local government in zambia adding pictures, pictures, photos, wallpapers, and more. In these page, we additionally have number of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Social security rates for self employed and self occupied persons in malta updated with 2018 official rates.

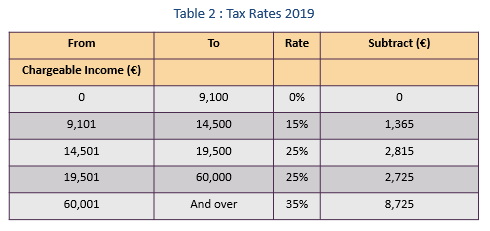

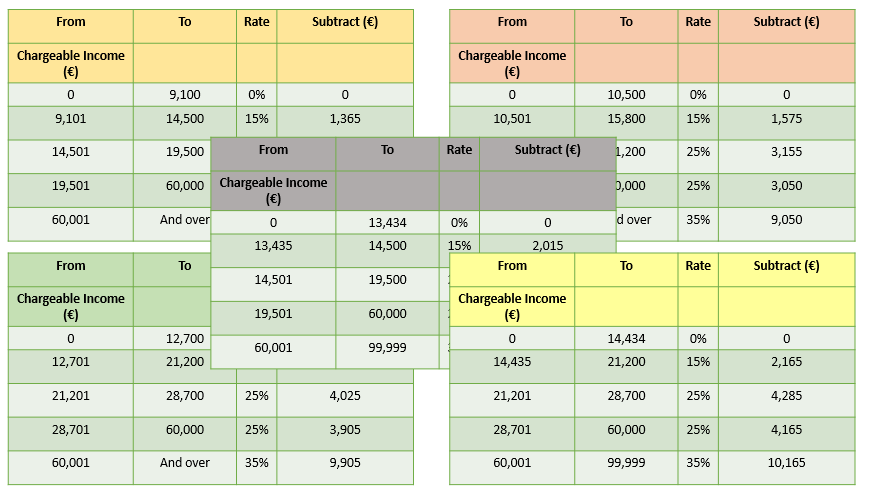

Functions of local government in zambia. A maltese company is taxed at a rate 35 on its operating profit whereas a self employed is taxed at individual rates which vary from 0 to a maximum of 25. The following may benefit from the 15 rate. When it comes to income tax if you make under 9100 no tax will be deducted.

Must pay the tax due using form ta22 by 30th april of the following year. If this condition is not satisfied you cannot qualify for this rate of tax. What must i do to pay tax at 15.

These ssc categories apply to full time and part time self employed persons. When conducting a business as a self employed there is no limited liability which can be offered through a maltese company. The global residence programme is aimed at attracting more third country national individuals in taking up residence in malta without taking up employment in malta with foreign source income remitted to malta by the beneficiary or its dependants being taxed at a flat rate of 15 subject to a minimum tax of eur 15000 per annum.

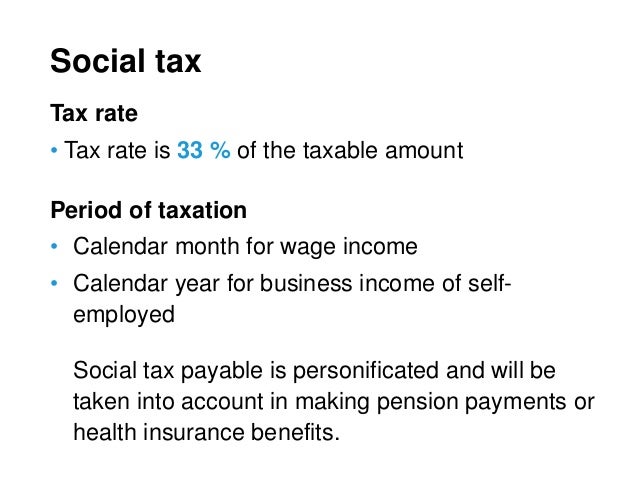

In the case of a married couple if both spouses qualify for the benefit they are entitled to 10000 each employment or 12000 each self employment. Payment of personal tax is mainly effected either through the provisional tax system the fss final settlement system or by means of the self assessment. For self employed people the tax rate on yearly income is 15.

From 9101 to 14500 the tax rate is 15 from 14501 to 19500 the tax rate is 25. The maximum payment each year is 1800 15 of 12000. In malta the taxation of an individuals income is progressive.

Beneficiaries should satisfy a number of qualifying criteria in order to be eligible for the beneficial tax treatment. Fill in form ta22. Full time students including apprentices.

The higher an individuals income the higher the tax paid.

More From Functions Of Local Government In Zambia

- Us Government Accountability Office

- Government Law College Ernakulam Address

- Government Furlough Scheme Calculator

- Covid 19 Government Control Meme

- Government Of Canada Icon

Incoming Search Terms:

- Taxes In Malta Government Of Canada Icon,

- Tax System In Malta 2020 Income Tax Rates And Brackets Soho Government Of Canada Icon,

- Payroll Tax Wikipedia Government Of Canada Icon,

- Malta Salary Calculator Government Of Canada Icon,

- The Latest Tax Policy Reforms Tax Policy Reforms 2019 Oecd And Selected Partner Economies Oecd Ilibrary Government Of Canada Icon,

- Estonian Taxes And Tax Structure As Of 1 July 2017 Government Of Canada Icon,