Self Employed Income Tax Rates 202021, Self Employed Tax Changes 2020 21

Self employed income tax rates 202021 Indeed lately is being hunted by users around us, maybe one of you. Individuals are now accustomed to using the net in gadgets to view image and video information for inspiration, and according to the title of this post I will talk about about Self Employed Income Tax Rates 202021.

- Self Assessment Income Tax Calculator And Dates Money Donut

- Taxation In Spain Wikipedia

- How Do I Pay Tax On Self Employed Income Low Incomes Tax Reform Group

- Listentotaxman Mobile Uk Salary Tax Calculator 2020 2021 Hmrc

- Furloughed Brits May Pay Too Much Tax While Self Employed Can Defer To 2021 Your Money

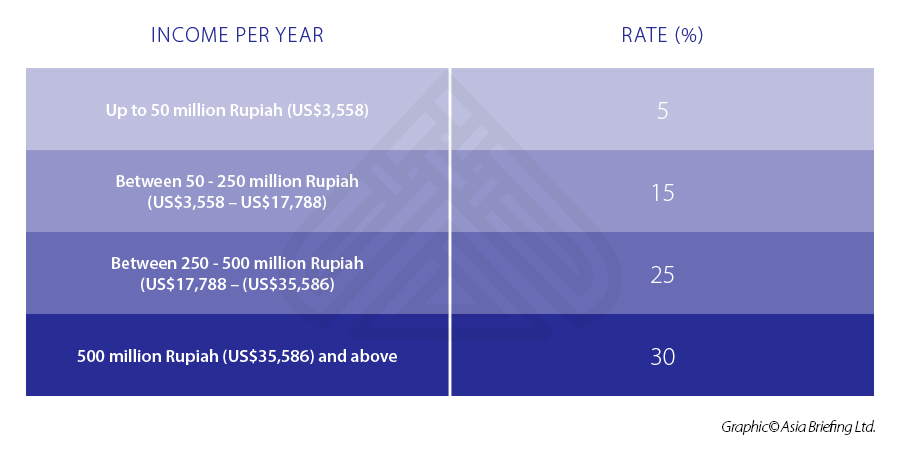

- Personal Income Tax In Indonesia For Expatriate Workers Explained

Find, Read, And Discover Self Employed Income Tax Rates 202021, Such Us:

- Coronavirus Self Employed Scheme Get The Details Right Accountingweb

- Income Tax Slabs And Rates In India Fy 2020 21

- Rates Thresholds 2020 21 Brightpay Documentation

- Personal Income Tax In Indonesia For Expatriate Workers Explained

- Federal Insurance Contributions Act Tax Wikipedia

If you are looking for Government Accounting Millan Solution Manual Chapter 2 you've reached the perfect place. We ve got 104 images about government accounting millan solution manual chapter 2 including pictures, pictures, photos, backgrounds, and more. In these web page, we additionally have number of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Self Employed National Insurance Class 2 And Class 4 Rates Government Accounting Millan Solution Manual Chapter 2

Https Assets Kpmg Content Dam Kpmg Fr Pdf Covid 19 Fr 02042020 Da Int Pdf Government Accounting Millan Solution Manual Chapter 2

Class 4 ni rate.

Government accounting millan solution manual chapter 2. Class 4 lower profits threshold. Resident tax rates 202021. You can use our 2020 21 income tax calculator to find out how much youll pay.

Calculating your income tax gives more information on how these work. Guidelines to certain vat procedures. Rate for tax year 2020 to 2021.

For full details and past rates visit this page. 5092 plus 325 cents for each 1 over 45000. When it comes to paying income tax there arent any differences in the tax rates you pay compared to employees.

Class 2 small profits threshold. What are the self employed income tax rates for 2020 21. 2 on profits over 50000.

Tax rates bands and reliefs the following tables show the tax rates rate bands and tax reliefs for the tax year 2020 and the previous tax years. As part of the 2020 budget chancellor rishi sunak announced that the national insurance contribution nic thresholds for the 2020 21 tax year will rise. Band taxable income tax rate.

Class 4 rate above 50000. 0 on the first 12500 you earn. Tax on this income.

How much you pay. Tax rates chargeable income. 9 on profits between 9501 and 50000.

Other useful information for self employed in 202021 tax year. You can see national insurance. 202021 national insurance rates for self employed in the uk.

Class 2 rate per week. In the 2020 21 tax year self employed and employees pay. 19 cents for each 1 over 18200.

Savings income 202021 and 201920.

Tax Issues Unpicked Self Employed Vs Companies Dentistry Online Government Accounting Millan Solution Manual Chapter 2

More From Government Accounting Millan Solution Manual Chapter 2

- Government Issued Photo Id

- Government Functions

- Furlough Scheme Uk Dropping To 60

- Self Employed Covid Grant Application

- Self Employed Income

Incoming Search Terms:

- Self Employed National Insurance Class 2 And Class 4 Rates Self Employed Income,

- Finance Act 2019 Acca Global Self Employed Income,

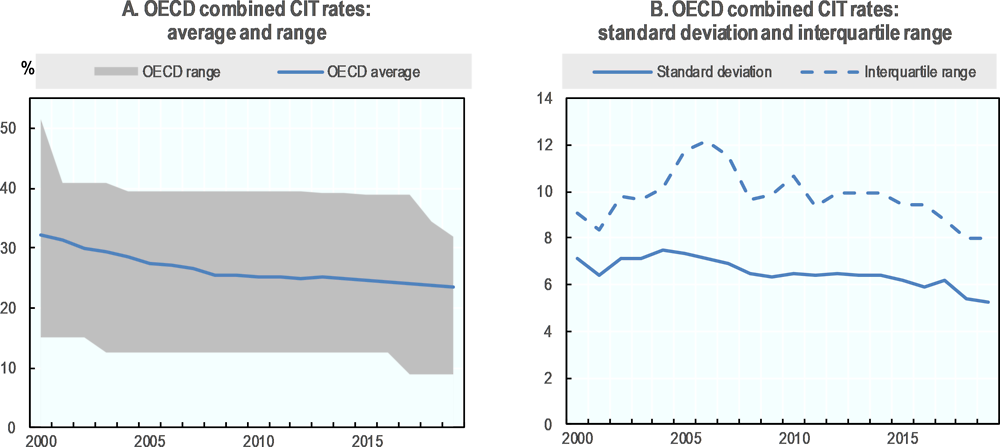

- The Latest Tax Policy Reforms Tax Policy Reforms 2019 Oecd And Selected Partner Economies Oecd Ilibrary Self Employed Income,

- Income Tax Calculator For Fy 2020 21 Ay 2021 22 Excel Download Self Employed Income,

- New Income Tax Table 2020 Philippines Self Employed Income,

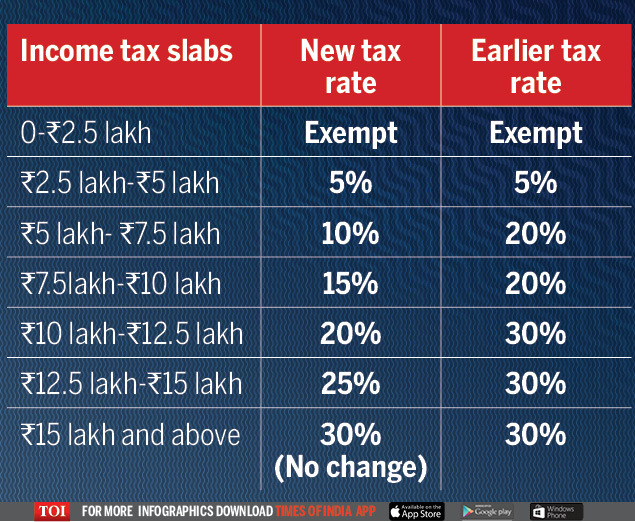

- Income Tax Slab 2020 New Lower Income Tax Rates Are Optional What It Means India Business News Times Of India Self Employed Income,