Government Furlough Scheme Calculator, The New World Of Flexible Furlough How Will It Work Nk Media

Government furlough scheme calculator Indeed recently is being sought by consumers around us, perhaps one of you personally. Individuals are now accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the title of the post I will discuss about Government Furlough Scheme Calculator.

- United Kingdom Further Updates And Faqs On The Uk Furlough Scheme Littler Mendelson P C

- Changes To The Government Job Support Scheme Example Wages

- Basic Paye Tools User Guide Gov Uk

- More Than 275 Accountancy Firms Ask Uk Government To Plug Gaps In Sme Aid Fintech Futures

- Steps To Take Before Calculating Your Claim Using The Coronavirus Job Retention Scheme Gov Uk

- Cjrs Further Updates To Government Guidance Fcsa

Find, Read, And Discover Government Furlough Scheme Calculator, Such Us:

- Coronavirus Job Retention Scheme Zoho Books

- Lewis Silkin How To Flexi Furlough Government Reveals More Details

- Free Calculator Job Retention Scheme Claims Youtube

- How Do I Calculate Pay For Workers Coming Off Furlough Watford Observer

- How To Approach Redundancy As The Furlough Scheme Winds Down Personnel Today

If you re searching for Self Employed Grant Second Payment Martin Lewis you've arrived at the ideal location. We ve got 100 images about self employed grant second payment martin lewis adding pictures, photos, photographs, wallpapers, and more. In these web page, we additionally provide number of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

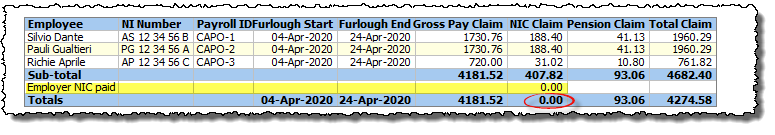

Coronavirus Job Retention Scheme Claims From July October 2020 Moneysoft Self Employed Grant Second Payment Martin Lewis

Job support scheme calculator.

Self employed grant second payment martin lewis. Steps to take before calculating your claim. We have updated the calculator below to allow entering dates up to march 31st 2021. Limitations of the employer furlough calculator.

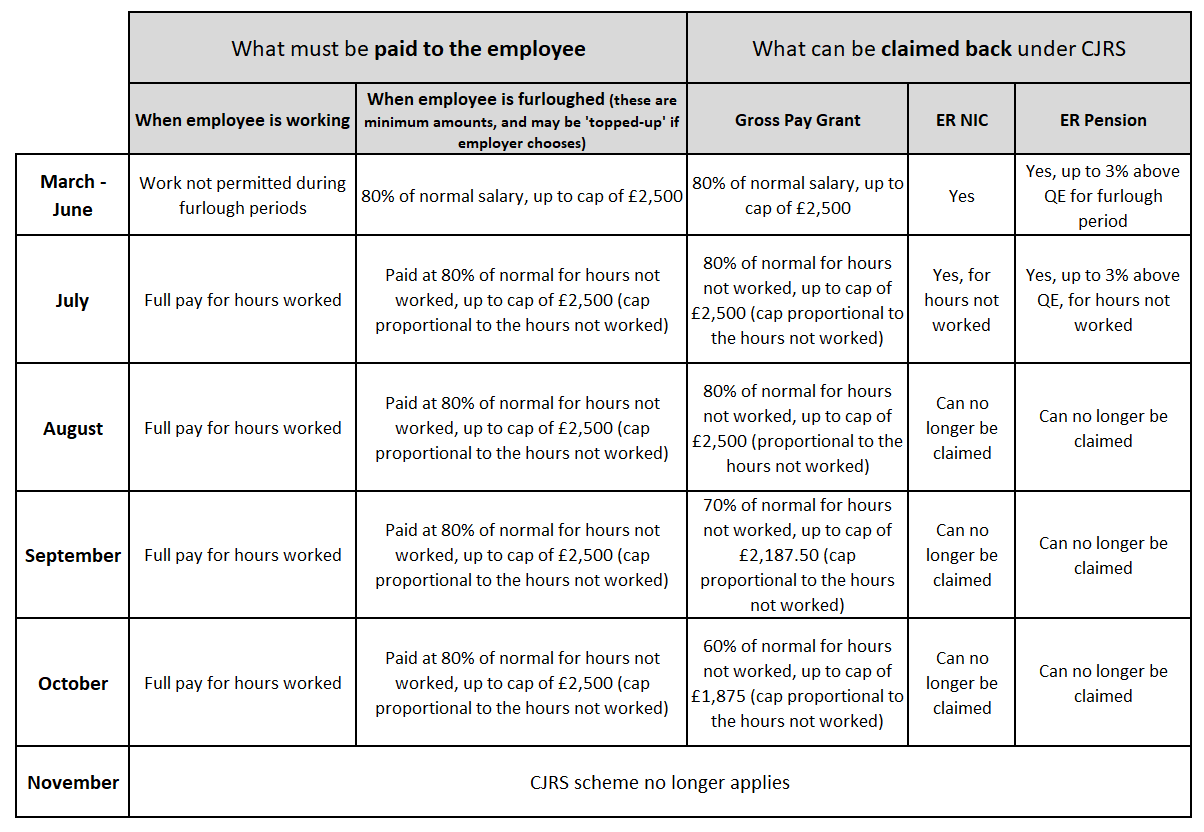

The scheme will begin after the furlough scheme which has cost the uk around 40 billion comes to an end in october. Calculate how much you have to pay your furloughed employees for hours on furlough how much you can claim for employer nics and pension contributions and how much you can claim back. The government has announced an extension of the coronavirus job retention scheme until at least the end of november 2020.

The governments contribution is capped at. Currently this calculator can only calculate furlough claims for payroll periods ending before 1st november 2020. When the government ends the scheme.

Calculate how much you have to pay your furloughed employees for hours on furlough how much you can claim for employer nics and pension contributions and how much you can claim back. This calculator is designed to provide a quick overview of furlough amounts based on the 80 rule with a maximum monthly amount of 250000 per employee. You will have until 31 march 2021 to make a job retention bonus claim after which the scheme will close.

Check which employees you can put on furlough. We now also have a new job support scheme calculator available for the new scheme to replace furlough. No further claims will be accepted after this date.

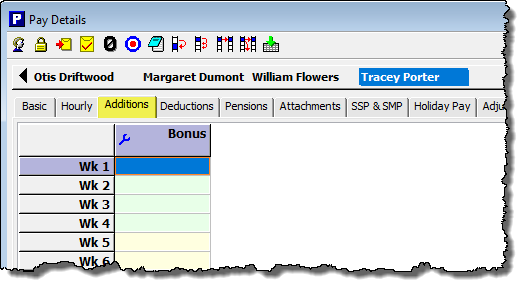

Where the employer provides benefits to furloughed employees including through a salary sacrifice scheme these benefits should be in addition to the wages that must be paid under the terms of. The calculator works by defining an annualised salary and producing an indicative daily rate based on 260 working days per year as a benchmark. The government has launched a calculator to help employers with their next coronavirus job retention scheme cjrs claims.

To use the scheme the steps youll need to take are.

Changes To The Coronavirus Job Retention Scheme From 1 July 2020 Charity Tax Group Self Employed Grant Second Payment Martin Lewis

More From Self Employed Grant Second Payment Martin Lewis

- Printable Self Employed Invoice Template Excel

- English Formal Letter To Government Malaysia

- Self Employed Electrician Jobs Bristol

- Us Government Debt To Gdp Ratio

- Furlough Return Rules

Incoming Search Terms:

- Lewis Silkin Coronavirus Job Support Scheme Faqs For Employers Furlough Return Rules,

- Covid 19 Furlough Under Job Retention Scheme Faqs Make Uk Furlough Return Rules,

- Free Calculator Job Retention Scheme Claims Youtube Furlough Return Rules,

- Steps To Take Before Calculating Your Claim Using The Coronavirus Job Retention Scheme Gov Uk Furlough Return Rules,

- Can Uk Employers Claim The Furlough Grant While Employees Are On Notice Clarity Is Required Walker Morris Furlough Return Rules,

- Coronavirus Job Support Scheme How Does It Work Who Is Eligible And When Does It Start Itv News Furlough Return Rules,