Self Employed Utr Number Online, A Guide To Unique Tax Reference Numbers What Is A Utr

Self employed utr number online Indeed lately is being sought by consumers around us, maybe one of you personally. Individuals now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of the post I will talk about about Self Employed Utr Number Online.

- Self Employment Income Support Scheme Novus Accountancy Ltd Facebook

- Sansdrama

- How To Complete A Self Assessment Tax Return With Pictures

- 9 Things You Need To Know About Utr Numbers 2020

- Construct Recruitment Blog How To Get Your Utr Number

- Self Employed Invited To Get Ready To Make Their Claims For Coronavirus Covid 19 Support Gov Uk

Find, Read, And Discover Self Employed Utr Number Online, Such Us:

- How To Cancel Hmrc Uk Contact Numbers

- How To Register As Self Employed In The Uk A Simple Guide

- 1

- Self Assessment Freeagent

- How To File Tax Return Online In The Uk

If you are searching for Self Employed Quickbooks Login you've reached the right place. We have 104 graphics about self employed quickbooks login adding images, photos, photographs, backgrounds, and more. In these web page, we additionally provide number of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Register by 5 october in.

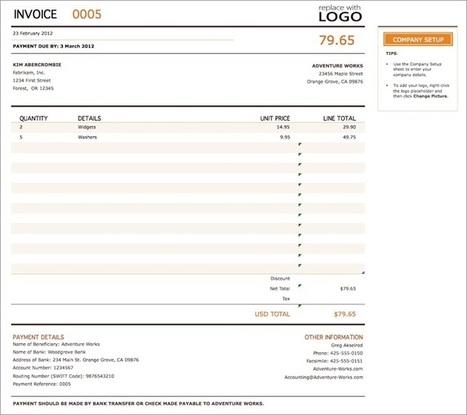

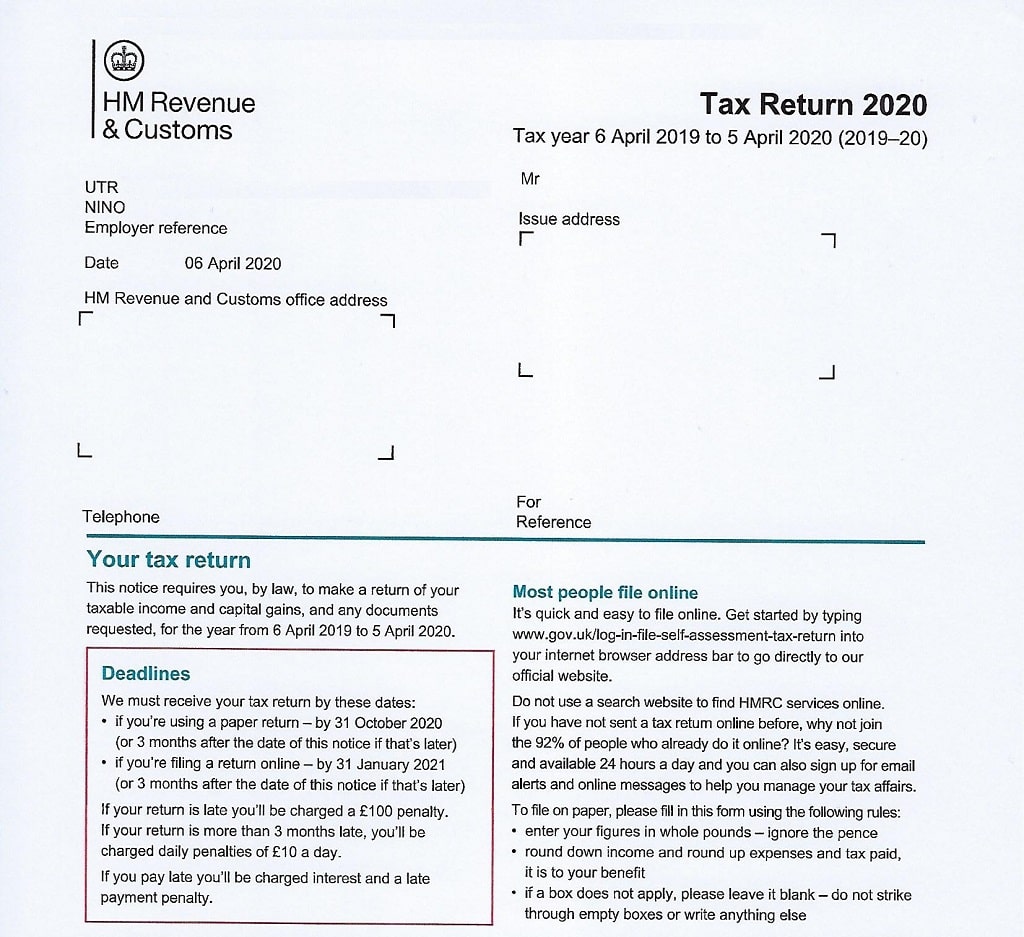

Self employed quickbooks login. If you still cant find your utr number you can call hmrcs self assessment helpline on 0300 200 3310. Before you start the registering as self employed online make sure you have your national insurance number handy. You earned more than 1000 from self employment between 6 april 2019 and 5 april 2020 you need to prove youre self employed for example to claim tax free childcare.

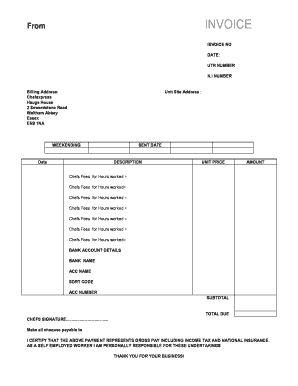

Register if youre self employed if you have to send a tax return and did not send one last year you need to register for self assessment and class 2 national insurance. The utr number can sometimes be labelled as a tax reference or official use on forms. Utr number is generated automatically by hmrc the length of the utr number is 22 characters long for rtgs and 16 characters for neft the format of utr.

You only need a utr number if you submit a self assessment tax return. Its helpful to have your ni number to hand when you make the call to help track. Youll then need to complete the following steps.

This could be the case if youre self employed or have set up a limited company if you owe tax on savings dividends or capital gains or if you earn more than 100000. Youll get a letter containing your unique taxpayer reference utr within 10 working days 21 if youre abroad. If youve sent a self assessment tax.

Call the self assessment helpline to request your utr if you cannot find any documents from hmrc. Grant claim reference youll find this in the online service or on your copy of the grant claim self assessment unique taxpayer reference utr number if you do not have this find out how. For that reason retrieving it may be a bit more tricky than you anticipate.

If you have a limited company you can request your corporation tax utr online. Utr number is issued on registering for self assessment which takes time up to seven to eight weeks to receive the information needed to activate the utr number through hmrc online account. It should also be recorded in your hmrc online account.

You need your utr to send a return. Who needs a utr number from hmrc.

More From Self Employed Quickbooks Login

- Government Guidelines For Covid 19 Testing

- Self Employed And Employed

- Self Employed Netherlands Tax

- The Furlough Scheme From August

- Government Bodies Involved In A Human Rights Complaint

Incoming Search Terms:

- Self Assessment Tax Return And Payments Inniaccounts Government Bodies Involved In A Human Rights Complaint,

- Self Employed Invited To Get Ready To Make Their Claims For Coronavirus Covid 19 Support Gov Uk Government Bodies Involved In A Human Rights Complaint,

- Uk Self Tax Partnership Tax Return United States Government Bodies Involved In A Human Rights Complaint,

- Self Employed Tax Codes What You Need To Know Government Bodies Involved In A Human Rights Complaint,

- Clark S Accountants Washington Posts Facebook Government Bodies Involved In A Human Rights Complaint,

- Living Abroad Ni And Utr Great Britain Bab La Government Bodies Involved In A Human Rights Complaint,