Self Employed Jobkeeper 2, The Jobkeeper Payment Ceebeks Business Solutions For Good

Self employed jobkeeper 2 Indeed recently is being hunted by consumers around us, maybe one of you. Individuals now are accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the name of the article I will talk about about Self Employed Jobkeeper 2.

- Jobkeeper 2 1 Fair Work Act Changes

- Extension Of The Jobkeeper Payment

- Checkout Our New Infographic On Kaizen Business Advisory Facebook

- Jobkeeper Payment How Will It Work Who Will Miss Out And How To Get It

- How To Apply For Jobkeeper For Sole Traders With Images Ato Tax Calculator

- Jobkeeper Explained

Find, Read, And Discover Self Employed Jobkeeper 2, Such Us:

- Jobkeeper And Jobseeker 2 0 Bis Cosgrove Accountants Palm Beach Gold Coast Financial Planning Business Advice Myob Specialists Superannuation Experts

- Checkout Our New Infographic On Kaizen Business Advisory Facebook

- Jobkeeper Payment What Business Owners Need To Know Walsh Accountants Gold Coast Accountants

- Job Keeper Payment Announced Pvw Partners Townsville

- Jobkeeper 2 What You Need To Know Ace Business

If you are searching for When Will The Furlough Scheme Drop To 60 you've reached the right place. We have 100 graphics about when will the furlough scheme drop to 60 including images, photos, photographs, backgrounds, and much more. In these page, we also provide variety of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

If you have already enrolled for jobkeeper you do not need to re enrol for the jobkeeper extension.

When will the furlough scheme drop to 60. From 30 march 2020 eligible sole traders and self employed people that operate via a partnership trust or company can claim 1500 per fortnight for 6 months ending 27 september 2020 with the first payments being made in the first week of may. The jobkeeper payment will be available to eligible businesses including the self employed and not for profits until 28 march 2021. The australian taxation office has responded to concerns around how self employed workers can be eligible for the jobkeeper payment during the six month extension period.

Speaking exclusively at mybusiness week ato deputy commissioner for small business kirsten fish said that like businesses with employees self employed workers also have an. This guide is for sole traders with no employees ie. This bit is important because the language appears to have changed since the.

Jobkeeper part 2 basic draft rules explained for business entities with self employed owners as at 9 april 2020 these rules have now been finalised last night the parliament passed the changes to the fair work act and some changes to the tax act to allow the jobkeeper payments to be made. Ato jobkeeper guide for sole traders including jobkeeper 20 changes for other self employed entities. If there are additional checks required or any errors made on your form it may take some additional time for us to resolve.

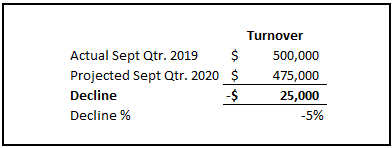

Jobkeeper 20 extends the jobkeeper program from 28 september 2020 to 28 march 2021. In addition if you receive jobseeker or youth allowance payments the amount you can earn before impacting income support has been increased to 300 per fortnight from 25. You will need to check your actual decline in turnover for continuing eligibility from 1 october 2020 and again from 1 january 2021.

After this you should receive jobkeeper payments within five business days. The jobkeeper guide for sole traders will help you through steps 1 3 of your jobkeeper application. The jobkeeper payment is a scheme to support businesses and not for profit organisations significantly affected by covid 19 to help keep more australians in jobs.

Whether you are new to the jobkeeper program or have been receiving these payments previously this comprehensive guide covers all the important information you need to know. Jobkeeper 20 everything you need to know. Partnerships companies and trusts see companion ato guide sole traders may be eligible for the jobkeeper payment under the business participation entitlement if their business has experienced a decline in turnover according to the eligibility criteria.

The jobkeeper payment is administered by the australian taxation office ato. Sole traders the self employed casuals or contractors who meet the income and assets tests.

More From When Will The Furlough Scheme Drop To 60

- Canadian Government Revenue Sources

- Self Employed Insurance Cost

- Government Laptop Lenovo E41 25 Drivers

- Government Debt Graph

- The Furlough Scheme End

Incoming Search Terms:

- Jobkeeper Payment For Self Employed Offpseo Medium The Furlough Scheme End,

- Simon Jones Co Jobkeeper Programme The Furlough Scheme End,

- Jobkeeper Payment What Business Owners Need To Know Walsh Accountants Gold Coast Accountants The Furlough Scheme End,

- Covid 19 Wage Subsidy Jobkeeper Payments Myob Essentials Accounting Myob Help Centre The Furlough Scheme End,

- Jobkeeper Payment How Will It Work Who Will Miss Out And How To Get It The Furlough Scheme End,

- Extension Of The Jobkeeper Payment Salisbury Accountants The Furlough Scheme End,