Self Employed Definition Irs, What Does Self Employed Mean Are You Self Employed

Self employed definition irs Indeed lately is being hunted by consumers around us, maybe one of you. Individuals now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will talk about about Self Employed Definition Irs.

- Staying Self Employed Vs Opening Up An S Corp

- Self Employment 1099s And The Paycheck Protection Program Bench Accounting

- Self Employment Ledger 40 Free Templates Examples

- What Is A Disregarded Entity And How Are They Taxed Ask Gusto

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctw7rwjhqvgpuzhoimbk04bp1 H 6gjv1nh Btkch8o6odh0gpz Usqp Cau

- Self Employment Wikipedia

Find, Read, And Discover Self Employed Definition Irs, Such Us:

- Section 106 Health Insurance Tax Deduction For Employer Groups

- How To File Schedule C Form 1040 Bench Accounting

- What Is Self Employment Income

- Publication 929 2019 Tax Rules For Children And Dependents Internal Revenue Service

- What Is A W 2 Form Turbotax Tax Tips Videos

If you are looking for Self Employed Business Bookkeeping Template you've arrived at the perfect location. We ve got 104 graphics about self employed business bookkeeping template including images, photos, photographs, backgrounds, and more. In such web page, we also have variety of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsk44skgy4zg3gigzptdi97h4290hj47sjgxgnadtizwoha3dce Usqp Cau Self Employed Business Bookkeeping Template

Bureau of labor statistics bls the internal revenue service irs and private.

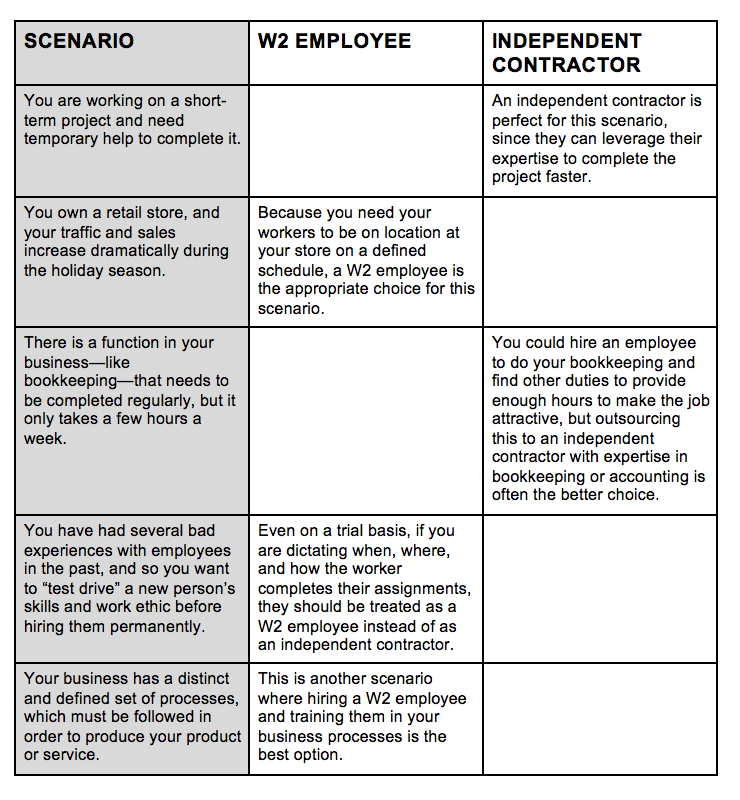

Self employed business bookkeeping template. Self employed individuals generally must pay self employment tax se tax as well as income tax. For more information on your tax obligations if you are self employed an independent contractor see our self employed tax center. Although the precise definition of self employment varies among the us.

Generally tax authorities will view a person as self employed if the person chooses to be recognized as such or is generating income such that the person is required to file a tax return under legislation in the relevant jurisdiction. As a self employed with your own business you work for yourself and you are in the position to realise a business profit or loss. Se tax is a social security and medicare tax primarily for individuals who work for themselves.

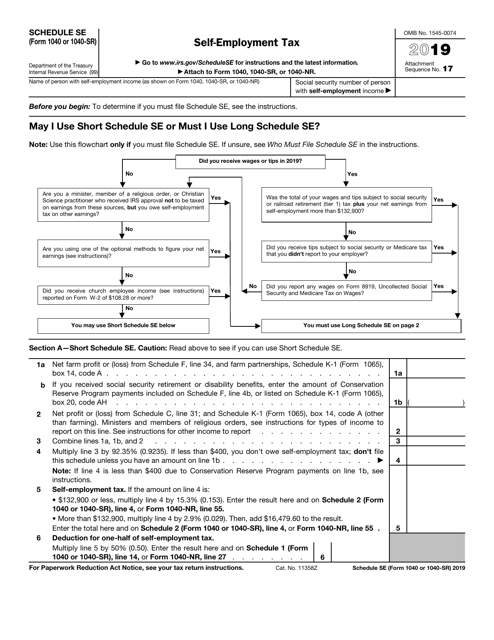

Access tax forms including form schedule c form 941 publications elearning resources and more for small businesses with assets under 10 million. Higher income business owners pay an additional 29 on medicare tax but the social security portion is capped. The tax is 153 124 for social security and 29 for medicare on their annual net income from the business.

The internal revenue service defines an individual as being self employed for tax purposes as. Ou carry on a trade or business as a sole proprietor or an independent contractor. How the irs defines self employment income self employment income is earned from carrying on a trade or business as a sole proprietor an independent contractor or some form of partnership.

Self employment is the state of working for oneself rather than an employer. Provide a service under a contract for service. You are self employed when you perform work for others eg.

The earnings of a person who is working as an independent contractor are subject to self employment tax. In general anytime the wording self employment tax. I hire or contract with individuals to provide services to my business if you are a business owner hiring or contracting with other individuals to provide services you must determine whether the individuals.

You are employed or an employee if you perform work under a contract of service where you work under the control of your employer. You are a member of a partnership that carries on a trade or business. What youll find here resources fo small businesses self employed internal revenue service.

To find out what your tax obligations are visit the self employed tax center. It is similar to the social security and medicare taxes withheld from the pay of most wage earners.

Irs Form 1040 1040 Sr Schedule Se Download Fillable Pdf Or Fill Online Self Employment Tax 2019 Templateroller Self Employed Business Bookkeeping Template

More From Self Employed Business Bookkeeping Template

- Government Wikipedia

- Government Scholarship 2020 21

- Hp 241 Government Laptop Battery Price

- Government Finance Statistics Yearbook 2019

- What Other Government Projects And Programs Are Available For Science Education In The Philippines

Incoming Search Terms:

- 3 11 13 Employment Tax Returns Internal Revenue Service What Other Government Projects And Programs Are Available For Science Education In The Philippines,

- Self Employed Avoid These Audit Red Flags On Your Tax Return Kiplinger What Other Government Projects And Programs Are Available For Science Education In The Philippines,

- Irs Form 1040 Ss Download Fillable Pdf Or Fill Online U S Self Employment Tax Return Including The Additional Child Tax Credit For Bona Fide Residents Of Puerto Rico 2019 Templateroller What Other Government Projects And Programs Are Available For Science Education In The Philippines,

- Freelancer Vs Contractor Vs Employee What Are You Being Hired As Freshbooks Blog What Other Government Projects And Programs Are Available For Science Education In The Philippines,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctw7rwjhqvgpuzhoimbk04bp1 H 6gjv1nh Btkch8o6odh0gpz Usqp Cau What Other Government Projects And Programs Are Available For Science Education In The Philippines,

- Solo 401k Contribution For Partnership And Compensation What Other Government Projects And Programs Are Available For Science Education In The Philippines,