Self Employed Retirement Plans Tax Deductible, What Is A Simplified Employee Pension Sep Ira 2020 Robinhood

Self employed retirement plans tax deductible Indeed lately has been sought by consumers around us, maybe one of you personally. Individuals now are accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the name of this post I will discuss about Self Employed Retirement Plans Tax Deductible.

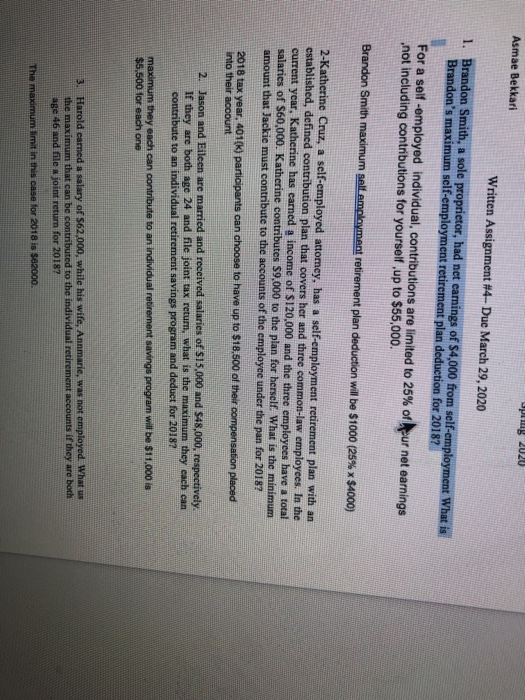

- What Is A Simplified Employee Pension Sep Ira 2020 Robinhood

- Solo 401k The Swiss Army Knife Of Retirement Plans For The Self Employed

- Massive Tax Deductible 200k Retirement Plan Contribution For Self Employed Massive Tax Deductible Contribution For Self Employed

- The Best Retirement Plans To Build Your Nest Egg

- Investing For Your Best Years Retirement Module Objectives After Completing This Module You Should Be Able To Understand How To Define Retirement Goals Ppt Download

- What Is A Self Employed Retirement Plan By Thomasedwin Issuu

Find, Read, And Discover Self Employed Retirement Plans Tax Deductible, Such Us:

- What Is An Ira Individual Retirement Account And How To Choose One

- The Best Retirement Plans For The Self Employed

- Simple Ira Basics For Self Employment Income 2019 2020

- Top Tax Write Offs For The Self Employed Turbotax Tax Tips Videos

- Retirement Plan Options For The Self Employed Iras Us News

If you re looking for Types Of Government Quizlet you've reached the right location. We ve got 101 images about types of government quizlet adding pictures, pictures, photos, wallpapers, and much more. In these page, we also provide variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Publication 560 2019 Retirement Plans For Small Business Internal Revenue Service Types Of Government Quizlet

Heres how the rates break down.

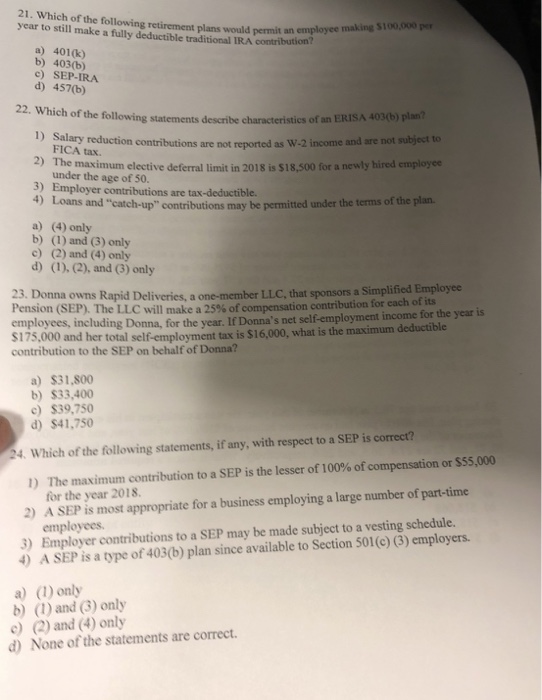

Types of government quizlet. The maximum contribution in 2015 and 2016 is 25 percent of your net self employment income after deducting self employment tax up to a maximum contribution of 53000. For a 401k plan the maximum possible contribution is 18000 if the participant is below the age of 50. It includes an additional 29 on the net income in excess of 132900.

Up to 13500 in 2020 13000 in 2019 plus an additional 3000 if youre 50 or older in 2015 2020 plus either a 2 fixed contribution or a 3 matching contribution. Everyone who works must pay these taxes which for 2021 are 765 for employees and 1530 for the self employed. You cannot borrow from a sep ira and you may face a 10 percent penalty if you take withdrawals before retirement.

You can put all your net earnings from self employment in the plan. The sep refers to a formal written retirement plan adopted by the employer. In other words the self employed persons fica tax rate for 2019 includes all of the following.

To calculate your plan compensation you reduce your net earnings from self employment by. Self employed tax deductions are the superheroes of your business taxes. The deductible portion of your se tax from your form 1040 return page 1 and the amount of your own not your employees retirement plan contribution from your form 1040 return page 1 on the line for self employed sep simple and qualified plans.

If you are self employed your fica federal insurance contributions act tax rate for 2019 is 153 on the first 132900 of net income. Yes the contributions to a retirement plan are tax deductible. Are contributions made to retirement plans tax deductible.

62 social security tax each for employee. Self employed persons can contribute up to 20 of their net self employment earnings towards their own account. They swoop in lower your tax bill and save your wallet from some serious destruction.

Under this arrangement you can generally contribute up to 19000 in tax year 2019 up to 25000 if. What are the contribution limits for retirement plans. The limits vary each year and by plan type.

You can make deductible contributions equaling the lesser of. 25 of net self employment earnings up to a maximum of 57000 net self employment earnings are equal to net profit minus your sep.

More From Types Of Government Quizlet

- Western Cape Government Vacancies Register

- Government Of India Act 1919 In Hindi Language

- Government Grants For Individuals Uk

- Self Employed Live In Care Jobs Uk

- Furlough Scheme End Date Redundancy

Incoming Search Terms:

- Form As6042 1 Download Printable Pdf Or Fill Online Deduction For Contributions To Qualified Retirement Plans And Tax On Certain Contributions Puerto Rico Templateroller Furlough Scheme End Date Redundancy,

- Self Employed Retirement Plans Furlough Scheme End Date Redundancy,

- When Should You Consider A Sep Ira Wealthfront Knowledge Center Furlough Scheme End Date Redundancy,

- What Is A Self Employed Retirement Plan By Thomasedwin Issuu Furlough Scheme End Date Redundancy,

- 2 Ways The 199a Deduction Has Changed Retirement Planning Furlough Scheme End Date Redundancy,

- What Is A Simplified Employee Pension Sep Ira 2020 Robinhood Furlough Scheme End Date Redundancy,