Canadian Government Revenue Sources, College Revenues Versus University Revenues Hesa

Canadian government revenue sources Indeed lately is being hunted by users around us, maybe one of you. Individuals now are accustomed to using the net in gadgets to view video and image information for inspiration, and according to the name of this post I will talk about about Canadian Government Revenue Sources.

- 359 Billion What Canada S Energy Sector Paid Governments From 2000 To 2018 Energy News For The Canadian Oil Gas Industry Energynow Ca

- Canada S Communications Future Time To Act Broadcasting And Telecommunications Legislative Review

- Bc Transit Funding Sources

- Revenue Of The Ontario Provincial Government By Source 2018 Statista

- Government Expenditures In Alberta

- Annual Financial Report Of The Government Of Canada Fiscal Year 2018 2019 Canada Ca

Find, Read, And Discover Canadian Government Revenue Sources, Such Us:

- Annual Financial Report Of The Government Of Canada Fiscal Year 2017 2018 Canada Ca

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctdo9imtqcd Nqjm0vfwtflfjovakzhcqd O6gfzy4wxdksq2po Usqp Cau

- Annual Financial Report Of The Government Of Canada Fiscal Year 2018 2019 Canada Ca

- Annual Financial Report Of The Government Of Canada Fiscal Year 2018 2019 Canada Ca

- Energy And The Economy

If you re looking for What Is New Furlough Scheme you've reached the right location. We have 104 images about what is new furlough scheme adding images, pictures, photos, backgrounds, and more. In such page, we additionally provide variety of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Printing of paper money 9.

What is new furlough scheme. Fine and penalties 7. Seignorage is one of the ways a government can increase revenue by deflating the value of its. Government revenues in canada averaged 1597601 cad million from 1985 until 2020 reaching an all time high of 32159 cad million in february of 2020 and a record low of 3384 cad million in april of 1985.

In 2018 roughly 4407 billion canadian dollars in revenue was collected by the ontario. Other revenue sources for canada come from the agricultural and fishing industries along with the government itself which employs about 288000 people at the federal level. This statistic shows the revenue of the ontario provincial government in 2018 by source of revenue.

The government posted a budgetary deficit of 190 billion in 201718 virtually unchanged from a deficit of 190 billion in 201617. Surplus of the public sector units 6. A tax is a compulsory.

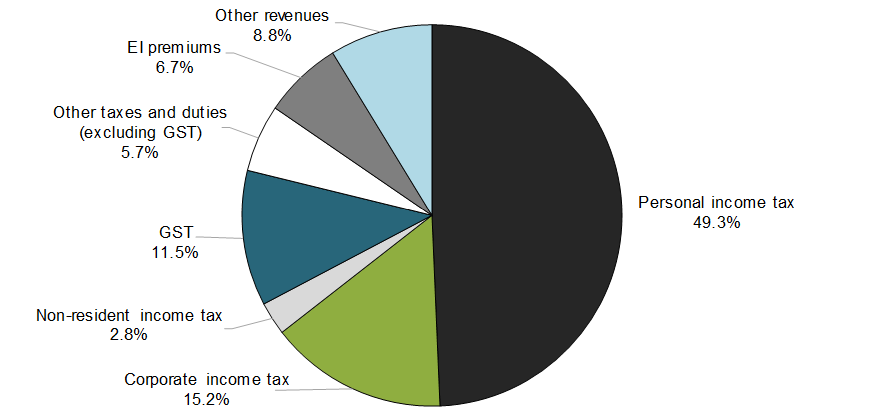

Gifts and grants 8. Corporate income tax revenues are the second largest source of revenues and accounted for 152 per cent of total revenues in 201819 down from 154 per cent in 201718. In the second quarter of 2020 the federal governments revenue amounted to 7487.

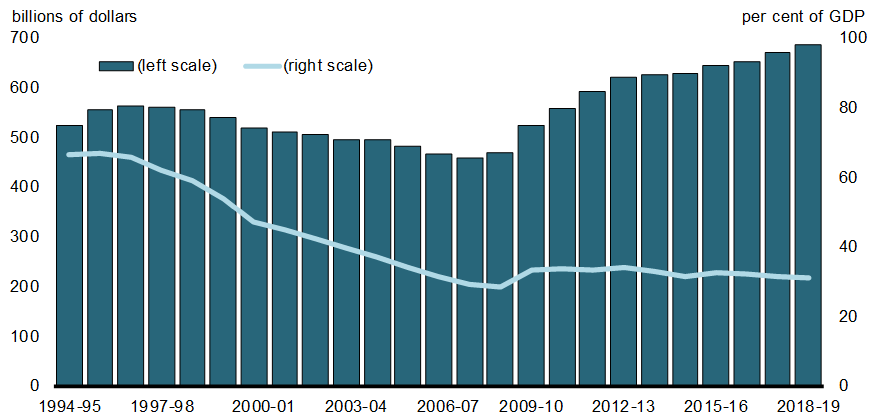

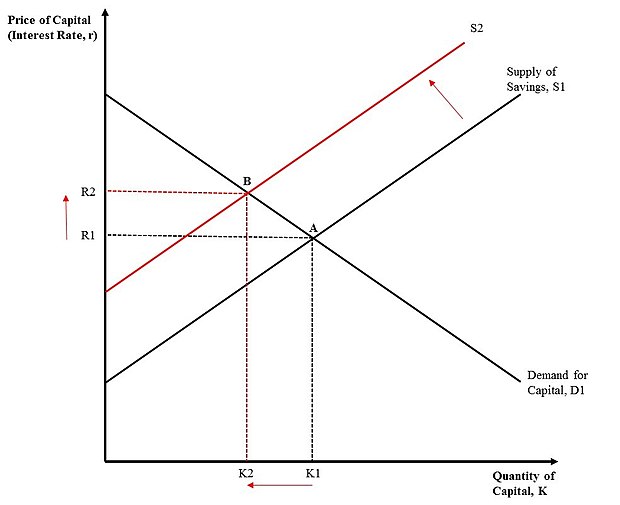

Revenue statistics 2019 canada tax to gdp ratio over time tax to gdp ratio compared to the oecd 2018 in the oecd classification the term taxes is confined to compulsory unrequited payments to general government. When the federal government records a deficit per capita expenditures are typically higher than per capita revenues as was the case from 2009 to 2013 and again in 2016 and 2017. Non resident income tax revenues are a comparatively smaller source of revenues accounting for only 28 per cent of total revenues in 201819 up from 25 per cent in.

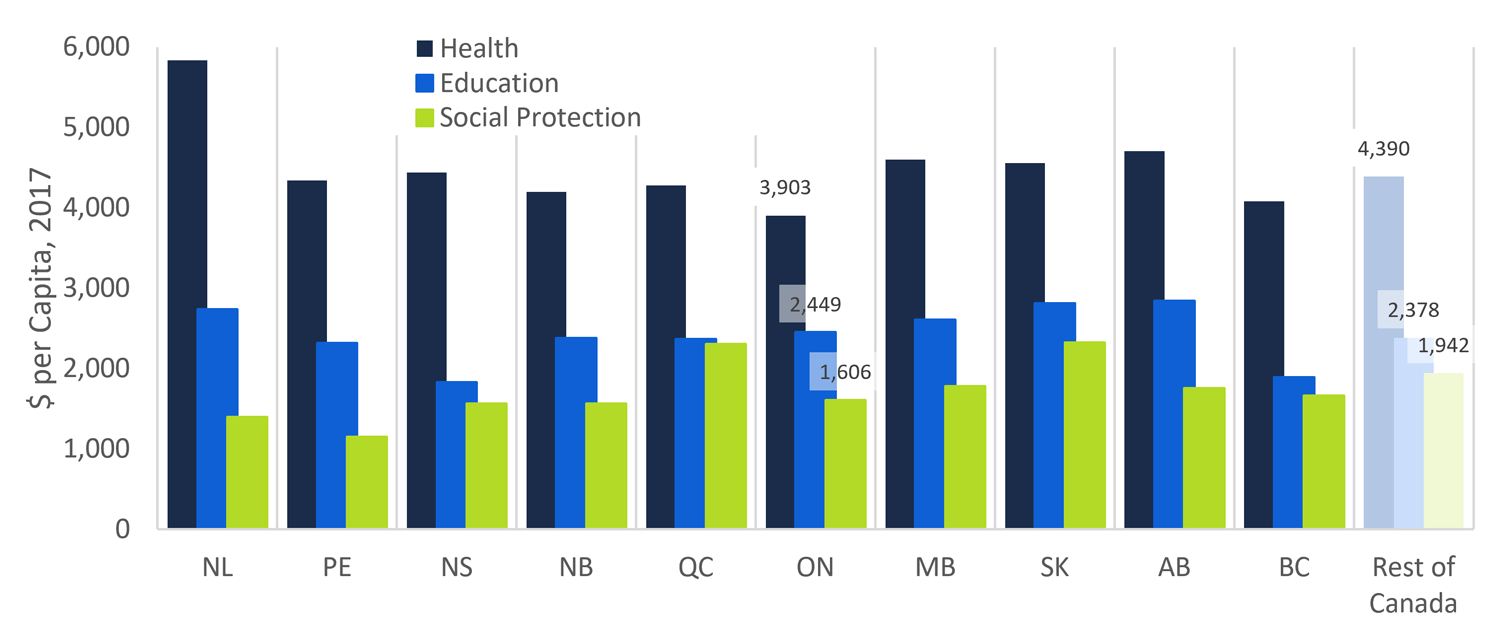

In 2017 the federal government collected an average of 8376 in revenues and incurred an average of 8408 in expenditures per canadian see figure 1. Taxes are unrequited in the sense that benefits provided by government to taxpayers are not normally in proportion to their. The following points highlight the nine main sources of government revenue.

This page provides canada government revenues actual values historical data. This statistic shows the revenue of the canadian government from 2013 to 2020 by government sector and quarter. Government revenue as well as government spending are components of the government budget and important tools of the governments fiscal policy.

More From What Is New Furlough Scheme

- All Government Universities In Lahore

- 3rd Self Employed Grant Claim Date

- Government Guidelines Covid 19 Scotland

- Government College University Lahore Fee Structure 2020

- Government Failure Adalah

Incoming Search Terms:

- Taxation Our World In Data Government Failure Adalah,

- Federal Political Financing In Canada Wikipedia Government Failure Adalah,

- Government Spending And Own Source Revenue For Canada S Aboriginals A Comparative Analysis Fraser Institute Government Failure Adalah,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsak14w2xc Lkymm18oemut Yqtn2hveknngx Bpskyrnswtu J Usqp Cau Government Failure Adalah,

- Annual Financial Report Of The Government Of Canada Fiscal Year 2018 2019 Canada Ca Government Failure Adalah,

- Sources Of Government Revenue In The Oecd Tax Foundation Government Failure Adalah,