Government Furlough Scheme Variable Pay, Job Retention Scheme Faqs Covid 19 Advice For Employers Menzies

Government furlough scheme variable pay Indeed lately is being hunted by users around us, maybe one of you personally. Individuals now are accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the title of this article I will talk about about Government Furlough Scheme Variable Pay.

- Coronavirus Q A On Understanding Flexible Furlough And The Extended Furlough Scheme

- Updated Guidance On The Coronavirus Job Retention Scheme Wilsons Solicitors Llp

- Coronavirus Furloughed Workers What You Need To Know

- Hmrc Coronavirus Job Retention Scheme Update Tim Prater Councillor For Sandgate West Folkestone Sandgate Village Harvey West Hythe East

- 2

- Lewis Silkin Furloughing Employees Faqs For Employers On The Coronavirus Job Retention Scheme

Find, Read, And Discover Government Furlough Scheme Variable Pay, Such Us:

- United Kingdom Updates And Faqs On The Uk Furlough Scheme Littler Mendelson P C

- Covid 19 Job Support Scheme Open Closed Explained Postponed Until December The Legal Partners

- Latest Coronavirus Guide For Employers Hr 4uk

- 2nkwbidjvapr M

- Updated Guidance And Analysis Of The Government S Coronavirus Job Retention Scheme Cjrs Updated 21st April 2020 Dolfinblue

If you are searching for Sri Lanka Government Gazette 2020 July 10 Sinhala you've arrived at the right place. We ve got 100 graphics about sri lanka government gazette 2020 july 10 sinhala adding pictures, pictures, photos, backgrounds, and more. In such page, we additionally provide number of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

Covid 19 Guidance For Ni Uk Employers On The Coronavirus Job Retention Scheme Updated 30 April 2020 Lexology Sri Lanka Government Gazette 2020 July 10 Sinhala

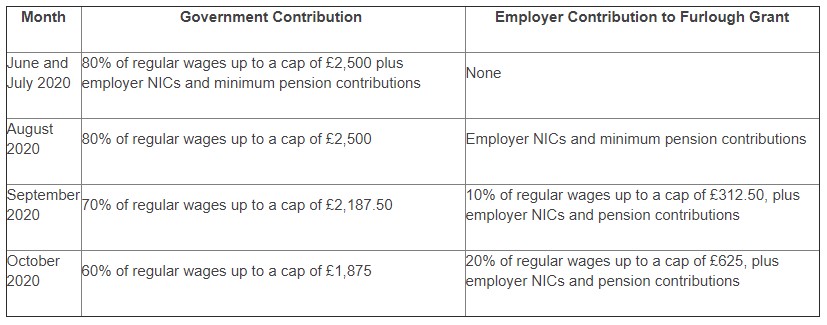

The grant contribution to the furlough pay reduces from 1 september so a further step is required to calculate how much to claim.

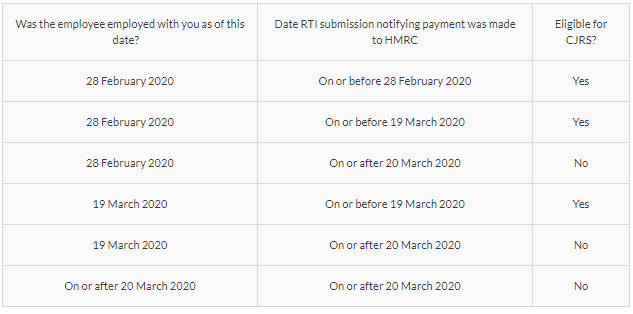

Sri lanka government gazette 2020 july 10 sinhala. To be eligible for the grant employers must continue to pay furloughed employees 80 of their wages up to a cap of 2500 per month for the time they are being furloughed. When the furlough scheme rules were first made available on 25 th march 2020 the government website stated that fees commission and bonus were not recoverable for employees placed upon furlough leave. Usual hours are calculated.

The temporary covid 19 wage subsidy is a scheme which allow employers to pay their employees during the covid 19 pandemic. Variable pay 80 of the average payable between the start of their employment or 6 april whichever is later and the day before the cjrs extension furlough period begins. If they have variable hours or pay their holiday pay is calculated as an average of the previous 52.

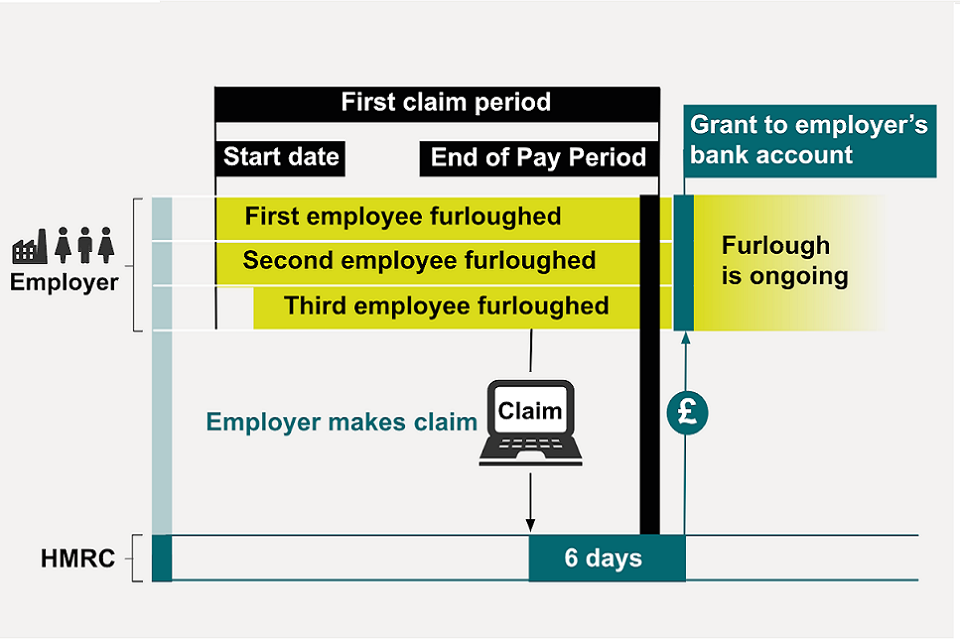

The employer is expected to make their best efforts to maintain as close to 100 of normal income as possible for the subsidised period. 12 june 2020 the page has been updated with information about. In short the new flexible furlough scheme abolishes the previous requirement for employees to be furloughed full time for a minimum of 3 weeks and will allow.

The previous cap 2500 applies to all calculations. Fixed hours the contracted hours in the last pay period ending 30 october 2020. Have been placed on furlough as part of the governments coronavirus job retention scheme.

Also added information on holiday pay that flexibly furloughed employees can be recorded as on furlough during time spent on holiday.

More From Sri Lanka Government Gazette 2020 July 10 Sinhala

- What Is Flexible Furlough Scheme

- Federal Government Icon Government Building Clipart

- Government Scholarship For College Students In Tamilnadu

- What Is Furlough Being Reduced To

- Government Help To Buy A House With Bad Credit

Incoming Search Terms:

- Https Www Gloucestershire Gov Uk Media 2099306 Furlough Leave Faq V8 9 July 2020 Pdf Government Help To Buy A House With Bad Credit,

- 2 Government Help To Buy A House With Bad Credit,

- Lewis Silkin Coronavirus Job Support Scheme Faqs For Employers Government Help To Buy A House With Bad Credit,

- Fretting About Flexible Furlough Low Incomes Tax Reform Group Government Help To Buy A House With Bad Credit,

- United Kingdom Further Updates And Faqs On The Uk Furlough Scheme Littler Mendelson P C Government Help To Buy A House With Bad Credit,

- Https Uk Markel Com Insurance Getmedia D0e14c7d 8f33 463c Afba D5c6777d6288 Furlough The Coronavirus Job Retention Scheme 20 04 20 Government Help To Buy A House With Bad Credit,