Self Employed Tax Id Number, Pin Di Worksheet

Self employed tax id number Indeed recently has been sought by users around us, perhaps one of you personally. Individuals are now accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the name of the post I will talk about about Self Employed Tax Id Number.

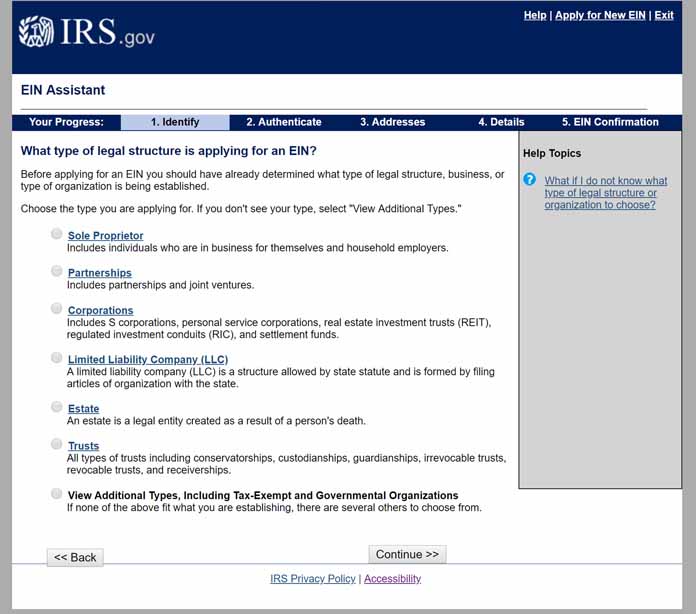

- Why Self Employed People Sometimes Need A Federal Tax Id Number And Ways To Obtain One Free From The Federal Government Cash Step

- What Is My Tax Id Number Ein Vs Sales Tax Id Paper Spark

- Why Self Employed People Sometimes Need A Federal Tax Id Number And Ways To Obtain One Free From The Federal Government Cash Step

- 2

- Postmates 1099 Taxes And Write Offs Stride Blog

- Https Www Siouxfalls Org Business Start New Business Irs Tax Information Fed Tax Responsibilities

Find, Read, And Discover Self Employed Tax Id Number, Such Us:

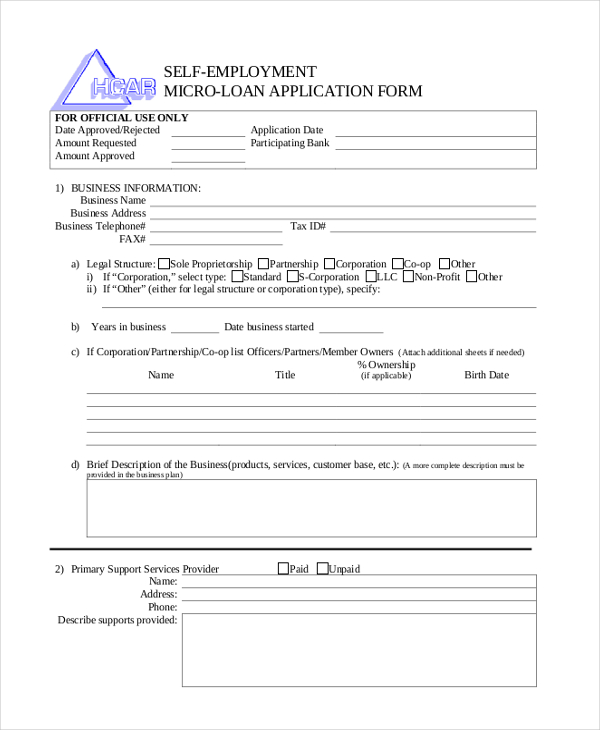

- Free 11 Sample Self Employment Forms In Pdf Word Excel

- Employment Verification Letter 8 Free Pdf Documents Download Free Premium Templates

- How To Get A Tax Id Number Or Ein For A Small Business

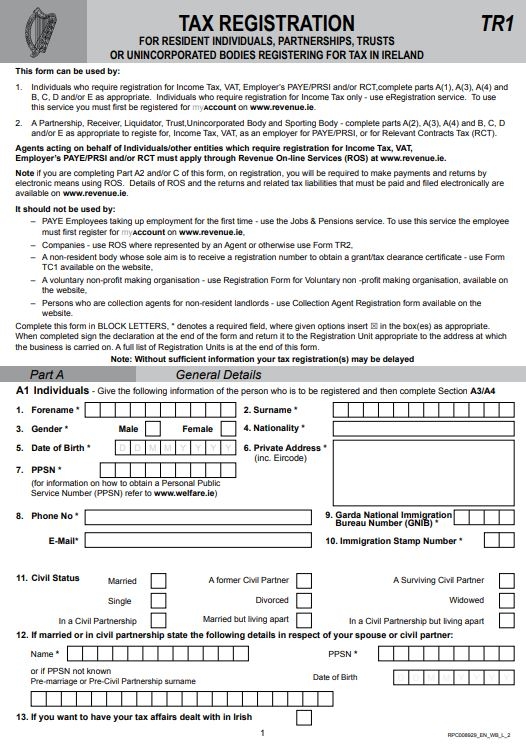

- How To Get A Tax Number In Malta As A Self Sufficient Resident

- 3knhaou4q Lwim

If you are searching for Local Government Icon Png you've arrived at the ideal location. We have 104 graphics about local government icon png adding images, photos, pictures, wallpapers, and much more. In such page, we additionally have variety of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Your tax id number sometimes also referred to as a federal tax identification number a 95 number or ein number is a nine digit number issued by the irs to be used by self employed individuals.

Local government icon png. You can operate your business and file your tax returns under schedule c the main self employment tax form using just your social security number ssn. You need to register for gst if you earn over 60000 a year. Resources for taxpayers who file form 1040 or 1040 sr schedules c e f or form 2106 as well as small businesses with assets under 10 million.

This could be the case if youre self employed or have set up a limited company if you owe tax on savings dividends or capital gains or if you earn more than 100000. This is a free service offered by the internal revenue service and you can get your ein immediately. Generally businesses need an ein.

You may apply for an ein in various ways and now you may apply online. Otherwise you do not need to have a federal employer identification number ein assigned in order to be self employed. You can find out if you need one by taking a six question irs survey.

Importance of tax id number to self employed individuals. How to obtain a tax id number for a self employed person. You only need a utr number if you submit a self assessment tax return.

An employer identification number ein is also known as a federal tax identification number and is used to identify a business entity. It is a number that usually requires most of the times by an irs. What youll find here.

There are a range of other circumstances where youll be required to submit a tax return. A tax id number also known as an ein. Eins common term is federal tax identification number.

Posted on july 19 2019 lisa 0 0. If youre self employed you use your individual ird number to pay tax. You pay tax on net profit by filing an individual income return.

In an upcoming business registration form there is a line written requesting for employees ein. As tax day 2020 approaches some self employed individuals might need a tax id number.

More From Local Government Icon Png

- Self Employed Invoice Template Word

- New Scheme To Replace Furlough Hmrc

- Government Consulting Services

- Government Of India Act 1919 In Hindi Language

- Government Consulting Jobs India

Incoming Search Terms:

- 2017 Self Employment Tax And Deduction Worksheet Writing Small Business Deductions Spreadsheet Fresh Prep Kidz Ac Golagoon Government Consulting Jobs India,

- 2019 Instructions For Schedule H 2019 Internal Revenue Service Government Consulting Jobs India,

- Free 11 Sample Self Employment Forms In Pdf Word Excel Government Consulting Jobs India,

- Chamber Of Commerce On Twitter 𝐇𝐨𝐰 𝐭𝐨 𝐠𝐞𝐭 𝐚 𝐭𝐚𝐱 𝐈𝐃 𝐧𝐮𝐦𝐛𝐞𝐫 𝐢𝐟 𝐲𝐨𝐮 𝐫𝐞 𝐬𝐞𝐥𝐟 𝐞𝐦𝐩𝐥𝐨𝐲𝐞𝐝 𝐨𝐫 𝐡𝐚𝐯𝐞 𝐚 𝐬𝐦𝐚𝐥𝐥 𝐛𝐮𝐬𝐢𝐧𝐞𝐬𝐬 Https T Co Az5mxm1clh Chamberofcommerce Smallbusiness Smb Smallbiz Government Consulting Jobs India,

- How To Get An Ein Or Federal Tax Id Number Applications In United States Application Gov Government Consulting Jobs India,

- Your Complete Guide To Self Employment Taxes In 2020 Ridester Com Government Consulting Jobs India,

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)