Self Employed Netherlands Tax, How To Declare Your Income Freelance Taxes In Sweden

Self employed netherlands tax Indeed lately has been hunted by consumers around us, maybe one of you personally. People now are accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the name of this article I will discuss about Self Employed Netherlands Tax.

- Freelance Taxes For The Self Employed In The Netherlands Expatica

- Spanish Vs Dutch Views On The Eu Recovery Fund

- Tax Guidelines For Uber Eats Delivery Partners

- Gielen Centre For Commercial Law Studies Queen Mary

- Freelance Taxes For The Self Employed In The Netherlands Expatica

- Https Www2 Deloitte Com Content Dam Deloitte Nl Documents Tax Deloitte Nl Factsheet Wbso Pdf

Find, Read, And Discover Self Employed Netherlands Tax, Such Us:

- How Much Should You Budget For Taxes As A Freelancer

- Coronavirus Self Employment Income Support Scheme What You Need To Know Sage Advice United Kingdom

- Simple Tax Guide For Americans In The Netherlands

- Social Security In The Netherlands Zorgverzekering Informatie Centrum

- Blue Clue Tax Solutions Prezentaciya Onlajn

If you are searching for Personal Loan For Self Employed With Itr you've come to the right place. We have 104 graphics about personal loan for self employed with itr adding pictures, photos, photographs, wallpapers, and more. In such page, we also have variety of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

The netherlands is a socially conscious country and higher earners can expect a substantial taxation of their salary up to 495.

Personal loan for self employed with itr. All residents in the netherlands need to pay a premium of around 1300 per year for basic health insurance however entrepreneurs and freelancers also need to pay an income related contribution. Sole traders self employed receive additional tax credits lowering the total amount of tax paid. You only pay tax on income earned there.

Freelancers and self employed professionals in the netherlands pay national insurance contributions through their income tax. Not resident in the netherlands. You meet the conditions that apply to everyone.

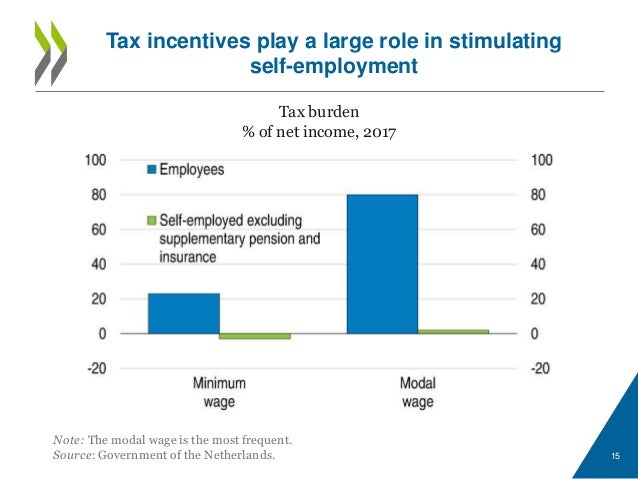

Resident in the netherlands. Some services are exempt from vat. Thanks to a set of deductions the first 24 thousand euros of their income is untaxed according to an analysis statistics netherlands published on monday.

Make sure you never pay tax twice on the same income. They will determine whether you are an entrepreneur for the purposes of turnover tax and income tax. The netherlands income tax for a self employed person is very advantageous as long as you dont make too much money.

If you carry out a temporary assignment in the netherlands as a freelancerself employed professional you sometimes have to pay vat as well. Just like other entrepreneurs freelancersself employed professionals must register with the dutch tax and customs administration belastingdienst. Many dutch self employed dont pay income tax many dutch self employed and freelancers for whom the bulk of their income come from these activities dont pay income tax.

Im self employed which income will be taxed in the netherlands. It is only with this registration that a healthcare provider with a foreign diploma may operate in the netherlands as a self employed person. Entrepreneur for the purposes of turnover tax vat value added tax is a form of turnover tax.

Vat turnover tax for non resident businesses. Use our dutch tax calculator to find out how much income tax you pay in the netherlands. Check the i enjoy the 30 ruling and find the maximum amount of tax you can save with the 30 percent ruling.

If you are self employed in the netherlands then you must calculate and pay your income tax via the annual tax return. However your personal situation type of work residency status and other assets and earnings particularly from abroad will affect your position considerably. Main personal and economic ties there you must pay tax on your worldwide income there.

Conditions for residence based on the dutch american friendship treaty or dutch japanese trade treaty. If you qualify for all of the self employed deductions you can make up to 29800 in 2020 without paying any income tax.

More From Personal Loan For Self Employed With Itr

- Government Officials In Ancient Egypt

- Government Intervention Economics Quizlet

- Self Employed Grant Claim Hmrc

- Self Employed Government Help Canada

- Government Symbol

Incoming Search Terms:

- Oecd Tax Database Oecd Government Symbol,

- The Rise Of Self Employment In The Netherlands Is The Polder Model At Risk Ecoscope Government Symbol,

- Covid 19 The Self Employed Are Hardest Hit And Least Supported Bruegel Government Symbol,

- Ibec S Myth Debunking Is Just Bunk Notes On The Front Government Symbol,

- Starting Your Own Business Pdf Free Download Government Symbol,

- Many Freelancers Don T Pay Any Income Tax At All Volkskrant Dutchnews Nl Government Symbol,

/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-e59e69ce6941454cb1025178eab3574d.png)