Self Employed Home Loan Lenders, Calameo How To Get Home Loan Application Approved

Self employed home loan lenders Indeed recently is being sought by users around us, perhaps one of you. People now are accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the title of this post I will discuss about Self Employed Home Loan Lenders.

- How A Self Employed Can Get A Home Loan From Clix Capital

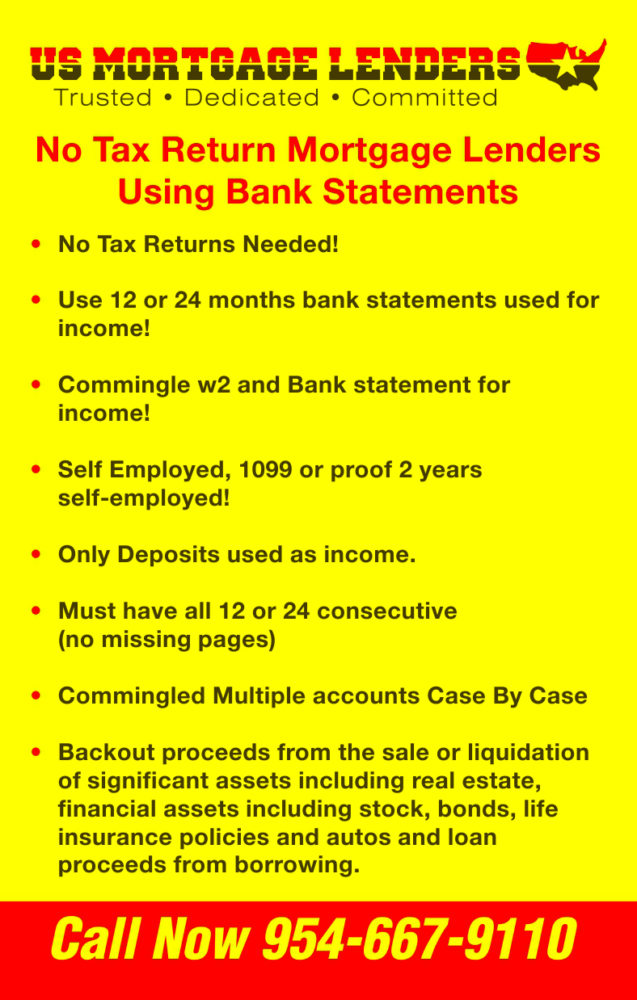

- Mortgage Guide Podcast E015 Bank Statement Loan For Self Employed

- Self Employed Mortgage Approvals Using Bank Statements Only

- Self Employed Home Loans Mortgage World Australia

- 10 Down Self Employed Mortgage Lenders Using Bs

- Bank Statement Loans For Self Employed 2020 Bank Statement Lenders

Find, Read, And Discover Self Employed Home Loan Lenders, Such Us:

- Mortgage Loan For Self Employed Homebuyers A Complete Guide

- Self Employed Mortgage Lenders Income Per Bank Statement Only

- Ppt Low Doc Loans 1 Powerpoint Presentation Free To Download Id 8c9d4c Ytlin

- Home Loans For The Self Employed Homeside Sa Home Loans

- Self Employed Tax Returns Are Not Needed To Secure A Home Loan Bankerbroker Com California Home Loans Mortgage Refinance No Doc Mortgages Voe Programs Call 1 877 410 Money

If you re searching for Self Employed Government Support Scheme Uk you've reached the right place. We have 100 images about self employed government support scheme uk including pictures, photos, photographs, wallpapers, and much more. In such webpage, we additionally provide number of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Common reasons the self employed get denied for a loan.

Self employed government support scheme uk. Another issue is not showing enough income. The self employed dont always offer the financial stability a lender looks for in a borrower and as such as a self employed person applying for a home loan youll need to provide tax returns and letters from your accountant before most lenders will even consider you. Lenders set new requirements for self employed mortgage borrowers during covid 19.

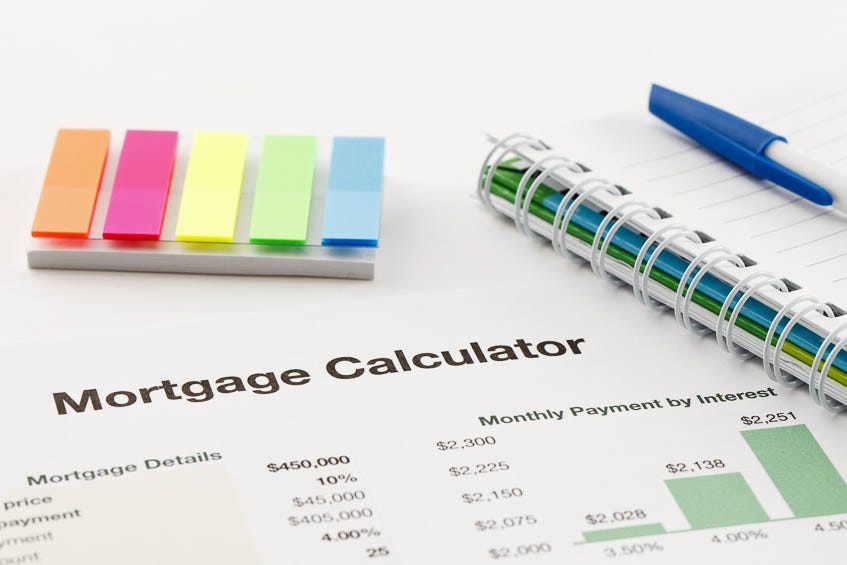

One of the biggest reasons the self employed get denied for a loan is that they havent been self employed for long enough. Mortgage lenders calculate your mortgage eligiblity based on how much money you make before you take any tax deducations or pay taxes. Best self employed mortgage lenders.

Have you experienced any difficulties in obtaining a home loan due to your self employment. Convert to full doc. Are you self employed.

Quicken loans is one of the countrys biggest lenders offering a full suite of mortgage products for the self employed including conventional loans jumbo loans refinancing and government backed fha and va loans. Plus how ppp and unemployment benefits are handled by lenders. Many lenders will allow low doc borrowers to convert their self employed home loan over to a full doc loan after a period of time without asking for financial verification.

Lenders like you to have been self employed for two years or more typically. Well you should be happy to know that there are numerous mortgage lenders that offer home loan programs to self employed borrowers. There are many ways you may be self employed and underwriters look at each structure differently.

Good news for the nations 14 million self employed workers mortgage lenders are making it easier to get approved for a purchase loan or home refinance. For a conventional loan with 20 down payment borrowers will typically need to show a good credit score of 700 or higher. The self employed lenders listed below are just a few examples and their guidelines and requirements are constantly changing.

Loan types range from 30 year fixed rate loans and 15 year fixed rate loans to fha arms va home loans etc. Rates range from 33 to 36. You can even get pre approved from a mobile device.

There are many non qm or portfolio lenders who offer self employed mortgages but the trick is to find the one who is the best fit for your self employment situation and with the best rates.

More From Self Employed Government Support Scheme Uk

- Government Jobs People Over 50

- Staff Nurse Vacancy In Gujarat Government 2020

- Petty Self Employed Workers

- Government College University Lahore Admission 2020 Fee Structure

- Government Quarters Inside

Incoming Search Terms:

- Self Employed Home Loans Mortgage World Australia Government Quarters Inside,

- Calameo How To Get Home Loan Application Approved Government Quarters Inside,

- Calameo Article Low Doc Home Homes Freedomloans Com Au Government Quarters Inside,

- Home Loan Options For The Self Employed Dpa Search Government Quarters Inside,

- Blog Secure Choice Home Loans Government Quarters Inside,

- Can I Get A Home Loan If I M Self Employed North Brisbane Home Loans Government Quarters Inside,