Self Employed Health Insurance Deduction Irs Publication, Https Www Irs Gov Pub Irs Dft P502 Dft Pdf

Self employed health insurance deduction irs publication Indeed lately is being sought by users around us, maybe one of you personally. Individuals now are accustomed to using the net in gadgets to see video and image information for inspiration, and according to the title of the post I will talk about about Self Employed Health Insurance Deduction Irs Publication.

- Http Uofi Tax 15a3x12

- 1040 2019 Internal Revenue Service

- Instructions For Form 8995 2019 Internal Revenue Service

- How To Write Off Medical Expenses As A Tax Deduction

- 1805 030 20 15 Allowable Deductions Dss Manuals

- Publication 463 2019 Travel Gift And Car Expenses Internal Revenue Service

Find, Read, And Discover Self Employed Health Insurance Deduction Irs Publication, Such Us:

- Maximizing Premium Tax Credits For Self Employed Individuals

- Publication 502 2019 Medical And Dental Expenses Internal Revenue Service

- Section 106 Health Insurance Tax Deduction For Employer Groups

- Re Self Employed Health Insurance Deduction 1040

- Irs 2019 Health Insurance Subsidy Tax Credit Reconciliation

If you re looking for Uk Government Furlough Scheme Cost you've arrived at the ideal location. We have 104 images about uk government furlough scheme cost adding images, pictures, photos, backgrounds, and more. In such page, we also provide variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

Publication 974 2019 Premium Tax Credit Ptc Internal Revenue Service Uk Government Furlough Scheme Cost

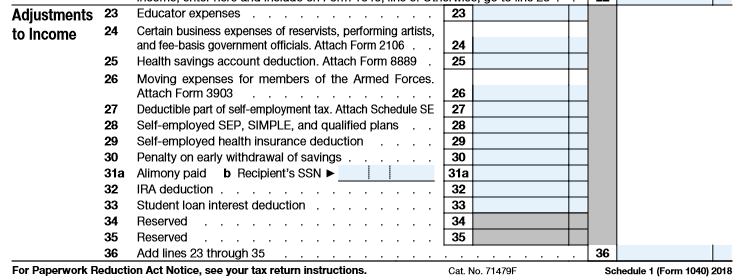

Figure your self employed health insurance deduction using the self employed health insurance deduction worksheet in the form 1040 or form 1040nr instructions or if required worksheet 6 a in chapter 6 of publication 535.

/GettyImages-184878144-fad59359c24245ceb97dafe44c6d0e9e.jpg)

Uk government furlough scheme cost. You cannot take the ptc. For the latest information about developments related to pub. Sep simple and qualified plan deductions.

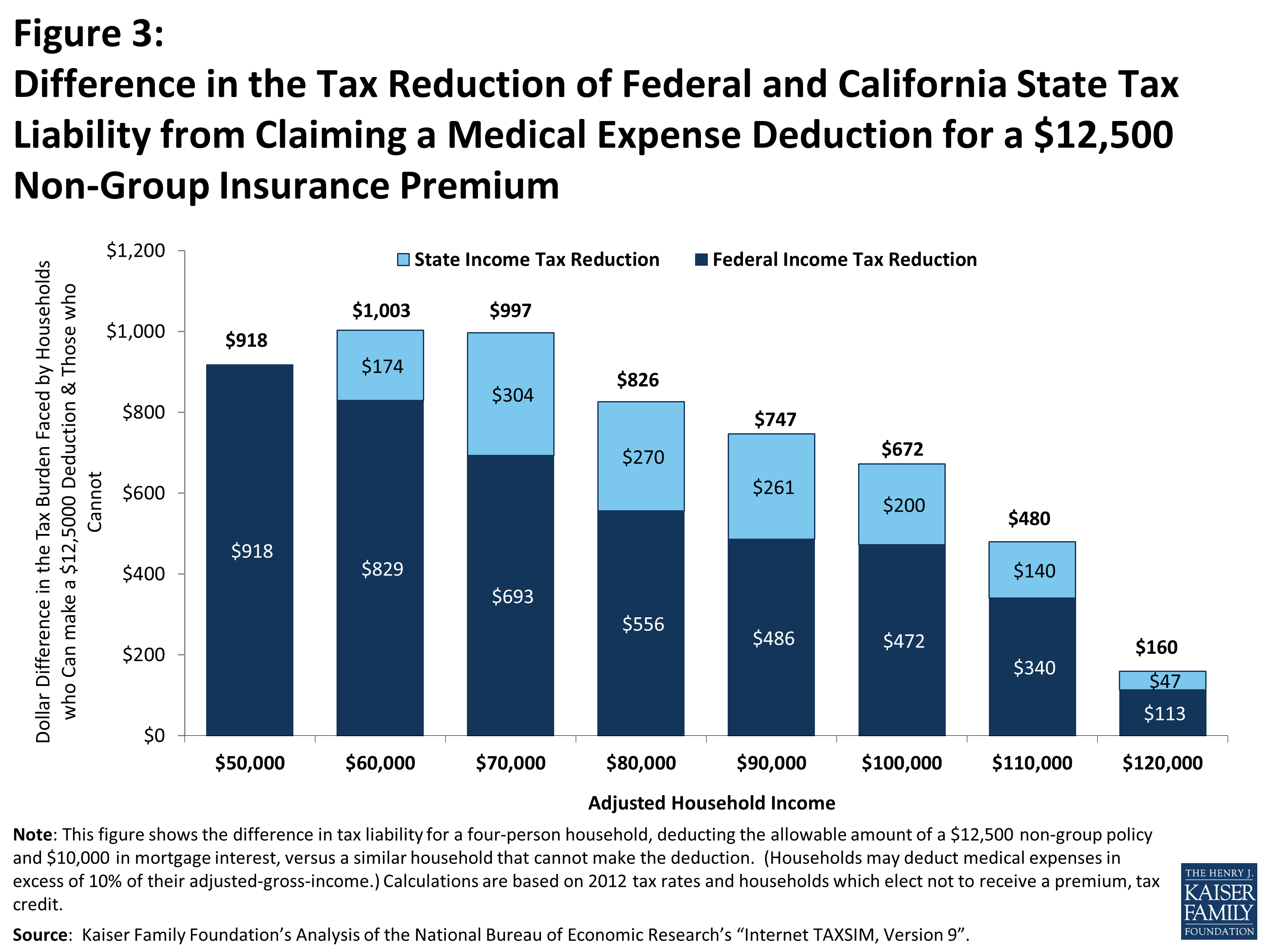

This publication also explains how to treat impairment related work expenses health insurance premiums if you are self employed and the health coverage tax credit that is available to certain individuals. With the rising cost of health insurance a tax deduction can help you pay at least a portion of the premium cost. Self employed health insurance deduction worksheet.

Go to irsgovorderforms to order current forms instructions and publica tions. Qualified long term care services. Publication 554 page 2.

502 covers many common medical expenses but not every possible medical expense. This publication also provides additional information to help you determine if your health care coverage is minimum essential coverage mec. And that will help to keep you healthyand happyin 2020 and beyond.

Deducting health insurance premiums if youre self employed accessed dec. Attach the form 8962 you used in step 4 to your tax return. Call 800 829 3676 to order prior year forms and instructions.

Qualified long term care insurance. Your self employed health insurance deduction is the total of the step 5 worksheet line 7 and worksheet w line 14. Self employed individuals calculating your own retirement plan contribution and deduction accessed dec.

Qualified long term care insurance contract. You can claim a self employed health insurance deduction for the specified premiums equal to the amount on line 7 of the step 5 worksheet. Effect on itemized deductions.

Qbi does not include items such as. Self employed health insurance deduction. Enter this total on.

Generally this includes but is not limited to the deductible part of self employment tax self employed health insurance and deductions for contributions to qualified retirement plans eg. Ordering tax forms instructions and publications. Include on line 1 of those worksheets the amount from line 5 of this worksheet.

2014 41 this revenue procedure provides guidance that a taxpayer may use to compute the deduction under 162 of the internal revenue code for health insurance costs for self employed individuals and the premium tax credit allowed under 36b. If you qualify the deduction for self employed health insurance premiums is a valuable tax break. Self employed taxpayers who wish to take the ptc and the self employed health insurance deduction.

Items that are not properly includable in taxable income.

Publication 17 2019 Your Federal Income Tax Internal Revenue Service Uk Government Furlough Scheme Cost

More From Uk Government Furlough Scheme Cost

- Furlough Scheme Scotland November

- Karnataka State Government Holidays

- Government Quota In Private Medical Colleges In Tamilnadu Fees

- Self Employed Furlough Scheme When Does It End

- Is The Furlough Scheme Likely To Be Extended

Incoming Search Terms:

- The Big List Of Small Business Tax Deductions 2020 Bench Accounting Is The Furlough Scheme Likely To Be Extended,

- Preparation Calculating Correct Entries For Self E Chegg Com Is The Furlough Scheme Likely To Be Extended,

- 2 Is The Furlough Scheme Likely To Be Extended,

- Federal Insurance Contributions Act Tax Wikipedia Is The Furlough Scheme Likely To Be Extended,

- 1040 2019 Internal Revenue Service Is The Furlough Scheme Likely To Be Extended,

- Publication 463 2019 Travel Gift And Car Expenses Internal Revenue Service Is The Furlough Scheme Likely To Be Extended,