Self Employed Health Insurance Deduction Worksheet Instructions, Form Mo Shc 2016 Self Employed Health Insurance Tax Credit Edit Fill Sign Online Handypdf

Self employed health insurance deduction worksheet instructions Indeed lately has been sought by consumers around us, perhaps one of you. People now are accustomed to using the net in gadgets to see image and video information for inspiration, and according to the title of this post I will discuss about Self Employed Health Insurance Deduction Worksheet Instructions.

- Table And Worksheets For The Self Employed Completetax

- Https Www Grandrapidsmi Gov Files Assets Public Departments Income Tax Files Individual 2019 Part Year Res Pdf

- 2017 Self Employment Tax Form Inspirational 30 Beautiful 2017 Self Employment Tax And Deduction Worksheet Models Form Ideas

- Health Coverage Tax Credit Omb No Form Attach To Form 1040 Form 1040nr Form 1040 Ss Or Form 1040 Pr Pdf Free Download

- Self Employed Health Insurance Deduction What To Know Credit Karma Tax

- Form 8965 Health Coverage Exemptions And Instructions Obamacare Facts

Find, Read, And Discover Self Employed Health Insurance Deduction Worksheet Instructions, Such Us:

- Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

- How To Fill Out The Schedule C

- Ppp Loan Forgiveness Application Guidance For The Self Employed Freelancers And Contractors

- Https Dor Mo Gov Pdf Morevmo Shc Pdf

- Https Www Mass Gov Doc 2011 Schedule Rnr Residentnonresident Worksheet Download

If you are looking for Government Vouchers Malta Validity you've come to the ideal location. We have 104 graphics about government vouchers malta validity including images, photos, pictures, backgrounds, and much more. In such webpage, we additionally provide variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

22 Tax Deductions No Itemizing Required On Schedule 1 Don T Mess With Taxes Government Vouchers Malta Validity

Self employed health insurance deduction worksheet form 1040 instructions page 32.

Government vouchers malta validity. Instead figure you self employed health insurance deduction using the self employed health insurance deduction worksheet in the form 1040 or form 1040nr instructions or if required worksheet 6 a in chapter 6 of pub. The insurance also can cover your child who was under age 27 at the end of 2019 even if the child wasnt your dependent. Self employed health insurance deduction.

Self employed health insurance deduction worksheet form 1040 instructions html. Selfemployed health insurance deduction worksheet. Self employed health insurance deduction worksheet.

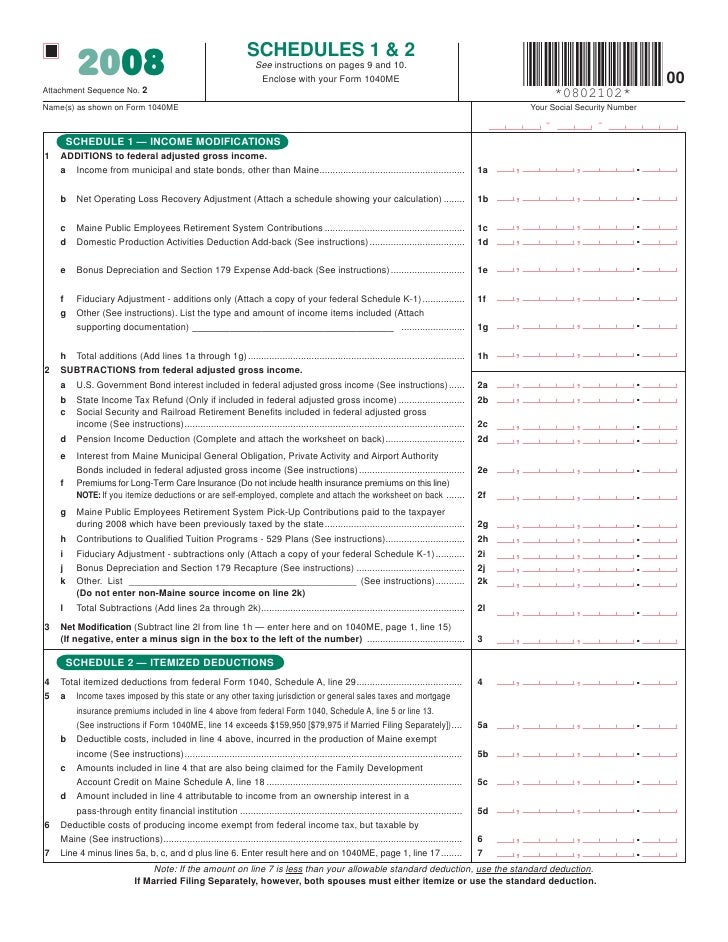

A worksheet is provided in the instructions for form 1040 to calculate the deduction and a more detailed worksheet can be found in publication 535. 2015 self employed health insurance deduction worksheet. Effect on itemized deductions.

Qualified long term care insurance. You may be able to deduct the amount you paid for health insurance for yourself your spouse and your dependents. Self employed health insurance deduction worksheet legal guidance rev.

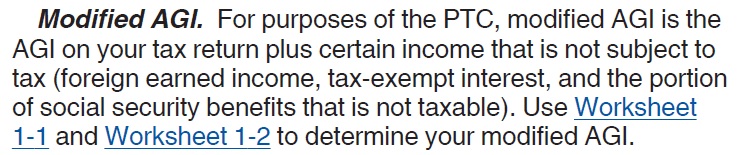

Qualified long term care services. If you are completing the selfemployed health insurance deduction worksheet in your tax return instructions and you were an eligible trade adjustment assistance taa recipient alternative taa ataa recipient reemployment taa rtaa recipient or pension benefit guaranty corporation pbgc payee you must complete form 8885 before. 2014 41 this revenue procedure provides guidance that a taxpayer may use to compute the deduction under 162 of the internal revenue code for health insurance costs for self employed individuals and the premium tax credit allowed under 36b.

Line 16 self employed health insurance deduction. Effect on self employment tax. You may be able to deduct the amount you paid for health insurance for yourself your spouse and your dependents.

Do not use this method. Using the instructions in this part is optional. If you are eligible for both a self employed health insurance deduction and ptc for the same premiums you may use any computation method that satisfies each set of rules as long as the sum of the deduction claimed for the premiums and the ptc computed taking the deduction into account is less than or equal to the premiums.

Qualified long term care insurance contract. The insurance also can cover your child who was under age 27 at the end of 2019 even if the child wasnt your dependent. 2018 self employed health insurance deduction worksheet.

Self employed health insurance deduction.

More From Government Vouchers Malta Validity

- Self Employed Vs Employed Uk

- Government Guaranteed Loans Canada

- Furlough Extension Northern Ireland

- Government Symbol Limited Government Drawing

- Self Employed Tax Form Uk

Incoming Search Terms:

- Breaking Down The Self Employed Health Insurance Deduction Eric Nisall Self Employed Tax Form Uk,

- Breaking Down The Self Employed Health Insurance Deduction Eric Nisall Self Employed Tax Form Uk,

- Https Www Reginfo Gov Public Do Downloaddocument Objectid 85804801 Self Employed Tax Form Uk,

- How To Claim The Home Office Deduction With Form 8829 Ask Gusto Self Employed Tax Form Uk,

- Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2 Self Employed Tax Form Uk,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctjyiuhoz3pc6uu01pkiqn9mkhxqkq Rcgzc2v5szzhwpvgnpxe Usqp Cau Self Employed Tax Form Uk,