Government Loans For Small Businesses Covid 19, Reeves Requests Low Interest Loans For Businesses Facing Covid 19

Government loans for small businesses covid 19 Indeed lately has been hunted by users around us, maybe one of you. Individuals now are accustomed to using the net in gadgets to see image and video information for inspiration, and according to the title of the post I will talk about about Government Loans For Small Businesses Covid 19.

- Covid 19 Small Business Help

- Small Business San Antonio Hispanic Chamber Of Commerce

- Welcome To The City Of Columbia

- Sba To Provide Disaster Assistance Loans For Small Businesses Impacted By Coronavirus Covid 19 Csu Bakersfield Sbdc

- Njeda Njeda Announces 50 Million Expansion Of Grant Program For Businesses Impacted By Covid 19

- Government Provides Business Continuity Loan Program For Small Businesses Access Accelerator Sbdc

Find, Read, And Discover Government Loans For Small Businesses Covid 19, Such Us:

- Gov Wolf Seeks Federal Loans For State S Small Businesses Hurt By Covid 19 Impact Pittsburgh Post Gazette

- Covid 19 Loan And Grant Programs Portland Me

- Covid 19 Has Hit Smes In South Africa S Food Sector Hard What Can Be Done To Help Them

- Covid 19 Resources

- Uk Government To Guarantee Covid 19 Loans Of Up To 50 000 To Smes The National

If you re looking for Three Branches Of Government Functions you've reached the right location. We have 100 images about three branches of government functions adding pictures, pictures, photos, wallpapers, and much more. In such web page, we additionally provide variety of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

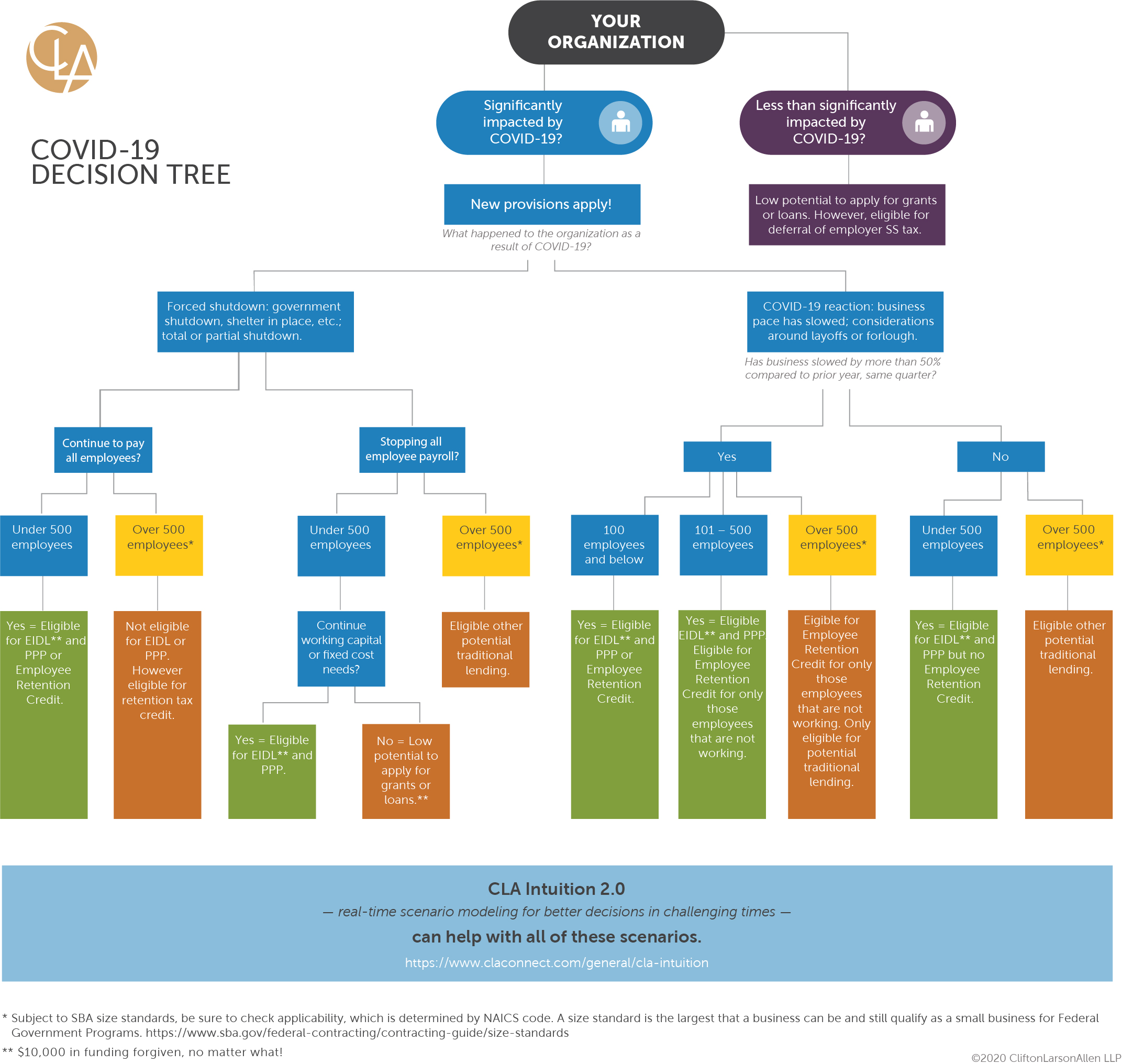

Decision Tree Navigate Covid 19 Loan And Grant Options With Ease 2020 Articles Resources Cla Cliftonlarsonallen Three Branches Of Government Functions

The government guarantees 80 of the finance to the lender and pays interest and.

Three branches of government functions. Pennsylvania is offering loans to small businesses through its covid 19 working capital access program. Having a partial guarantee on the funds means that lenders are able to offer loans to customers at lower. Small businesses suffering economic injury during the covid 19 pandemic are able to apply for working capital loans up to 2 million to help overcome the temporary loss of revenue due to this crisis.

The scheme is enhancing lenders ability to provide cheaper credit allowing many otherwise viable smes to access vital additional funding to get. The scheme helps small and medium sized businesses to access loans and other kinds of finance up to 5 million. For covid 19 government backed business loans this guarantee is 50 of the funding amount.

The coronavirus small and medium enterprises sme guarantee scheme is supporting up to 40 billion of lending to smes including sole traders and not for profits by guaranteeing 50 per cent of new loans issued by participating lenders to smes. Small business guidance loan resources. Business covid 19 the governments small business loan program is lending money again.

Applications are open until 31 december 2020 and can be made through myir. Economic injury disaster loan eidl the us small business administrations economic injury disaster loan eidl is intended to provide low interest federal disaster loans to small businesses. Government will provide one off loans to small businesses including sole traders and the self employed impacted by covid 19 to support their cash flow needs.

The morrison government is extending its small business covid 19 loans scheme until june next year after revealing that banks have so far lent a far lower amount than was targeted at the height. These loans can be up to 100000 and have three year terms with a 12 year amortization.

Small Businesses Have Another Six Months To Apply For An Interest Free Government Backed Loan As The Small Business Cashflow Loan Scheme Is Extended Interest Co Nz Three Branches Of Government Functions

More From Three Branches Of Government Functions

- Government Accounting Millan Solution Manual Chapter 5

- Self Declaration Proof Of Income Letter Self Employed

- Self Employed Taxes California

- Us Government Budget Graph

- Self Employed Maternity Pay For Dads

Incoming Search Terms:

- Small Businesses Have Another Six Months To Apply For An Interest Free Government Backed Loan As The Small Business Cashflow Loan Scheme Is Extended Interest Co Nz Self Employed Maternity Pay For Dads,

- Gov Ivey Small Businesses Impacted By Covid 19 Eligible For Assistance Self Employed Maternity Pay For Dads,

- 100 Public Pharma And Cmos Took Ppp Covid 19 Small Business Loans Self Employed Maternity Pay For Dads,

- Sba Release For Small Businesses Impacted By Coronavirus Covid 19 Growgrow Self Employed Maternity Pay For Dads,

- Covid 19 Small Business Help Self Employed Maternity Pay For Dads,

- Governor Carney Requests Federal Assistance For Small Businesses State Of Delaware News Self Employed Maternity Pay For Dads,