Self Employed Taxes California, What Is A Sole Proprietorship Everything You Need To Know

Self employed taxes california Indeed lately is being hunted by consumers around us, maybe one of you. People are now accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the name of this article I will discuss about Self Employed Taxes California.

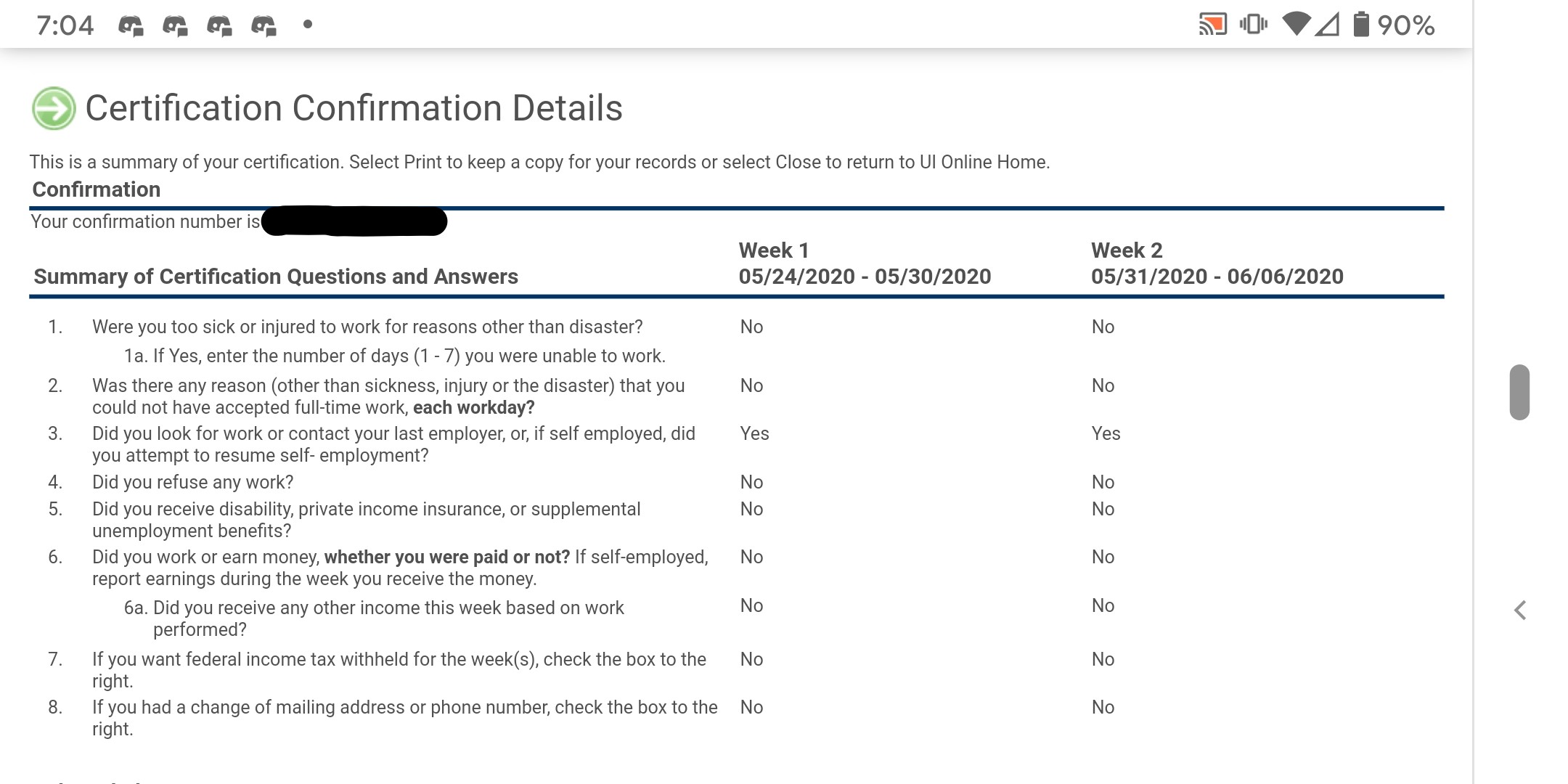

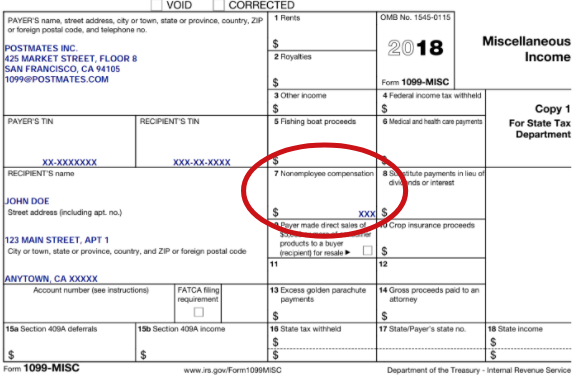

- Postmates 1099 Taxes And Write Offs Stride Blog

- Deducting Self Employment Expenses California Perfect Tax

- Thesis On Self Employment Tax Calculator 2015 California Cleanilstasdic

- Do I Have To File Taxes

- 1099 Taxes Calculator Estimate Your Self Employment Taxes

- Irs Issues 2020 Form W 4

Find, Read, And Discover Self Employed Taxes California, Such Us:

- 14 Tax Tips For The Self Employed Taxact Blog

- California And New Jersey Hsa Tax Return Special Considerations

- Online Ca Find Items In Libraries Across Alberta

- Deductible Part Of Self Employment Tax Attach Schedule Se Tax Walls

- Top 7 Mistakes That Rideshare Drivers Make At Tax Time Stride Blog

If you re looking for Furlough Extension End Of June you've come to the ideal place. We ve got 104 images about furlough extension end of june including pictures, photos, photographs, backgrounds, and much more. In these webpage, we also have number of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

That rate is the sum of a 124 for social security and 29 for medicare.

Furlough extension end of june. Self employment tax applies to net earnings what. 124 for social security tax and 29 for medicare. California self employment tax by the franchise tax board.

This tax applies to those who are sole proprietors with a net profit of 400 or more during the year. According to the state of california franchise tax board irs self employment tax consists of medicare and social security but the purpose of this article is to explain taxes for california for self employed people. What is self employment tax.

The self employment tax applies evenly to everyone regardless of your income bracket. Board of equalization franchise tax board. With the amount of taxes the irs already collects from taxpayersas well as the ever increasing cost of living self employedtax payers can ill afford to overlook claiming as many deductions as the irs makes available.

This rate is derived from the fact that self employed taxpayers can deduct the employers portion of the tax which is 765. As a self employed person you can deduct not only the employer share of your social security and medicare taxes you can take other deductions such as home office educational or auto expenses. Note that the social security tax rate is currently 153 29 for medicare plus 124 for social security.

Take advantage of these deductions. Department of industrial relations employment. Paying taxes on your self employment income.

The 1099 tax rate consists of two parts. The income and expense situation of self employed taxpayers are widely recognized as fertile hunting grounds for a wide variety of deductions. Small business events in your area.

Our folsom tax planning attorneys provide a guide for an efficient way to calculate your self employment taxes if you are self employed in california. Se taxes are reported using schedule se self employment tax which should be attached to your income tax return. The tax rate is currently 153 of your income with 124 going to social security and 29 going to medicare.

Self employment tax is social security and medicare tax for people who are self employed. The biggest reason why filing a 1099 misc can catch people off guard is because of the 153 self employment tax. The irs self employment tax applies to residents who are sole.

It also applies to individuals who have a net profit of 400 or more during the year from the partnership or limited liability company that is structured. 2016 tax rates for the self employed. The self employment tax is calculated on 9235 of your total income.

Use forms 1040 es and 540 es schedule se to report self employment tax. Governors office of business and economic development permits and licenses secretary of state california department of business oversight.

More From Furlough Extension End Of June

- Government College University Lahore Admission 2020 Last Date

- New Furlough Scheme Announcement

- Self Employed Relief Covid

- Project Grants Definition Government

- Government Icon White Png

Incoming Search Terms:

- Payroll Tax Wikipedia Government Icon White Png,

- How To Pay Little To No Taxes For The Rest Of Your Life Government Icon White Png,

- How Starting An S Corp Could Lower Your Taxes By 5 000 Tax Savings Calculator Gusto Government Icon White Png,

- Work From Home Tax Deduction Only Applies To Self Employed Workers Business Insider Government Icon White Png,

- Now California Can Assess Taxes No Matter Where You Live Really Government Icon White Png,

- Http Etd Repository Ugm Ac Id Penelitian Unduh 257391 Government Icon White Png,