Self Employed Netherlands Tax Calculator, Netherlands Measures In Response To Covid 19 Kpmg Global

Self employed netherlands tax calculator Indeed recently is being hunted by consumers around us, maybe one of you personally. Individuals are now accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the name of this article I will discuss about Self Employed Netherlands Tax Calculator.

- Https Www Oecd Org Ctp Tax Policy Personal Income Tax Rates Explanatory Annex Pdf

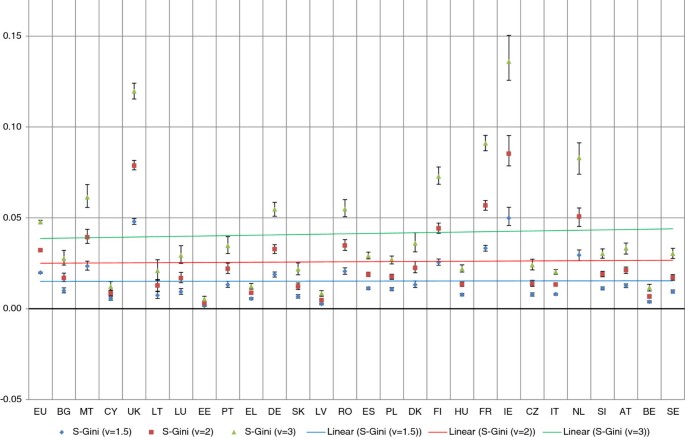

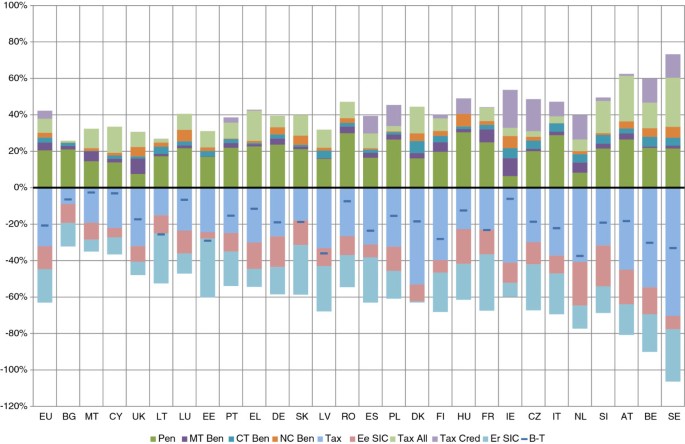

- Https Www Imf Org Media Files Publications Wp 2019 Wpiea2019064 Ashx

- Income Redistribution In The European Union Springerlink

- Dentons The Netherlands Tax Plan 2021

- Workplace Calculator Www Sodra Lt

- Carbon Tax Wikipedia

Find, Read, And Discover Self Employed Netherlands Tax Calculator, Such Us:

- Dutch Corporate Income Tax Intercompany Solutions Blog

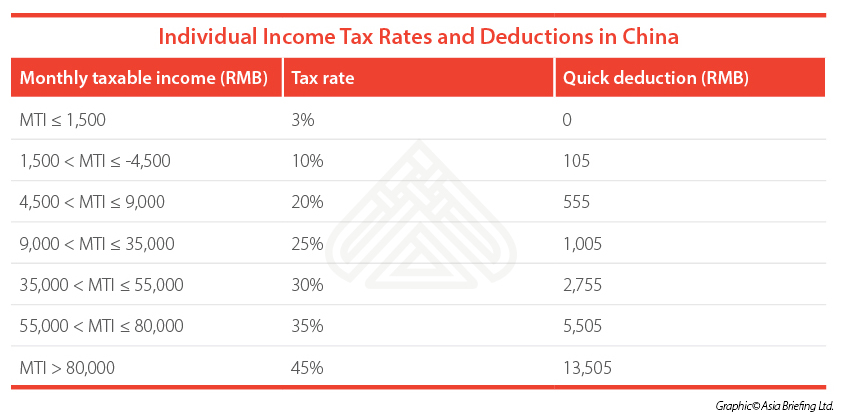

- Paying Foreign Employees In China Individual Income Tax China Briefing News

- Your Bullsh T Free Guide To Canadian Tax For Working Holidaymakers

- Netherlands Global Payroll Tax Information Guide Payslip

- Social Security In The Netherlands Your Dutch Social Security Benefits About Netherlands Expatica The Netherlands

If you are searching for Self Employed Nail Technician Near Me you've come to the ideal location. We ve got 104 images about self employed nail technician near me including pictures, pictures, photos, backgrounds, and much more. In such page, we additionally have variety of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Paying Foreign Employees In China Individual Income Tax China Briefing News Self Employed Nail Technician Near Me

More information about the calculations performed is available on the details page.

Self employed nail technician near me. The salary amount does not matter if working with scientific research. All residents in the netherlands need to pay a premium of around 1300 per year for basic health insurance however entrepreneurs and freelancers also need to pay an income related contribution. You will have to pay an additional 360 2 on another 18000 of your self employment income.

Check the i enjoy the 30 ruling and find the maximum amount of tax you can save with the 30 percent ruling. The calculator uses tax information from the tax year 2020 2021 to show you take home pay. Use our dutch tax calculator to find out how much income tax you pay in the netherlands.

Whether youre employed self employed or a combination of both working out your take home pay after tax can be tricky. Employed and self employed tax calculator. If you are self employed use this simplified self employed tax calculator to work out your tax and national insurance liability.

Freelancers and self employed professionals in the netherlands pay national insurance contributions through their income tax. With our employed and self employed tax calculator you can very quickly find out how much income tax and national insurance you should expect to pay as well as the impact this will have on your pension. Vat turnover tax for non resident businesses.

You will also have to pay 900 9 on 10000 of your self employment income. See what happens when you are both employed and self employed at the same time with uk income tax national insurance student loan and pension deductions. The analysis was done by looking at the tax declarations of self employed and freelancers in 2014.

The salary criteria for the 30 ruling as per january 2020 are as follows. Some services are exempt from vat. Consult a qualified tax services professional before making any decision.

Income tax calculator netherlands. No guarantee is made for the accuracy of the data provided. You will need to pay class 2 ni worth 159.

If you are based in the netherlands as a freelancerself employed professional you nearly always have to pay turnover tax vat. This is the first time statistics netherlands looked at the proportion of self employed and freelancers who do not contribute to the wage and income tax state pension aow survivors pension anw and long term care for disabled or elderly wlz. This calculator is for illustrative purposes only.

You pay 7200 40 on your self employment income between 10000 and 28000. Entrepreneur for the purposes of income tax being considered an entrepreneur for the purposes of turnover tax does not mean that you will automatically be considered an entrepreneur for the purposes of income tax. Employed and self employed uses tax information from the tax year 2020 2021 to show you take home pay.

Sole traders self employed receive additional tax credits lowering the total amount of tax paid. Sole proprietors and self employed professionals now have 2 vat numbers. More information about the calculations performed is available on the details page.

More From Self Employed Nail Technician Near Me

- Government Institutions

- Graphic Organizer Three Branches Of Government Worksheet Pdf

- Self Employed Unemployment Ny Reddit

- Self Employed Meaning In Telugu

- Self Employed Furlough Scheme Can You Still Work

Incoming Search Terms:

- Dutch Income Tax Calculator Self Employed Furlough Scheme Can You Still Work,

- Https Www Pwc Com Id En Pocket Tax Book English Pocket Tax Book 2020 Pdf Self Employed Furlough Scheme Can You Still Work,

- Social Security In The Netherlands Your Dutch Social Security Benefits About Netherlands Expatica The Netherlands Self Employed Furlough Scheme Can You Still Work,

- 30 Ruling Receive 30 Of Your Salary Free Of Tax Self Employed Furlough Scheme Can You Still Work,

- Your Bullsh T Free Guide To New Zealand Tax For Working Holidaymakers Self Employed Furlough Scheme Can You Still Work,

- Many Dutch Self Employed Don T Pay Income Tax Nl Times Self Employed Furlough Scheme Can You Still Work,