Government Tax Revenue Formula, Https Apps Who Int Iris Bitstream 10665 178574 1 9789240694606 Eng Pdf

Government tax revenue formula Indeed lately has been hunted by consumers around us, perhaps one of you. Individuals are now accustomed to using the net in gadgets to see image and video information for inspiration, and according to the title of this post I will talk about about Government Tax Revenue Formula.

- Taxation Our World In Data

- Kebijakan Fiskal Multiplier Dari Pajak Dan Pengeluaran Pemerintah Halaman 1 Kompasiana Com

- Tax Revenue And Deadweight Loss Youtube

- How To Calculate Excise Tax And The Impact On Consumer And Producer Surplus Youtube

- Property Tax Tax Rate And Bill Calculation

- The Study Economics For Ma Ignou Microeconomics Macroeconomics Econometrics Mathmatical Economics Section 01 Elasticity Beyond Supply And Demand

Find, Read, And Discover Government Tax Revenue Formula, Such Us:

- Taxation Our World In Data

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcq0eb4uejvnoy03csm45tpddg Bdvdrh2pfnuduorgsuebpmhz9 Usqp Cau

- Public Accounts 2018 19 Annual Report Ontario Ca

- Difference Between Full Employment Budget Surplus And Budget Surplus

- Tax Wikipedia

If you re looking for Government Systems Chart you've reached the ideal location. We have 104 images about government systems chart including pictures, photos, pictures, backgrounds, and more. In such webpage, we additionally provide variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

The formula to account for multiple marginal tax rates requires multiplying the total amount of money earned in each successive bracket by the tax rate and adding the values together.

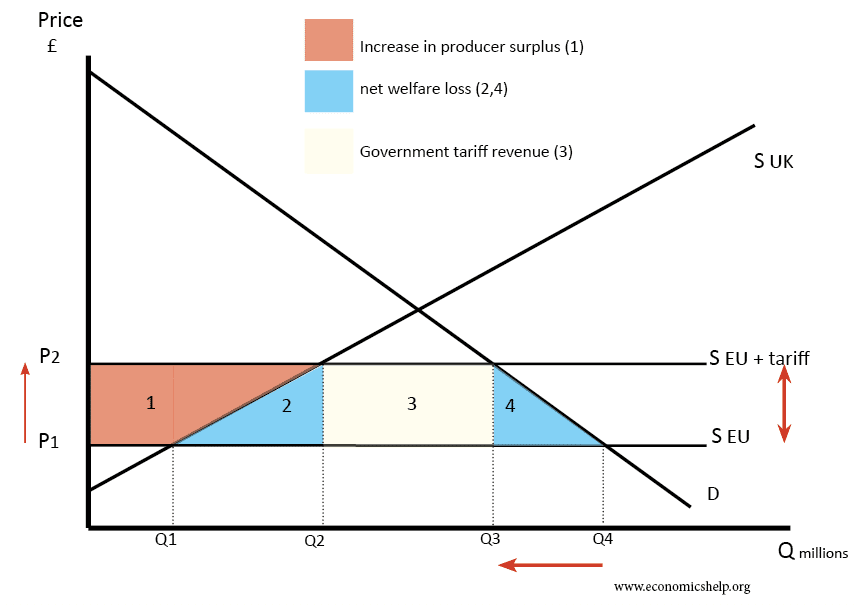

Government systems chart. Tax revenue is the income that is gained by governments through taxationtaxation is the primary source of government revenuerevenue may be extracted from sources such as individuals public enterprises trade royalties on natural resources andor foreign aidan inefficient collection of taxes is greater in countries characterized by poverty a large agricultural sector and large amounts of. The total price gained by a given source is revenue. Learn how to better interpret your financial statements in this online course.

Budget deficit total expenditures by the government total income of the government. Of customers x average price of services. 55060 taxation revenue australia 2008 09.

Federal tax revenue as share of gdp 1990 2009 for 148 countries excludes voluntary insurance programs. For example many companies will model their revenue forecast forecasting methods top forecasting methods. Government revenue is derived from.

Add each tax payment made during the legally defined tax collection period to arrive at total tax revenue. Of units sold x average price. Total expenditure includes the expense in defense energy science healthcare social security etc.

Includes dividends from government owned corporations central bank revenue and capital receipts in the form of external loans and debts from international financial. Total income of the government includes corporate taxes personal taxes stamp duties etc. The formula for calculating income tax is the product of the total amount of taxable income multiplied by the tax rate according to the internal revenue service.

In economics revenue will help know the sales of given quantity of goods and services. Including taxes on the incomes and wealth accumulation of individuals and corporations and on the goods and services produced exported and imported. Revenue should be reported to the government periodically so that the government could know the total income of the country and collect the taxes.

For instance in 2013 the state of new jersey collected a total of 8235 billion in sales and use tax revenues which was approximately 305 percent of the 27 billion the state government collected from all taxes and fees for the same period. Revenue is the top line and net income is the bottom line. Tax revenue of gdp international monetary fund government finance statistics yearbook and data files and world bank and oecd gdp estimates.

More From Government Systems Chart

- Furlough Scheme Rules Martin Lewis

- Government Corruption Artwork

- Furlough Extended To October 80

- Furlough Scheme Rules For October

- News About Furlough Scheme

Incoming Search Terms:

- 8 3 Who Pays Where California S Public School Funds Come From Ed100 News About Furlough Scheme,

- Taxation Our World In Data News About Furlough Scheme,

- Difference Between Full Employment Budget Surplus And Budget Surplus News About Furlough Scheme,

- Per Unit Tax Graph Ap Microeconomics Youtube News About Furlough Scheme,

- Understanding California S Sales Tax News About Furlough Scheme,

- Find Dead Weight Loss And Quantity Produced From Tax Revenue News About Furlough Scheme,

/LafferCurve2-3509f81755554440855b5e48c182593e.png)