Self Employed Tax Return Form, Http Nsfr Dk Uf 90000 99999 92226 8395cead6bd198ffb2f8ad496f22f02f Pdf

Self employed tax return form Indeed recently has been hunted by users around us, maybe one of you. Individuals now are accustomed to using the net in gadgets to view video and image information for inspiration, and according to the title of this article I will talk about about Self Employed Tax Return Form.

- Irs Schedule C Instructions For 1099 Contractors Shared Economy Cpa

- Page 43 Tax Tribune 35

- Self Employment Tax Form Sample Forms

- Tax Forms For The Self Employed The Turbotax Blog

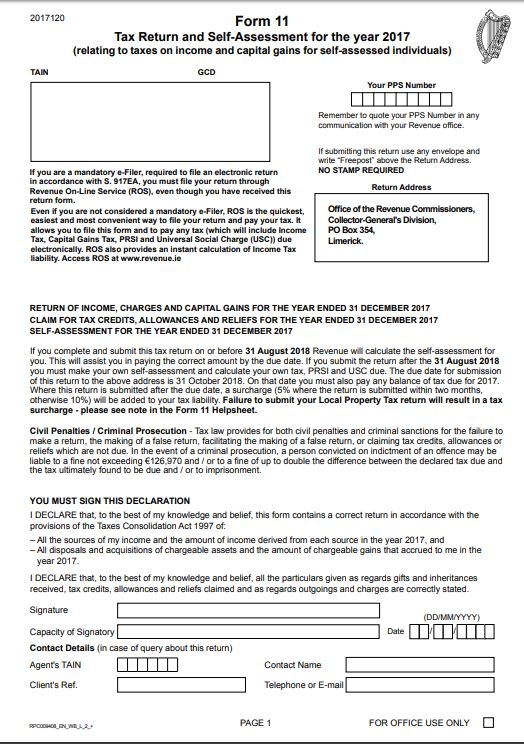

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

- Example 1040 Form Filled Out Unique Self Employed Tax Return Form Example Unique Tax Return Spreadsheet Models Form Ideas

Find, Read, And Discover Self Employed Tax Return Form, Such Us:

- Sa100 Personal Tax Return Form Example 2020 M Tax Accountant In Surrey Helping The Self Employed

- Irs Form 1040 Ss Download Fillable Pdf Or Fill Online U S Self Employment Tax Return Including The Additional Child Tax Credit For Bona Fide Residents Of Puerto Rico 2019 Templateroller

- 7 Self Employment Tax Forms For Home Business Owners Tax Forms Business Tax Small Business Finance

- Form 1040 Ss U S Self Employment Tax Return Form 2014 Free Download

- Paper Copy Self Assessment Tax Return

If you re looking for Government Scholarship Programs you've come to the ideal location. We have 104 images about government scholarship programs adding pictures, photos, pictures, wallpapers, and more. In such webpage, we additionally provide variety of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

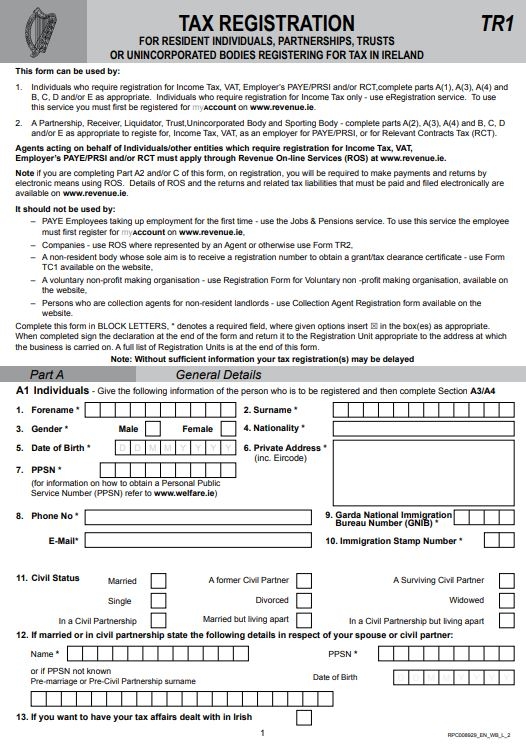

The self employment short form and notes have been added for tax year 2019 to 2020.

Government scholarship programs. The tax return form and notes have been added for tax year 2018 to 2019 and the self assessment returns address for wales has been updated. Hmrc will let you fill it in if your business turnover was less than 85000 during the tax year for the return you. Church employee income see instructions.

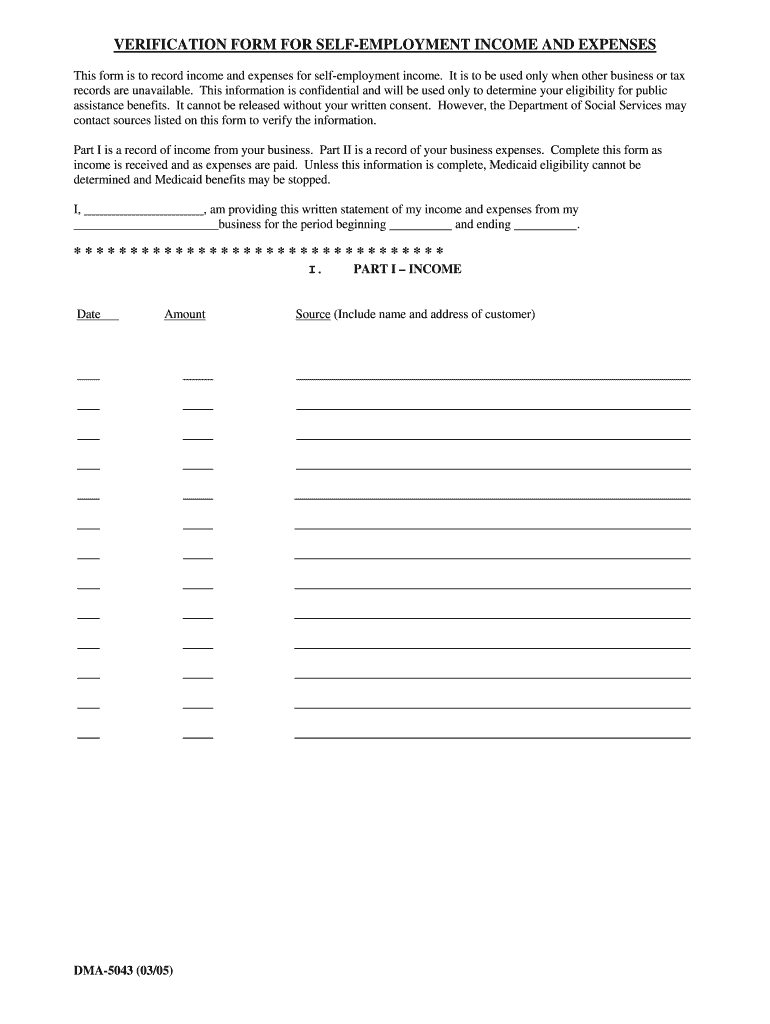

Information about schedule se form 1040 or 1040 sr self employment tax including recent updates related forms and instructions on how to file. The self employment short form and notes have been added for tax year 2018 to 2019. Schedule se serves as the basic irs form that determines the tax self employed individuals have to pay.

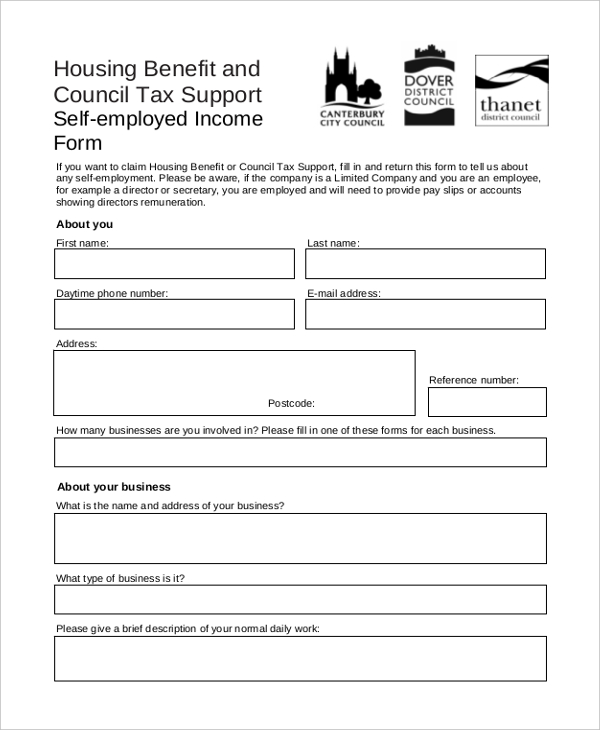

Self assessment tax return forms and helpsheets for the current tax year. It requires less information from you when it comes to declaring your self employment earnings and can make completing your tax return quicker. People and businesses with other income.

Form 945 x adjusted annual return of withheld federal income tax or claim for refund form 1040es estimated tax for individuals form 1040 or 1040 sr schedule h household employment taxes. Name of person with self employment income as shown on form 1040 1040 sr or 1040 nr social security number of person with. Who can use self employment tax forms.

Also see instructions for the. The short tax return form sa200 is issued by hmrc if you are self employed and your affairs are simple. If your only income subject to self employment tax is.

This form also becomes the basis of the social security administration in calculating social security taxes. Self assessment is a system hm revenue and customs hmrc uses to collect income taxtax is usually deducted automatically from wages pensions and savings. There are 2 ways to do a self assessment tax return.

Business and self employed childcare and parenting. Those who earn 400 or more from self employment have to pay self employment tax to the government. Updated 1 september 2020.

6 april 2018 the 2017 to 2018 form and notes have been.

More From Government Scholarship Programs

- Resume Format For Government Jobs In India

- Self Employed Furlough Cheats

- Self Employed Profit And Loss Statement For Small Business

- Indonesian Government Bonds

- Self Employed Definition Ato

Incoming Search Terms:

- Itr Filing Fy2020 21 How To File Itr Online India Paisabazaar Com Self Employed Definition Ato,

- Fill Free Fillable Self Employment Tax Form 1040 Schedule Se Pdf Form Self Employed Definition Ato,

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland Self Employed Definition Ato,

- Tax Self Assessment Form High Resolution Stock Photography And Images Alamy Self Employed Definition Ato,

- Free 6 Sample Self Employment Tax Forms In Pdf Self Employed Definition Ato,

- Sa100 Personal Tax Return Form Example 2020 M Tax Accountant In Surrey Helping The Self Employed Self Employed Definition Ato,

/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)