Self Employed Tax Return Form Ireland, Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

Self employed tax return form ireland Indeed recently is being hunted by users around us, maybe one of you. Individuals are now accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the title of this article I will talk about about Self Employed Tax Return Form Ireland.

- Completing Form 1040 With A Us Expat 1040 Example

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

- How To Fill Out Your Self Assessment Tax Return This Is Money

- Six Things To Know About Filing A Tax Return In Shadow Of Covid Independent Ie

- Changing A Tax Return How Do I Change My Return After Filing

- Simple Paye Taxes Guide Tax Refund Ireland

Find, Read, And Discover Self Employed Tax Return Form Ireland, Such Us:

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

- Irs Tax Forms Wikipedia

- Do I Have To File A Tax Return Mirror Online

- Tax Guide For Self Employed Sole Traders Lawyer Ie

- Use Your Irish P60 To Get A Tax Refund

If you are looking for Government Office Interior India you've reached the perfect place. We ve got 101 images about government office interior india including pictures, pictures, photos, backgrounds, and more. In these web page, we additionally have number of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Youre a contractor or sub contractor.

Government office interior india. It looks like you have javascript disabled. Youre a landlord or host airbnb in ireland. If you are self employed you or an agent must make your income tax return and self assess your tax liability.

You must file your tax return on or before 31 october in the year after the year to which the return relates. There are help videos on. If your taxable non paye income in a year does not exceed 5000 and your gross non paye income does not exceed 50000 you will need to submit a tax return form 12.

The content on these pages will help you make your 2019 income tax it return and make a self assessment. The type of tax return you have to file depends on how much income you earn. Completing the self employed income section in the form 11 including information for farmers completing the rental income section in the form 11.

You have the following options. Certain parts of this website may not work without it. Under self assessment there is a common date for the payment of tax and filing of tax returns.

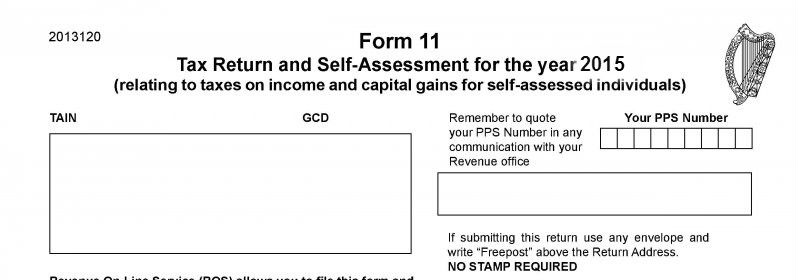

Investment portfolio rental income income from a construction trade capital gains consulting contracting or if you receive any other untaxed income from nixers or work. A form 11 or form 12 in smaller cases must be prepared and filed and paid on or before 31 october in the year following the year of assessment. You can use a shorter form 11e which is an extract of the main personal tax return form.

Sole traders must then complete and file annual income tax returns under the self assessment rules as follows. You can fill out a paper form 11 pdf and send to revenue. Expenses are claimed through the revenue online service ros on a form 11 or form ct1.

Corporation tax ct in the companies and charities section. Capital gains tax cgt in the cgt section. Received tax credits allowances and reliefs claimed and as regards outgoings and charges are correctly stated signature date capacity of signatory rpc012736enwbl1 income tax return and self assessment for the year 2019 form 11 relating to taxes on income and capital gains for self assessed individuals remember to quote your ppsn in any.

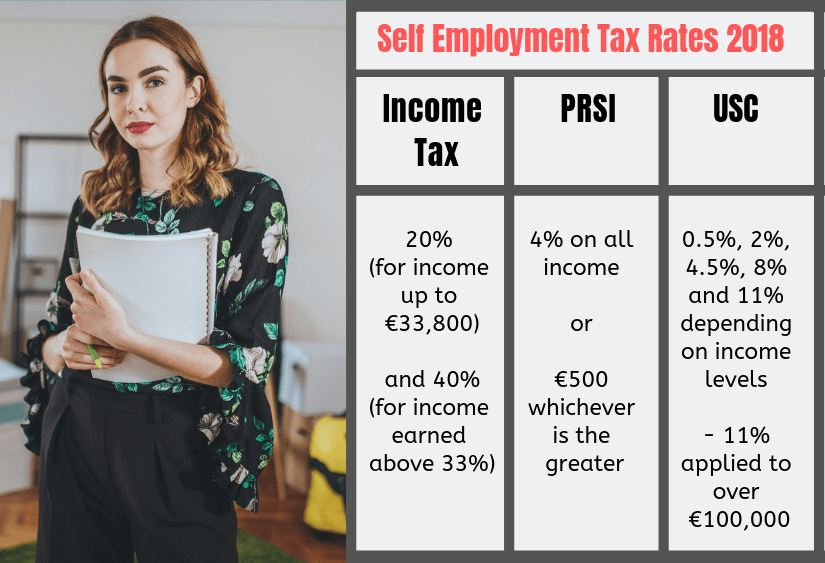

For paye workers you need to submit a form 12 unless the non paye income exceeds 5000 then you must register for the self assessment income tax system and submit an income tax form 11. Information about tax and tax compliance matters for the self employed including how to calculate and pay your tax and file your tax returns. When is the ros extended pay file tax return deadline 2020 in ireland.

However every self employed person must file a tax return every year. For example for a year ended 31032014 or 31092014 or 31122014 the return is due. What expenses can be claimed.

You receive income in addition to paye eg.

More From Government Office Interior India

- India Government Spending Pie Chart 2020

- News About Furlough Scheme

- Government College University Lahore Fee Structure

- Furlough Scheme Rules For Self Employed

- Furlough And Unemployment Texas

Incoming Search Terms:

- Taxes In Japan Halal In Japan Furlough And Unemployment Texas,

- Tax And The Pandemic Unemployment Payment Your Questions Answered Furlough And Unemployment Texas,

- Foreign Tax Credit Form 1116 And How To File It Example For Us Expats Furlough And Unemployment Texas,

- Https Www Revenue Ie En Online Services Support Documents Ros Help Submitting A Form 11 Online Pdf Furlough And Unemployment Texas,

- Completing Form 1040 With A Us Expat 1040 Example Furlough And Unemployment Texas,

- Making Sense Of Your Tax Forms Furlough And Unemployment Texas,