Government Bonds India 2020 Interest Rate, Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqnqgwlbiu9jvwyg9nw 3ohoyil4zlig5 D1yu4yxinstapmy26 Usqp Cau

Government bonds india 2020 interest rate Indeed lately is being sought by consumers around us, perhaps one of you. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this post I will discuss about Government Bonds India 2020 Interest Rate.

- What Is Repo Rate Yadnya Investment Academy

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqnqgwlbiu9jvwyg9nw 3ohoyil4zlig5 D1yu4yxinstapmy26 Usqp Cau

- Explained In Charts Interest Rate Risks For The Economy Rediff Com Business

- Philippine Bonds Lose Allure As Real Rates Turn Red Bnn Bloomberg

- Government Securities Varsity By Zerodha

- Does It Make Sense To Buy Rbi 7 75 Bonds In Low Rate Regime

Find, Read, And Discover Government Bonds India 2020 Interest Rate, Such Us:

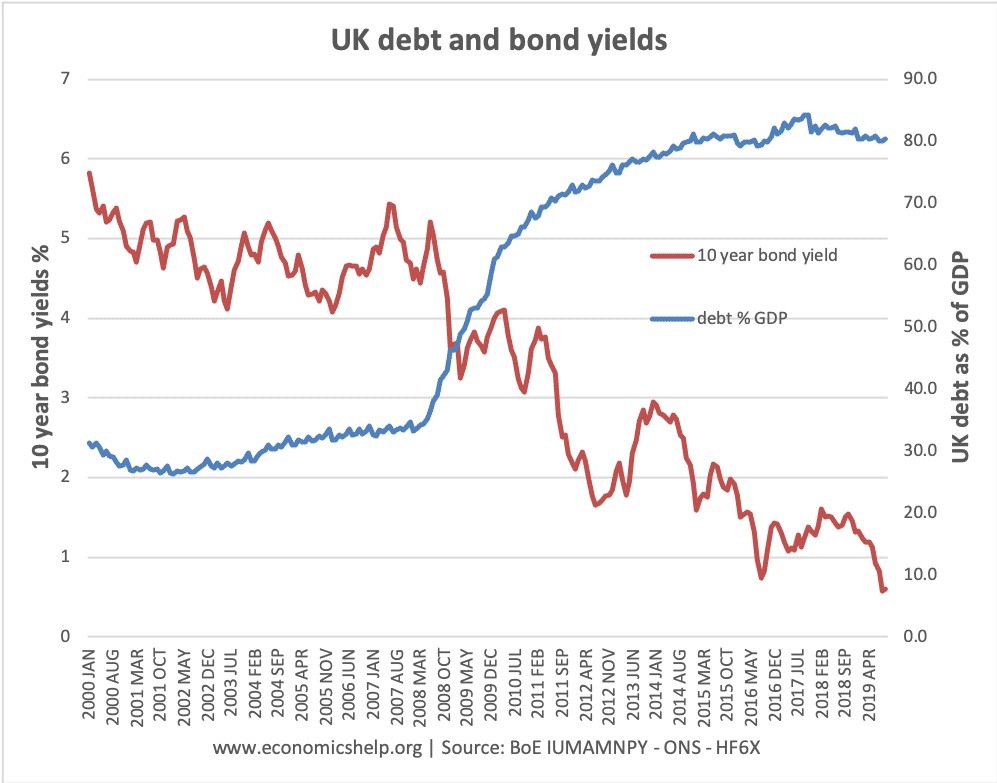

- Problems Of Government Borrowing Economics Help

- How To Buy And Invest In Government Bonds In India

- Government Revised Interest Rates For Nsc Ppf And Other Small Savings Schemes

- How To Buy Government Bonds In India Getmoneyrich

- Hey Pm Modi India S Dollar Bond Can Ease Covid 19 Economic Crisis

If you re looking for Government Building Cartoon Png you've arrived at the ideal location. We have 104 graphics about government building cartoon png adding pictures, pictures, photos, backgrounds, and much more. In these web page, we additionally provide number of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

Most of the other interest yielding instruments like bank deposits company fixed deposits nsc post office monthly income scheme sr.

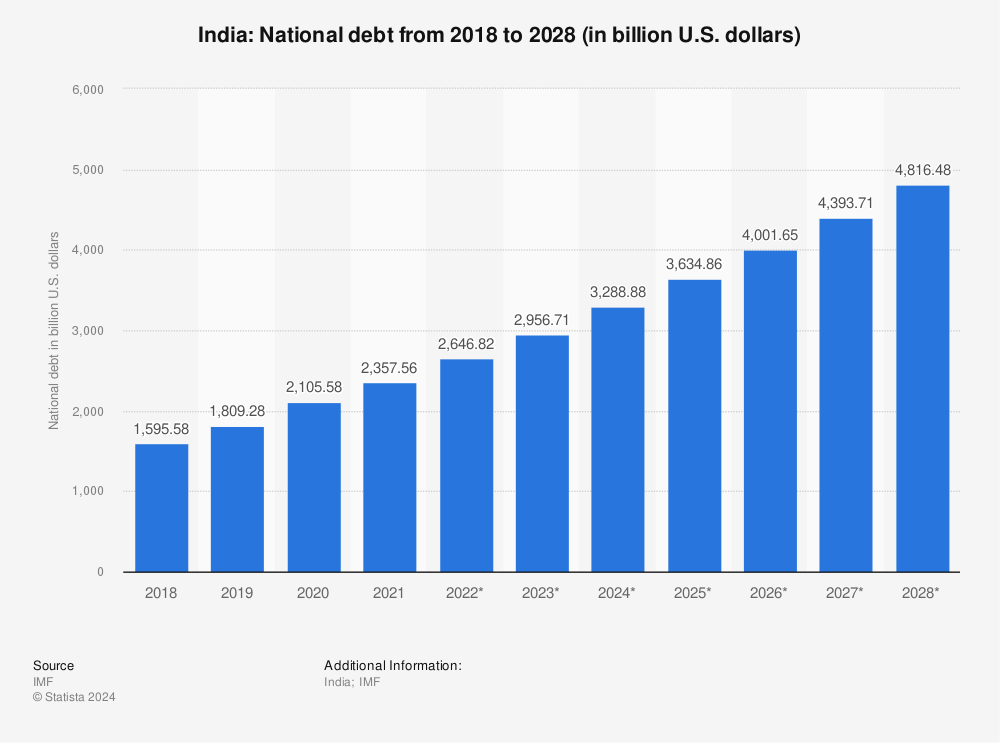

Government building cartoon png. A predetermined interest rate. The government has announced the launch of floating rate savings bonds 2020 taxable with an interest rate of 715 per cent. Gdp growth for 2020 21 is expected to contract 95 percent with risk tilted to the downside 98 percent in the second quarter of 2020.

Citizen savings scheme 775 goi bonds etc can attract tax on interest income. What is the return of 775 government of india bonds. Bonds market in india.

The reserve bank of india rbi has recently released its fifth bi monthly rate review of financial year 2019 20though the key interest rates have been kept unchanged the rbi. Icici direct offers the best investment instruments called as government bonds in india having fixed maturity which help investors to invest and secure their future. The bond will replace the savings bonds offered by the government at 775 per.

The bonds will bear interest at the rate of 775 per annum. While the interest is paid to the bond holder at regular intervals the principal amount is repaid at a later date known as the maturity date. Interest on non cumulative bonds will be payable at half yearly intervals from the date of issue the date of issue of the bonds in the form of bonds ledger account will be opened issued from the date of tender of cash or the date of realization of draftcheque or interest.

Historically the india government bond 10y reached an all time high of 1476 in april of 1996. Get the latest updates on bonds issue returns government bonds infrastructure bonds non convertible debentures bondsncd bonds tax free bonds indiaissue 2020. As per the reserve bank of india rbi press release the interest rate on these bonds will be reset every six months the first reset being on january 01.

10 years vs 2 years bond spread is 1715 bp. Current 5 years credit default swap quotation is 10714 and implied. The india 10y government bond has a 5886 yield.

Interest rate in india averaged 656 percent from 2000 until 2020 reaching an all time high of 1450 percent in august of 2000 and a record low of 4 percent in may of 2020. Central bank rate is 400 last modification in may 2020. Normal convexity in long term vs short term maturities.

4 nov 2020 1315 gmt0. The coupon rate will be pegged with the prevailing national saving certificate nsc rate with a spread of 35 basis points over the respective nsc rate the details and operational guidelines on which will be issued by the reserve bank of india rbi shortly. The bonds are available for subscription july 1 2020 onwards.

More From Government Building Cartoon Png

- Government Quarantine Facilities List Singapore

- Furlough Scheme End Date Self Employed

- Government Of Karnataka Logo Svg

- Self Employed Health Insurance Deduction 2019 Form

- Total Government Jobs In India 2020

Incoming Search Terms:

- Problems Of Government Borrowing Economics Help Total Government Jobs In India 2020,

- Government Of India Floating Rate Savings Bond 2020 Explained In Tamil Youtube Total Government Jobs In India 2020,

- Top Performing Government Bonds Mutual Funds 2020 Fincash Com Total Government Jobs In India 2020,

- Should You Buy Rbi Floating Rate Savings Bonds 2020 Total Government Jobs In India 2020,

- Credible Emerging Market Central Banks Could Embrace Quantitative Easing To Fight Covid 19 Vox Cepr Policy Portal Total Government Jobs In India 2020,

- Reserve Bank Of India Rbi Bulletin Total Government Jobs In India 2020,