Self Employed Tax Return Form 2020, Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

Self employed tax return form 2020 Indeed recently is being hunted by users around us, maybe one of you personally. Individuals now are accustomed to using the net in gadgets to view video and image data for inspiration, and according to the name of the post I will discuss about Self Employed Tax Return Form 2020.

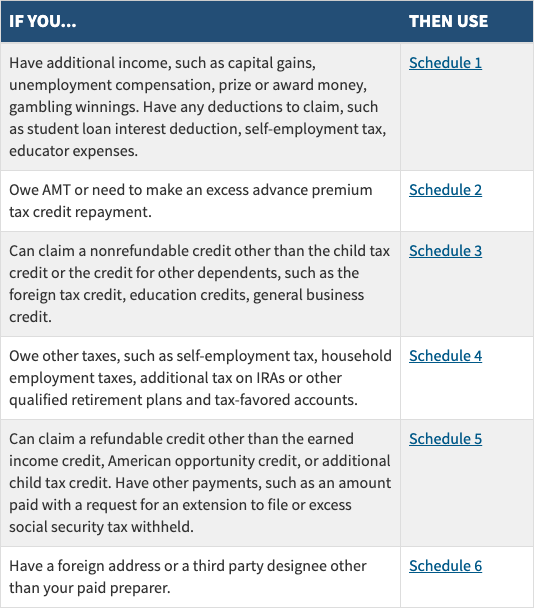

- Who S Required To Fill Out A Schedule C Irs Form

- How To Get Your Sa302 Form Online Or By Phone Goselfemployed Co

- Breakdown Of Irs Deadline Extensions Due To Covid 19 Lexology

- How To Get Your Sa302 Form Online Or By Phone Goselfemployed Co

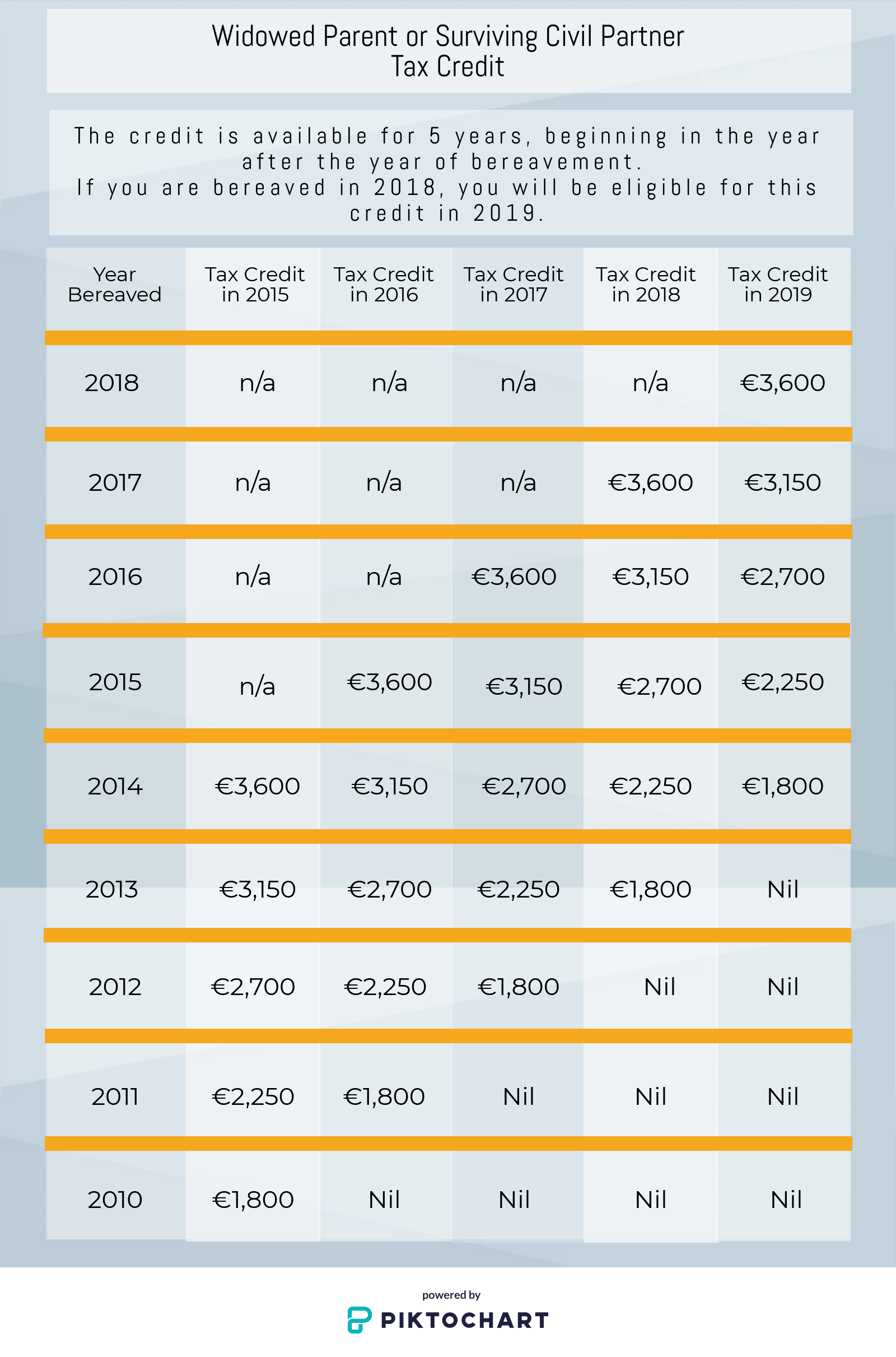

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

- Understanding Tax Returns Innovative Tax Relief

Find, Read, And Discover Self Employed Tax Return Form 2020, Such Us:

- Download Income Tax Return Forms Ay 2020 21 Itr 1 Sahaj Itr 4 Sugam Basunivesh

- Irs Releases New Draft Form W 4 To Help Taxpayers Avoid Withholding Surprises

- Iras We Have Recently Received Enquiries From Those Who Facebook

- Publication 908 02 2020 Bankruptcy Tax Guide Internal Revenue Service

- Form W 2 Understanding Your W 2 Form

If you re searching for Government Job Vacancy 2020 you've come to the ideal location. We ve got 104 graphics about government job vacancy 2020 including pictures, pictures, photos, backgrounds, and more. In these webpage, we also have variety of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

The self employment short form and notes have been added for tax year 2018 to 2019.

Government job vacancy 2020. There are 2 ways to do a self assessment tax return. The social security administration uses the information from schedule se to figure your benefits under the social security program. Use schedule se form 1040 or 1040 sr to figure the tax due on net earnings from self employment.

If youre self employed have more complex tax affairs and your annual business turnover was 73000 or more use the full version of the self employment supplementary page when filing a tax return for the tax year ended 5 april 2020 keywords. Tax return before sending it to us. 6 april 2018 the 2017 to 2018 form and notes have been.

Information sheet hmrc 1219 utr nino employer reference date hm revenue and customs office address issue address telephone for reference tax return 2019 tax year 6 april 2018 to 5 april 2019 201819 sa100 2019 page tr 1 hmrc 1218 1 your date of birth it helps get your tax. Self assessment is a system hm revenue and customs hmrc uses to collect income taxtax is usually deducted automatically from wages pensions and savings. It requires less information from you when it comes to declaring your self employment earnings and can make completing your tax return quicker.

The short tax return form sa200 is issued by hmrc if you are self employed and your affairs are simple. Hmrc will let you fill it in if your business turnover was less than 85000 during the tax year for the return you. This tax applies no matter how old you are and even if you are already getting social security or medicare benefits.

1096 annual summary and transmittal of us. Use schedule se form 1040 or 1040 sr to figure the tax due on net earnings from self employment. Use this form to pay tax on income that is not subject to withholding ie earnings from self employment rents etc 1040 or 1040 sr se self employment tax.

People and businesses with other income. Sa103f self employment full 2020 subject. The tax return form and notes have been added for tax year 2018 to 2019 and the self assessment returns address for wales has been updated.

Self assessment tax return forms and helpsheets for the current tax year. Self employment sa103s or sa103f. Form 945 x adjusted annual return of withheld federal income tax or claim for refund form 1040es estimated tax for individuals form 1040 or 1040 sr schedule h household employment taxes.

More From Government Job Vacancy 2020

- American Government Quizlet Unit 1

- Self Employed Furlough Scheme Extension Application

- Self Employed Vat Registered Or Not

- Government Unemployment Stimulus Florida

- Has The Furlough Scheme Been Extended In Scotland

Incoming Search Terms:

- Publication 505 2020 Tax Withholding And Estimated Tax Internal Revenue Service Has The Furlough Scheme Been Extended In Scotland,

- Form I 5 Instructions 5 5 Quick Tips Regarding Form I 5 Instructions 5 Di 2020 Has The Furlough Scheme Been Extended In Scotland,

- Form 1099 Misc Miscellaneous Income Definition Has The Furlough Scheme Been Extended In Scotland,

- Self Assessment Self Employment Short Sa103s Gov Uk Has The Furlough Scheme Been Extended In Scotland,

- Taxes For The Self Employed And Independent Contractors Has The Furlough Scheme Been Extended In Scotland,

- 2 Has The Furlough Scheme Been Extended In Scotland,