Self Employed Income Tax Calculator 201920, Finance Act 2019 Acca Global

Self employed income tax calculator 201920 Indeed lately has been sought by consumers around us, maybe one of you personally. People now are accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the title of this post I will talk about about Self Employed Income Tax Calculator 201920.

- Optimum Salary And Dividends 2019 20 Limited Company Directors Jf Financial

- Free Tax Estimate Excel Spreadsheet For 2019 2020 Download

- All In One Income Tax Calculator For The Fy 2019 20 Ay 2020 21

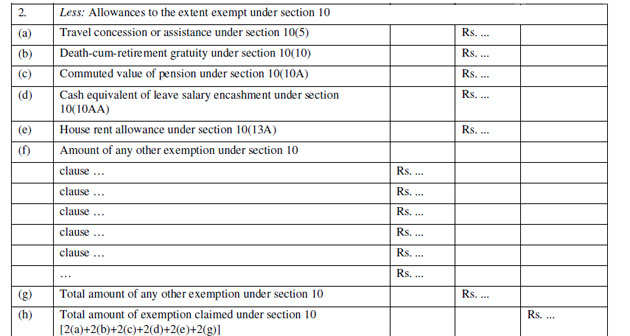

- Standard Deduction Budget Announcements Budget 2018 Gives Rs 40 000 Standard Deduction Removes Other Allowances Salaried May Be Left Poorer

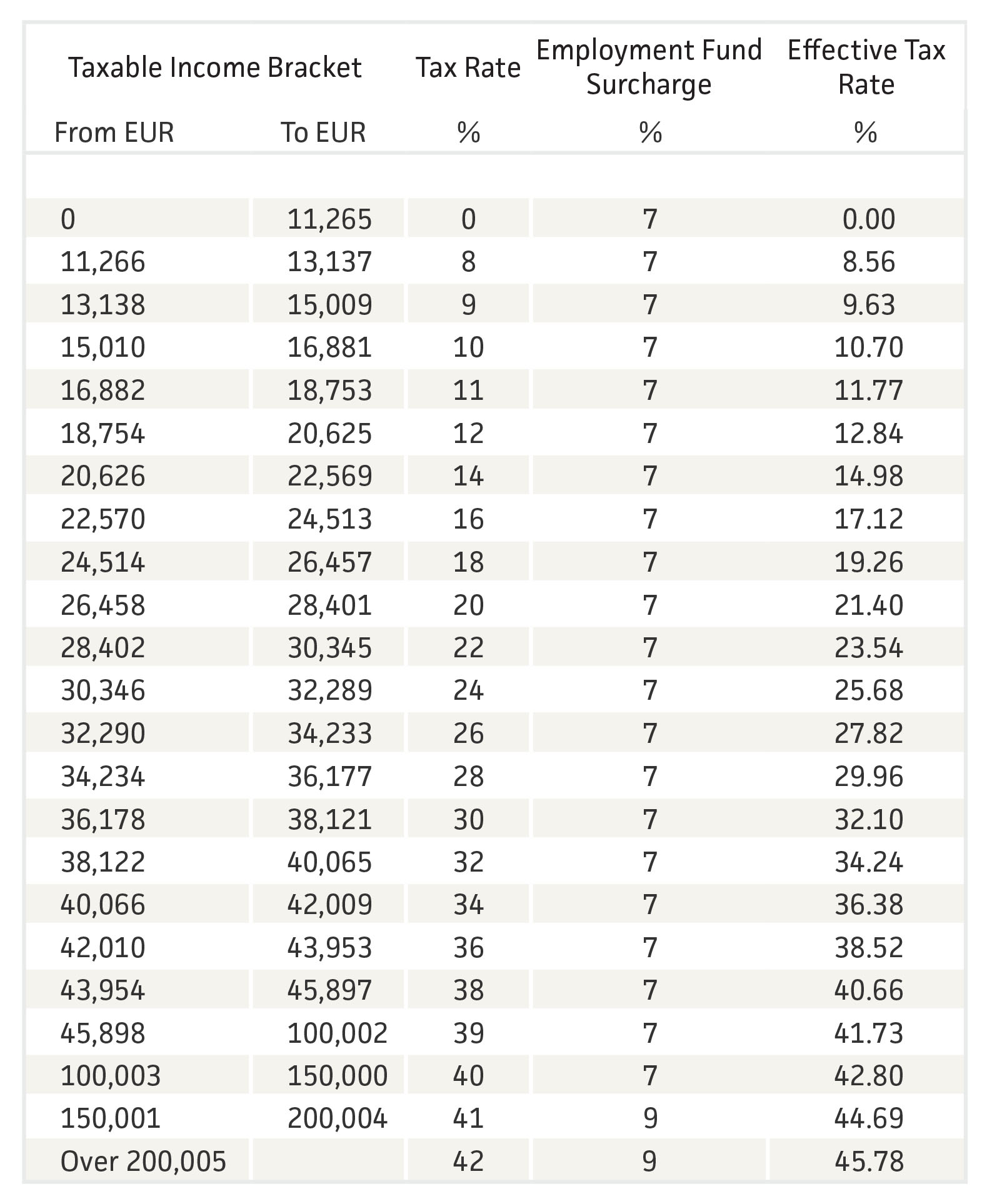

- Luxembourg Tax Guide Analie Tax Accounting

- Free Tax Estimate Excel Spreadsheet For 2019 2020 Download

Find, Read, And Discover Self Employed Income Tax Calculator 201920, Such Us:

- Income Tax Calculator Know Your Income Tax Slab Tax Brackets From Tax Calculator

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gct2i77s5rjxyckunwfeyqgp7ku5t1yxcxzhgdwcgfv4znugja0m Usqp Cau

- Malaysia Personal Income Tax Guide 2019 Ya 2018

- Income Tax Computation Savings Income Acca Taxation Tx Uk Fa2018 Youtube

- Calculating Your Business Income For Self Assessment Freeagent

If you are searching for Government Decree No 341 Of 2020 Vii 12 you've reached the perfect place. We have 104 images about government decree no 341 of 2020 vii 12 including pictures, pictures, photos, backgrounds, and much more. In these web page, we additionally have variety of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

Self employed tax and national insurance calculator 201920.

Government decree no 341 of 2020 vii 12. The changes from 2018 for budget 2019 are. More information about the calculations performed is available on the details page. Use our handy calculator to find out how much tax will you will pay tax year.

Please enter your salary details in the variables section below. Self employment profits are subject to the same income taxes as those taken from employed people. 2 per cent rate of usc now kicks in at 19874 an increase of 500.

For a more robust calculation please use quickbooks self employed. The calculator uses tax information from the tax year 2020 2021 to show you take home pay. Income tax slabs in india.

If you are self employed use this simplified self employed tax calculator to work out your tax and national insurance liability. Self employed tax calculator 2020 2021. Annual salary please note that the results you see on your screen are estimates only.

You will pay an additional 09 medicare tax on the amount that your annual income exceeds 200000 for single filers 250000 for married filing jointly. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts. Self employed tax and national insurance calculator.

The calculations provided should not be considered financial legal or tax advice. Irish tax calculator 2019. Check your certificate of tax free allowances to ensure that the specified values are correct.

Individuals who are below the age of 60 years. Please note that the constants section does not need to be changed and is exposed for completeness. The key difference is in two areas national insurance contributions and the ability to deduct expenses and costs before calculating any deductions.

The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. This calculator is designed for illustrative purposes onlythe results should in no way be viewed as definitive for personal tax purposes for your individual tax payment. You pay 2000 20 on your self employment income between 0 and 10000.

The deadline is january 31st of the following year. This calculator provides an estimate of the self employment tax social security and medicare and does not include income tax on the profits that your business made and any other income. If you are self employed your social security tax rate is 124 percent and your medicare tax is 29 percent on those same amounts of earnings but you are able to deduct the employer portion.

Income taxpayers both salaried self employed have been categorized into three age groups. You will need to submit a self assessment tax return and pay these taxes and contributions yourself. Senior citizens who are between 60 years and 80 years old.

More From Government Decree No 341 Of 2020 Vii 12

- Furlough Scheme Uk 3 Weeks

- Government Procurement Policy Board Philippines

- What Is The Furlough Percentage For August

- Self Employed Kitchen Fitter

- Government Unemployment Benefits Extension

Incoming Search Terms:

- Do I Need To Complete A Tax Return Low Incomes Tax Reform Group Government Unemployment Benefits Extension,

- Https Www2 Deloitte Com Content Dam Deloitte Id Documents Tax Id Tax Indonesian Tax Guide 2019 2020 En Pdf Government Unemployment Benefits Extension,

- Income Tax Calculator For Fy 2018 19 Download Excel File Planmoneytax Government Unemployment Benefits Extension,

- Malaysia Personal Income Tax Guide 2019 Ya 2018 Government Unemployment Benefits Extension,

- Sansdrama Government Unemployment Benefits Extension,

- Employed And Self Employed Tax Calculator Taxscouts Government Unemployment Benefits Extension,