Self Employed Tax Brackets, Canadian Tax Brackets Marginal Tax Vs Average Tax Retire Happy

Self employed tax brackets Indeed recently is being sought by consumers around us, maybe one of you personally. Individuals are now accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the title of this article I will discuss about Self Employed Tax Brackets.

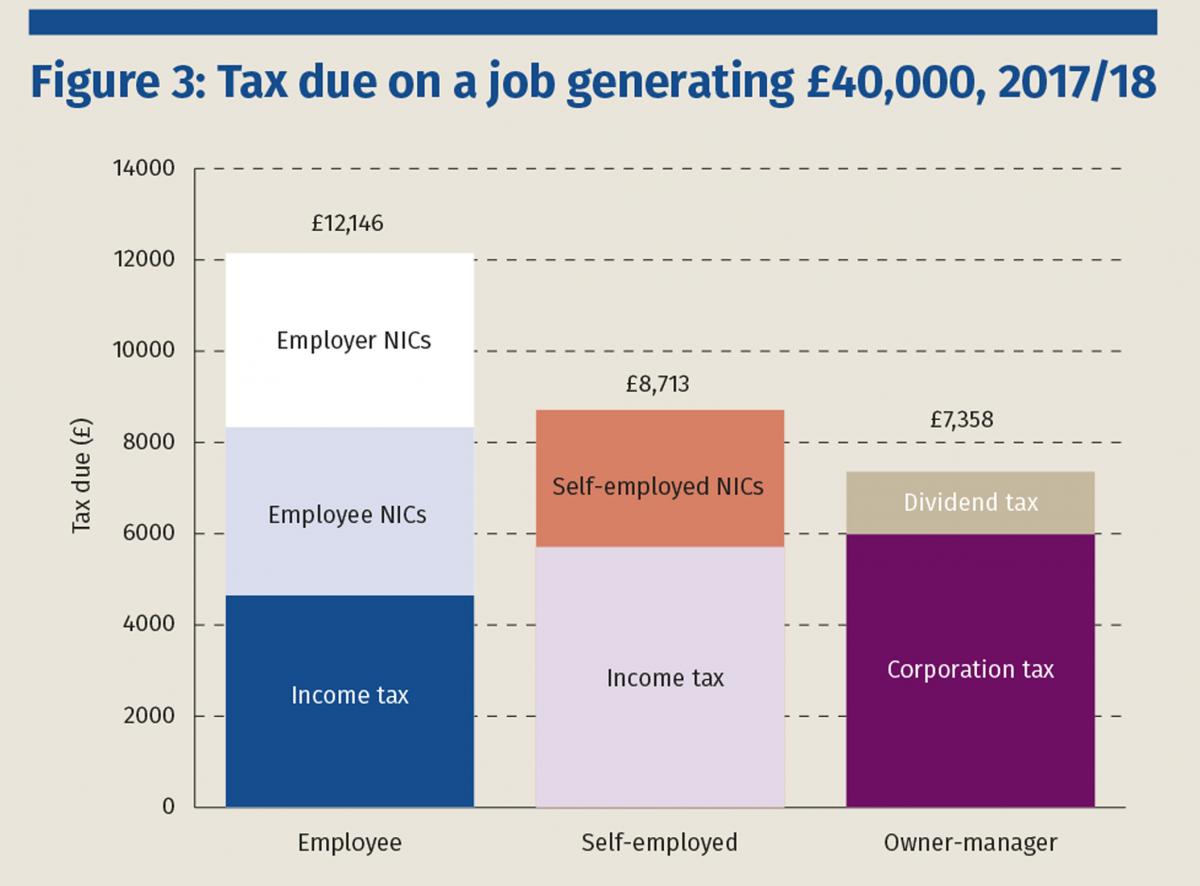

- Tax In A Changing World Of Work

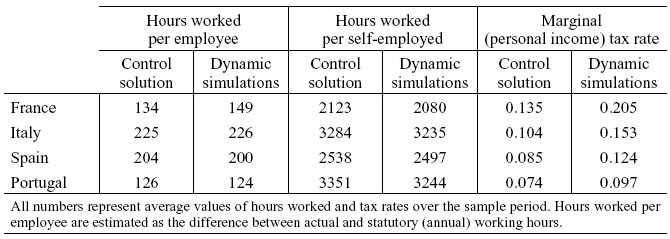

- Pdf The Responsiveness Of Self Employment Income To Tax Rate Changes Semantic Scholar

- The Net Taxation By Type Of Earned Income And With No Family Burden Download Scientific Diagram

- Pdf Tax Progressivity And Self Employment Evidence From Canadian Provinces Semantic Scholar

- What Is Tax Form 1040 Schedule Se

- Pdf The Responsiveness Of Self Employment Income To Tax Rate Changes Semantic Scholar

Find, Read, And Discover Self Employed Tax Brackets, Such Us:

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

- How To File Taxes As A Freelancer Chime

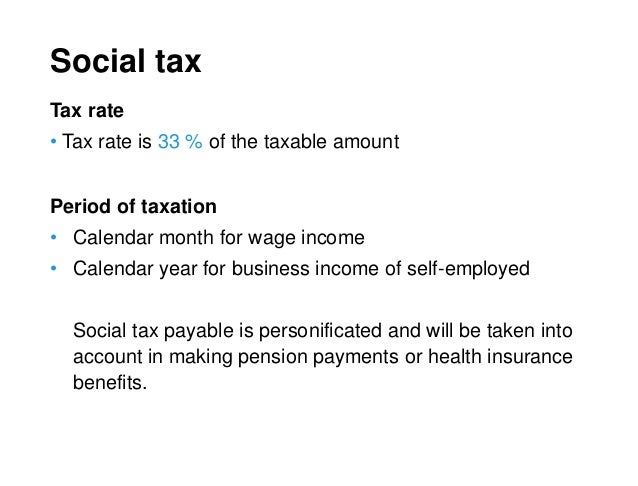

- Director Of Finance And Administration Ppt Download

- Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

- Tax System Of The Czech Republic A Brief Comparison Economical And Political System Others Taxes At A Glance 2011ccz Uzb Pdf Ppt Download

If you re searching for Register Self Employed you've reached the ideal place. We have 104 images about register self employed including images, photos, photographs, backgrounds, and much more. In these web page, we also have variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Americas income tax system is a progressive tax system which means that people with higher incomes are taxed at higher rates.

Register self employed. 15 oct 2020 qc 16218. If youre self employed or working in the sharing economy you may be wondering which tax bracket you are in since any profits or losses from your sharing economy work is going. 12500 visit this page basic tax rate.

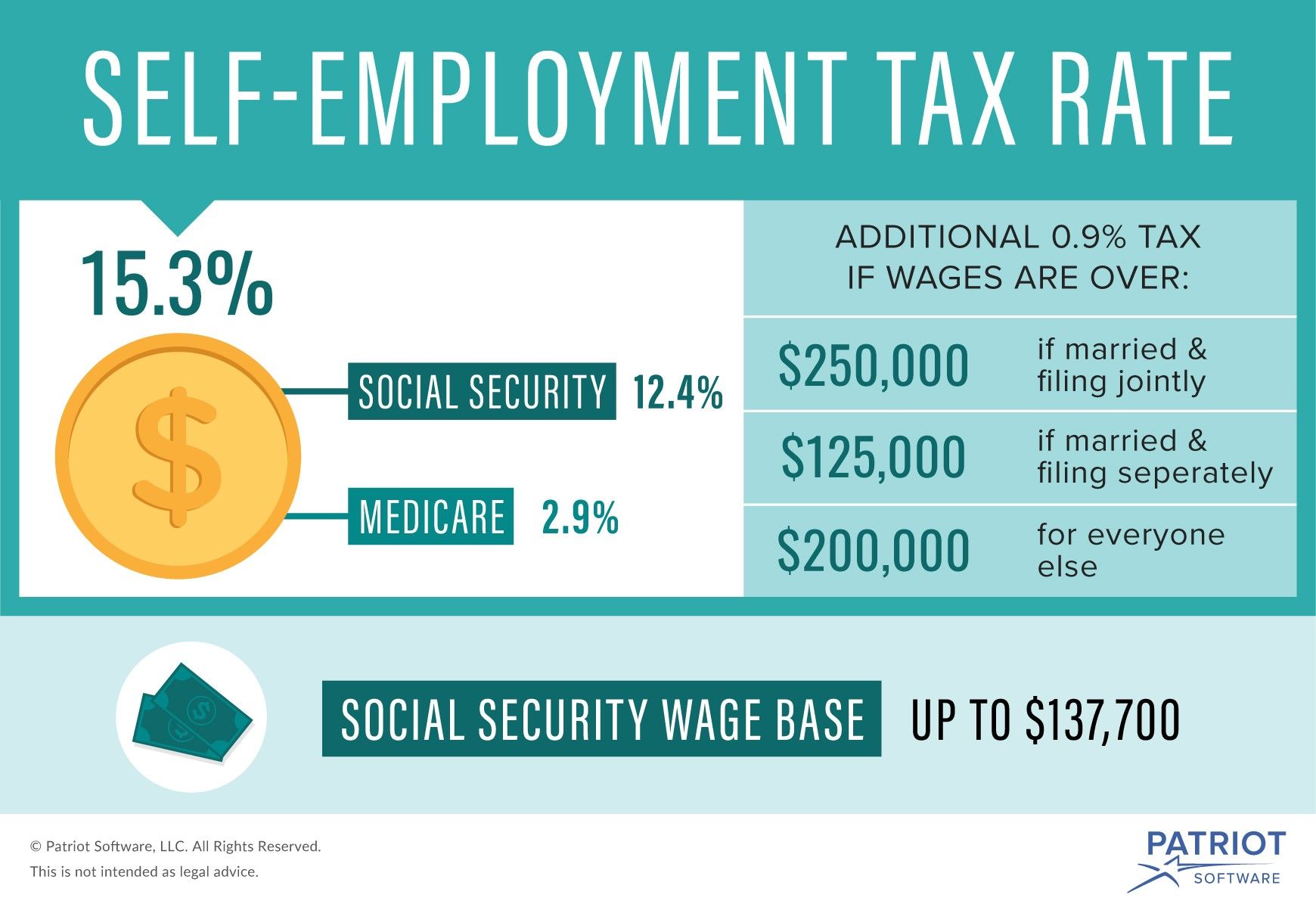

Video tax tips on atotv external link. As noted the self employment tax rate is 153 of net earnings. The maximum social security earnings are capped and are set each year.

Self employment tax brackets. Income tax rates and bands. These figures are mostly taken from the 2018 uk budget published 29 october 2018 and are subject to change.

20 12501 50000 higher tax rate. The tax accounts for social security and medicaid. 201920 tax rates for self employed in the uk.

If your social security tax exceeds the maximum no social security tax is imposed on the amount over the maximummedicare tax is imposed on all net earnings with no maximum. If you need help applying this information to your personal situation phone us on 13 28 61. The self employed tax is a special tax filing for individuals who are self employed.

In the 2020 21 tax year self employed and employees pay. 31st january 2021 personal allowance. Self employed people pay the same income tax in certain brackets as.

What are the self employed income tax rates for 2020 21. Individual income tax rates for prior years. Self employment tax is not the same as.

Brackets are assigned based on taxable income and applied at each bracket. Someone who owns their own business has deductions that are more than the average wage earner the income earned from self employment can be from a sole proprietorship or a partnership. The tax rate for self employment income is 153 for social security and medicare based on the net earnings of the business.

Each level of income that corresponds to a certain tax rate is called a bracket. Business and self employed childcare and parenting. 6th april 2019 to 5th april 2020 tax return deadline.

The table shows the tax rates you pay in each band if you have a standard personal allowance of 12500. You can use our 2020 21 income tax calculator to find out how much youll pay. When it comes to paying income tax there arent any differences in the tax rates you pay compared to employees.

That rate is the sum of a 124 social security tax and a 29 medicare tax on net earnings. Income tax rates range anywhere from 10 to 37 depending on which tax bracket youre in. Those who consider themselves self employed are required to submit taxes for themselves using the 1040 form schedule through the irs.

More From Register Self Employed

- Highest Paying Government Jobs In India 2019

- Independent Contractor Self Employed Resume Examples Pdf

- Self Employed Business Loan Lloyds

- Government Bond Indonesia

- Us Government Budget Breakdown 2019

Incoming Search Terms:

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland Us Government Budget Breakdown 2019,

- Understanding Self Employment Taxes As A Freelancer Self Employment Small Business Tax Tax Deductions Us Government Budget Breakdown 2019,

- Understanding Self Employment Taxes As A Freelancer Tax Queen Self Employment Business Tax Money Frugal Us Government Budget Breakdown 2019,

- Tax Reform For The Independent Contractor Financial Designs Inc Us Government Budget Breakdown 2019,

- 1 Us Government Budget Breakdown 2019,

- Detailed Explanation Of Personal Income Tax And Personal Income Tax Levy To Solve The Problem Of Personal Income Tax Programmer Sought Us Government Budget Breakdown 2019,