Self Employed Tax Brackets Uk, What Tax Rates Apply To Me Low Incomes Tax Reform Group

Self employed tax brackets uk Indeed lately has been sought by users around us, perhaps one of you. Individuals are now accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of the post I will discuss about Self Employed Tax Brackets Uk.

- Dividend Tax Rate All About Uk Dividend Tax For The Self Employed

- Budget2017 Self Employment Tax Changes

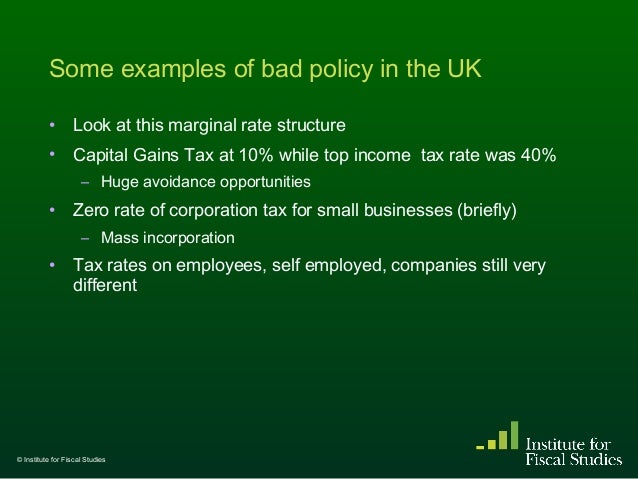

- Ifs

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcthtz5cjkvfenlq91r8ox1ylescm65gmo8lgjxdls4wxylnngq8 Usqp Cau

- Tcy F0pbrv5 Dm

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqtfwjnrgrx5izwpvbyjsix Ugn Ybpfrxpwo4gucz6n3omumvb Usqp Cau

Find, Read, And Discover Self Employed Tax Brackets Uk, Such Us:

- Tax Rates For 2019 20 What The Taxman Gets Liquid Friday

- 2019 20 Tax Rates And Allowances Boox

- Tax Revenues Where Does The Money Come From And What Are The Next Government S Challenges Institute For Fiscal Studies Ifs

- Employed Self Employed And Rental Income Jf Financial

- Income Tax Archives Bourne Accountancy

If you are looking for Self Employed General Contractor Resume you've arrived at the right place. We ve got 104 graphics about self employed general contractor resume including pictures, pictures, photos, backgrounds, and more. In such webpage, we also provide variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Do I Need To Complete A Tax Return Low Incomes Tax Reform Group Self Employed General Contractor Resume

You pay 9 on profits between 9500 and 50000.

Self employed general contractor resume. We use this information to make the website work as. Here are some of the most common at a glance figures you might find useful for the next tax year. Your self employed trading profits must be less than 50000 and more than 50 percent of your income must come from self employment.

List of information about self employment. Income tax bands are different if you live in scotland. 1000 visit this page.

However self employed people can also offset some of their expenditure against tax. For earnings above 150000 the rate is 45 per cent for both the 2018 19 and 2019 20 tax years. The 202021 tax year in the uk runs from 6th april 2020 to 5th april 2021.

We use cookies to collect information about how you use govuk. 40 50001 150000 personal savings allowance. Tax returns for this tax year are generally due by 31st january 2022.

Class 4 contributions in 2019 20 are as below. Income tax rates and bands the table shows the tax rates you pay in each band if you have a standard personal allowance of 12500. For the year 2020 21 the rate is 305 a week on profits of 6475 or more per year.

If youre self employed the self employed ready reckoner tool can help you budget for your tax bill. Yes most self employed people pay class 2 nics if your profits are at least 6475 during the 202021 tax year or 6365 in the 201920 tax year. At profits between 8632 and 50000 in 2019 2020 or 9501 and 50000 for 2020 21 self employed professionals pay nics of 9.

If youre over this limit you will pay 3 a week or 156 a year for the 201920 tax year and 305 a week or 15860 a year for the 202021 tax year. For the 2020 21 year class 2 contributions are payable on earnings between 6475 and 9500 and youll pay a flat rate of 305 per week. For the 2019 20 tax year this is for earnings between 50001 and 150000.

Uk self employed tax rates 202021 at a glance. 6th april 2019 to 5th april 2020. Profits above 50000 attract a rate of 2.

Start now on the hmrc website. You may be able to claim a refund if youve paid too much tax. Published on 5 january 2020.

12500 visit this page basic tax rate. You pay 2 on profits over 50000. If youre self employed and your income has gone down you can claim 80 percent of your profits up to a maximum of 2500 a month.

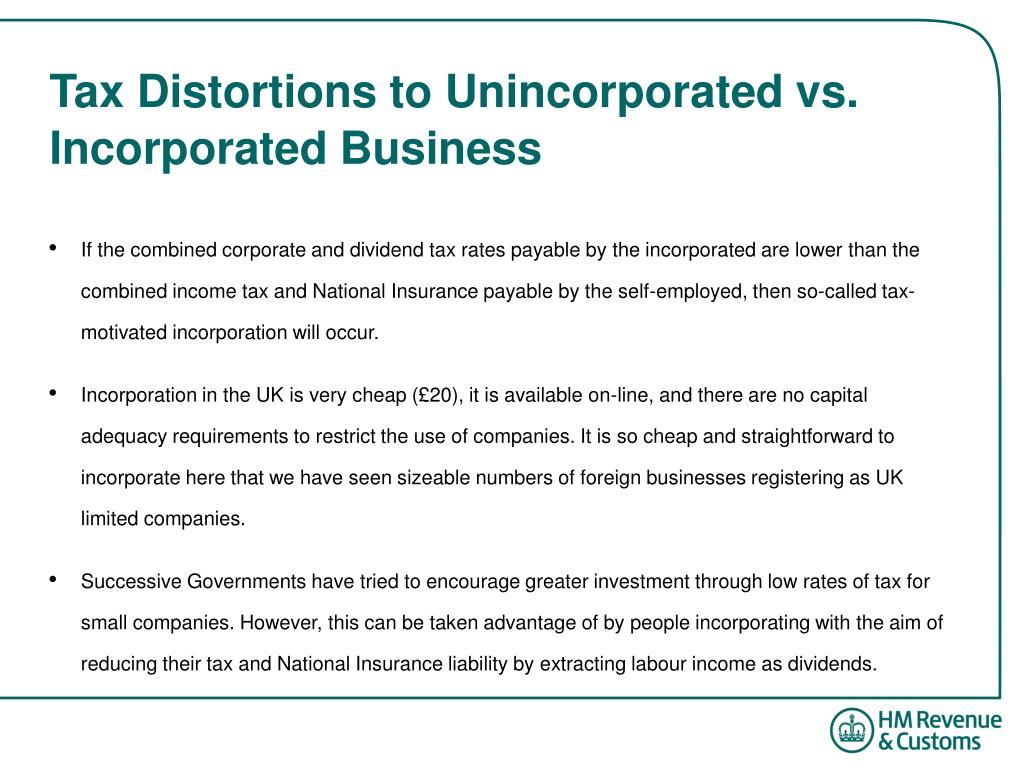

Ppt Many Are Called Few Are Chosen The Dilemma Of Taxing Smes Powerpoint Presentation Id 5469480 Self Employed General Contractor Resume

More From Self Employed General Contractor Resume

- Furlough Rules June

- Government Intervention Economics Definition

- Government To Citizen G2c

- Furlough Duration Rules

- What Is Furlough This Month

Incoming Search Terms:

- Budget 2016 Gov Uk What Is Furlough This Month,

- Income Tax Citizens Advice What Is Furlough This Month,

- Tax Self Assessment Form High Resolution Stock Photography And Images Alamy What Is Furlough This Month,

- Income Tax Bands 2018 2019 Uk Goselfemployed Co What Is Furlough This Month,

- Oecd Tax Database Oecd What Is Furlough This Month,

- Seven Steps To Heaven Taxation What Is Furlough This Month,