Self Employed Company Car Tax Rules, Form P87 Claim For Tax Relief For Expenses Of Employment Low Incomes Tax Reform Group

Self employed company car tax rules Indeed recently has been sought by users around us, perhaps one of you personally. Individuals now are accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the name of the post I will discuss about Self Employed Company Car Tax Rules.

- Claiming Car Mileage Allowance Car Mileage Claim Gst

- An Introduction To The Tax System For The Self Employed Pdf Free Download

- Am I Employed Self Employed Both Or Neither Low Incomes Tax Reform Group

- Company Car Tax For Business Owners Guides

- 2

- 14 Tax Tips For The Self Employed Taxact Blog

Find, Read, And Discover Self Employed Company Car Tax Rules, Such Us:

- Self Employed Motoring Tax Efficiency Business Car Manager

- Company Car Tax For Business Owners Guides

- Scheme And The General Health Insurance Scheme They Are Compulsorily Download Scientific Diagram

- Tax Guide For Independent Contractors

- Tax Help For Beauty And Barber Shops Advance Tax Relief

If you are searching for Government Vouchers Malta Contact Number you've reached the perfect place. We have 104 images about government vouchers malta contact number adding pictures, pictures, photos, backgrounds, and more. In such web page, we also have number of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Schedule f form 1040 or 1040 sr profit or loss from farming pdf if youre a farmer.

Government vouchers malta contact number. Help us improve govuk. If a taxpayer uses the car for both business and personal purposes the expenses must be split. A self employed individual will most likely use the car as a family vehicle and use it for personal errands and activities.

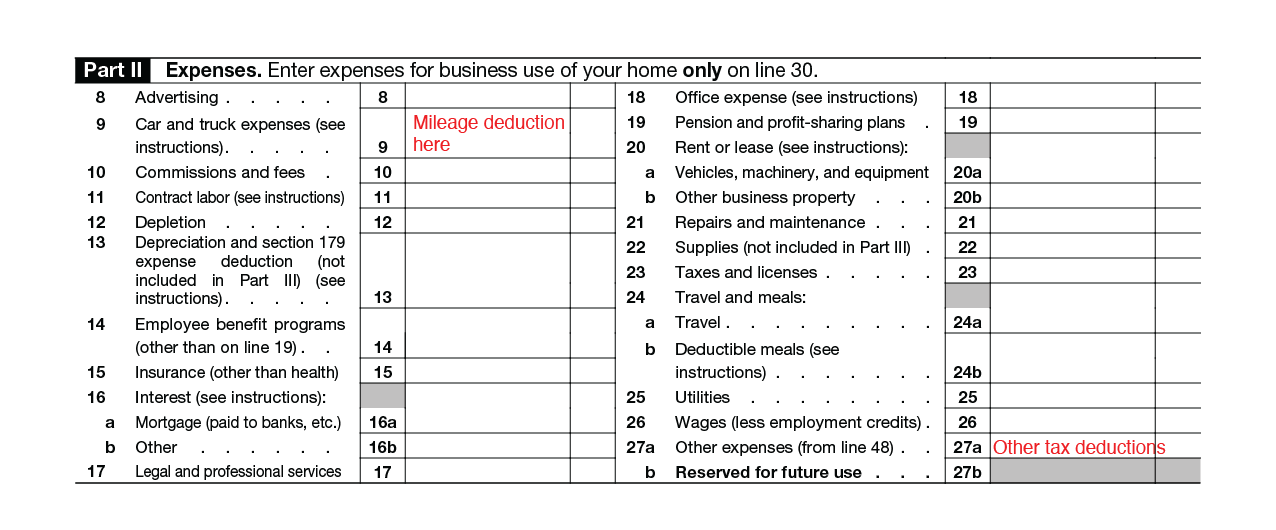

Self employed tax deductions for cars. Driving for business is deductible but you have to. The irs allows employees and self employed individuals to use a standard mileage rate for expensing vehicles under the 6000 pound limit which for 2013 business driving is 565 cents per mile.

You need to keep track of how much of the car goes toward the business. The canada revenue agency cra allows for the deduction of these car expenses so long as they are in proportion to the self employed individuals business use. Self employed company car or not.

If you use your car in the course of your business you may have a tax write off. Deduct your self employed car expenses on. Well send you a link to a feedback form.

Rules out a van. How it works vehicle expenses are recorded on schedule t2125 statement of business activities on the t1 personal income tax return. This post is for self employed and sole traders.

It will take only 2 minutes to fill in. Business owners and self employed individuals. As a self employed person you deduct car expenses on internal revenue service schedule c the same form on which you report your business income.

In the event you only use your car 60 percent of the time for your business then you can only deduct 60 percent of the expenses. To help us improve govuk wed like to know more about your visit today. Buying a car through your business as a sole trader self employed buying a car as a business expense is fairly common practice and within the rules set out by hmrc.

I f you cant or dont want to deduct based on mileage you can deduct based on cost of operating the vehicle eg. Schedule c form 1040 or 1040 sr profit or loss from business sole proprietorship pdf or. Individuals who own a business or are self employed and use their vehicle for business may deduct car expenses on their tax return.

Different rules apply if you have a limited company.

More From Government Vouchers Malta Contact Number

- Government Guidelines For Physical Activity In Schools

- Uk Lockdown Furlough Scheme

- Government Quarantine List Poland

- Government Quota In Private Medical Colleges In Rajasthan

- Furlough Rules March 2020

Incoming Search Terms:

- Tax Guide For Self Employed Actors Kwa Tax Returns Online Furlough Rules March 2020,

- Self Employed Motoring Tax Efficiency Business Car Manager Furlough Rules March 2020,

- Information For Foreign Employees Pdf Free Download Furlough Rules March 2020,

- Business Use Of Vehicles Turbotax Tax Tips Videos Furlough Rules March 2020,

- Self Employed Motoring Tax Efficiency Business Car Manager Furlough Rules March 2020,

- An Introduction To The Tax System For The Self Employed Pdf Free Download Furlough Rules March 2020,