What Is Furlough Calculated On, T Ukbhcji1dy8m

What is furlough calculated on Indeed recently is being sought by consumers around us, maybe one of you personally. Individuals now are accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the title of this post I will discuss about What Is Furlough Calculated On.

- The Coronavirus Job Retention Scheme 80 Bindmans Llp En

- Free Furlough Calculator

- Furlough Calculations And Payroll Support For Coronavirus Job Retention Scheme Lancashire Business View

- Coronavirus Important Updates To The Furlough Scheme

- Furlough Grant Calculator Job Retention Scheme

- Furlough Pay For Umbrella Employees Calculated On Average Pay Aspire Business Partnership

Find, Read, And Discover What Is Furlough Calculated On, Such Us:

- How To Check If Your Employer Has Calculated Your Furlough Pay Correctly And 7 Things To Check Your Wage Slip For

- Wbex Coronavirus More On Who You Can Furlough Plus A Furlough Claim Calculator By Lwa

- Http Www Portlandoregon Gov Article 760080

- Steps To Take Before Calculating Your Claim Using The Coronavirus Job Retention Scheme Gov Uk

- Https Www Gsa Gov Cdnstatic Furlough Guide To Reading My Earning 26 Leave Statement Pdf

If you are searching for Self Employed Income Support Scheme Northern Ireland you've arrived at the perfect location. We ve got 100 images about self employed income support scheme northern ireland adding pictures, photos, pictures, backgrounds, and more. In these webpage, we also have number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Esfa Reveals Calculations For The Furloughed Apprentice Wage Top Up Self Employed Income Support Scheme Northern Ireland

How To Calculate Redundancy Pay For Furloughed Staff The Gazette Self Employed Income Support Scheme Northern Ireland

That means that anyone who earns over 30000 a month could see more than.

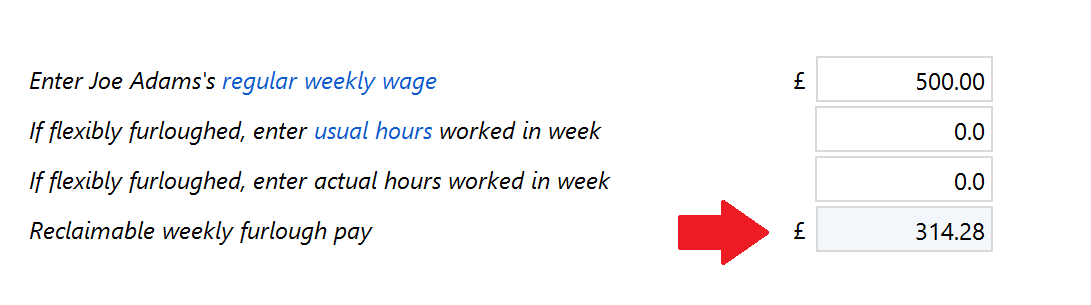

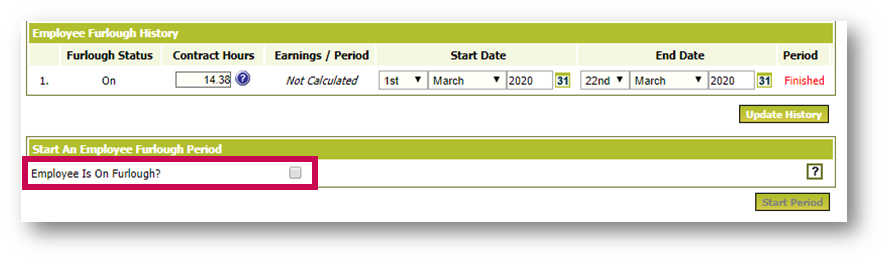

Self employed income support scheme northern ireland. The government sets out five scenarios and offers a calculator to help employers work out how much they need to claim. The employer furlough calculator is designed to be intuitive but we feel it is always useful to have a step by step guide to using the calculator to ensure you the user get the most out of this tool and the best experience whilst using icalculator. Furlough hours are calculated as.

How is the 80 figure calculated. Number of usual hours 178. How to calculate 80 of your employees wages for furlough for several employees.

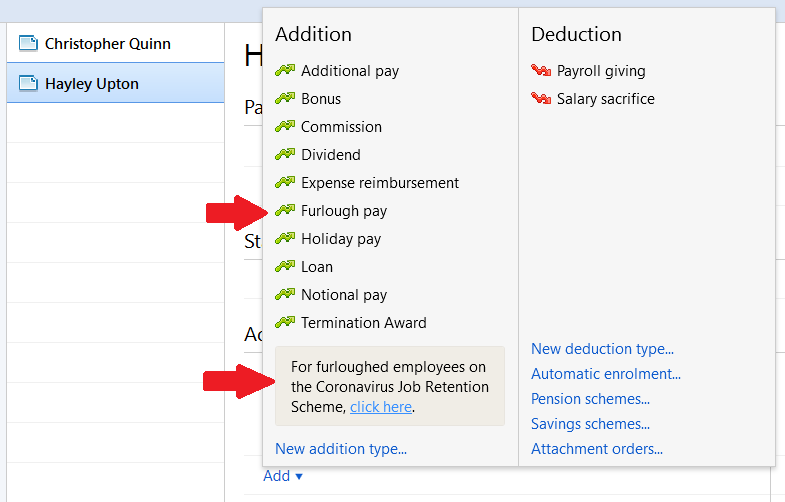

If an employee is furloughed you may claim 80 of their monthly wage costs capped at 2500 gross plus the associated employers ni and minimum auto enrolment pension contributions. Calculate how much you have to pay your furloughed employees for hours on furlough how much you can claim for employer nics and pension contributions and how much you can claim back. How is my furlough pay calculated.

Subtract the number of actual hours worked so subtract 60 118 furlough hours. Your employer can claim up to 80 per cent of your wages to a cap of 2500 a month. Your employer will have to choose the best calculation that fits you.

Notice Pay During Furlough Birkett Long Solicitors Self Employed Income Support Scheme Northern Ireland

More From Self Employed Income Support Scheme Northern Ireland

- Government Gateway Id For Company

- Furlough Scheme Uk Meaning

- Functions Of Urban Local Self Government

- Government Exams Question Papers With Answers 2020

- Self Employed Support Scheme August

Incoming Search Terms:

- Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp Self Employed Support Scheme August,

- Update On Job Retention Scheme Claiming The Furloughing Grant Smith Cooper Self Employed Support Scheme August,

- Hmrc Confirms Usual Hours Calculation For Flexible Furlough Cowgills Self Employed Support Scheme August,

- From Furloughs To Financing Essential Business Advice To Cope With Coronavirus Self Employed Support Scheme August,

- Hm Revenue Customs On Twitter The Job Retention Scheme Launched On 20 April By Midnight 3 May A Total Of 6 3m Jobs Furloughed 800k Employers Furloughing Self Employed Support Scheme August,

- Http Www Portlandoregon Gov Article 760080 Self Employed Support Scheme August,