Government Budget Constraint Explained, 6 1 The Budget Line Principles Of Microeconomics

Government budget constraint explained Indeed lately has been hunted by consumers around us, maybe one of you. Individuals are now accustomed to using the net in gadgets to see video and image information for inspiration, and according to the title of this article I will talk about about Government Budget Constraint Explained.

- The Theory Of Individual Labor Supply

- 6 1 The Budget Line Principles Of Microeconomics

- Monetary Policy Vs Fiscal Policy Economics Help

- What Is Modern Monetary Theory Econofact

- 1

- Budget Constraints Economics Help

Find, Read, And Discover Government Budget Constraint Explained, Such Us:

- Fiscal Policy In A Small Open Economy With Oil Sector And Non Ricardian Agents

- How To Use The Budget Line To Look At Taxes And Subsidies Dummies

- The Government S Budget Constraint Principles Of Public Finance

- The Benefits Of Deficits

- Https Eml Berkeley Edu Webfac Obstfeld E202a F12 Seigniorage Pdf

If you re looking for Self Employed Wage Subsidy Scheme you've reached the ideal location. We ve got 104 graphics about self employed wage subsidy scheme adding pictures, pictures, photos, wallpapers, and much more. In these web page, we also provide variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

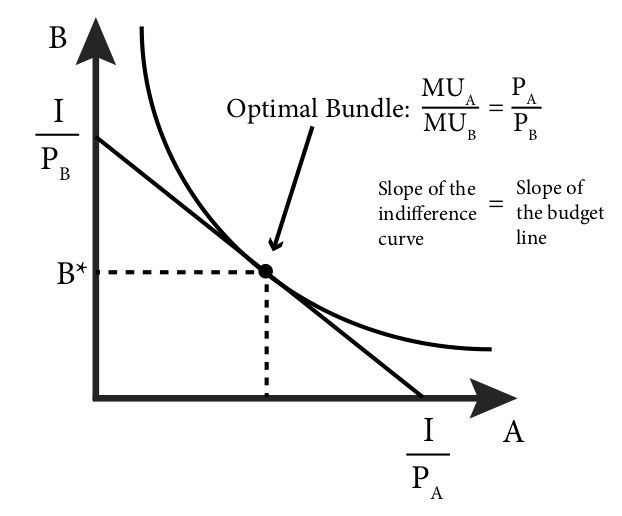

The concept of budget constraint explained with examples.

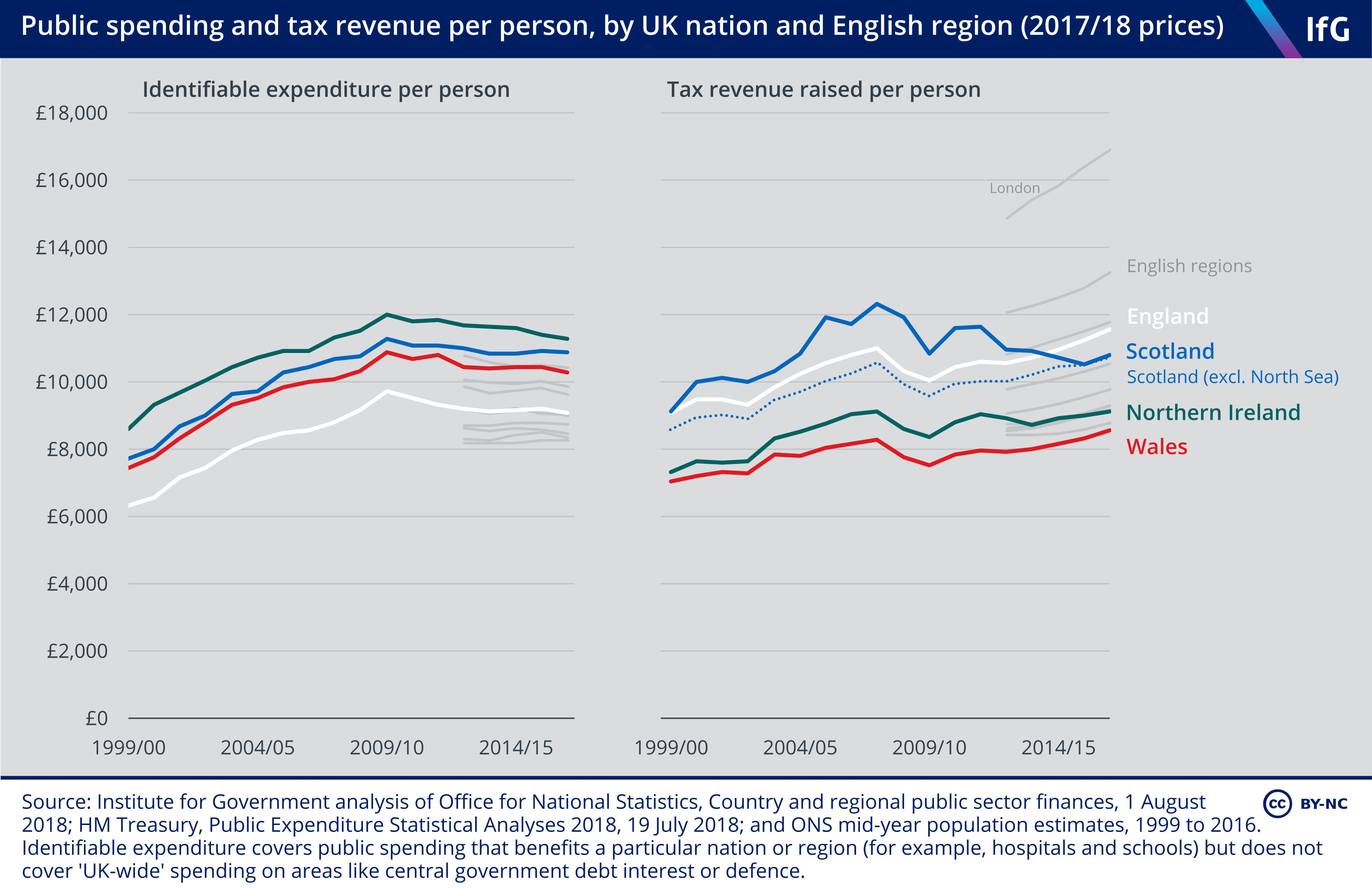

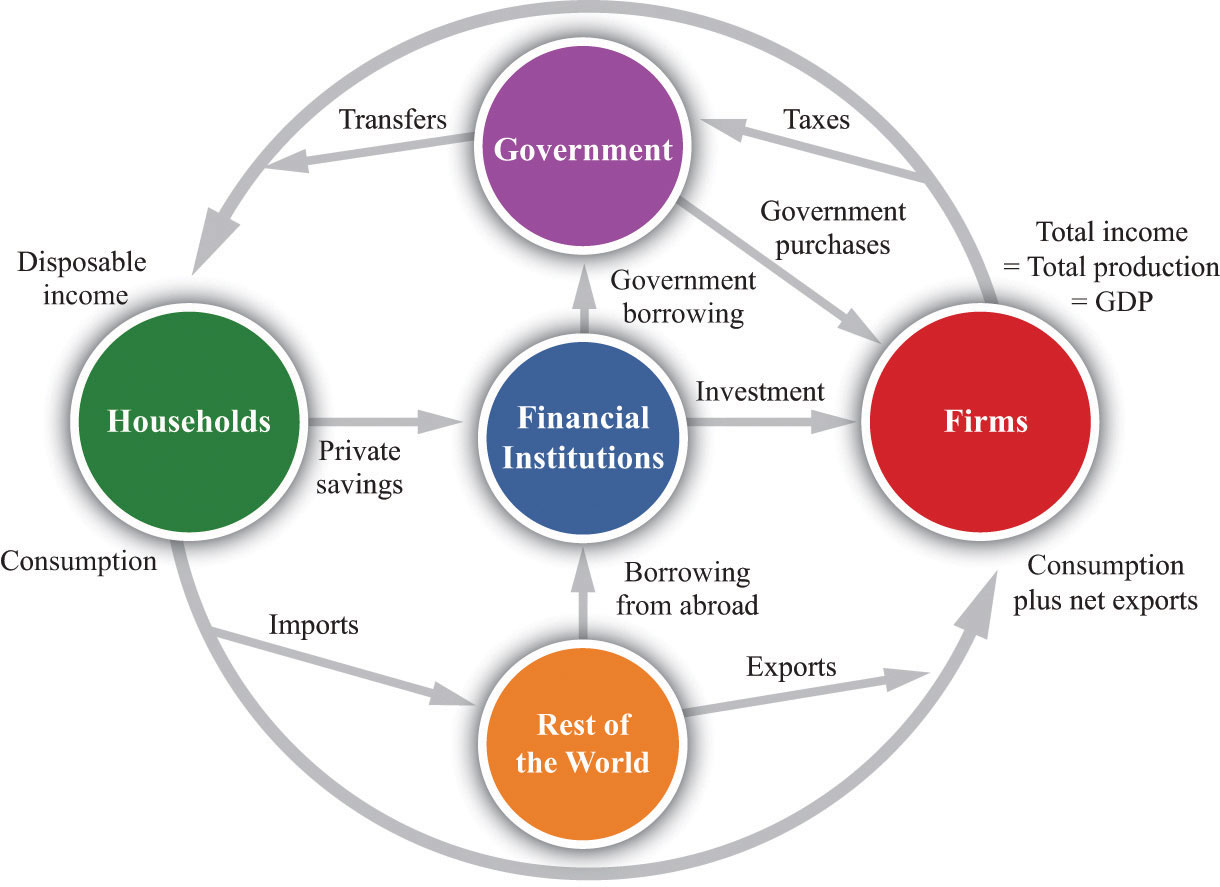

Self employed wage subsidy scheme. Government budget constraint definition and meaning. Tax revenue pt and issuance of new debt delta bgthe existence of government debt means that there is interest payment ibg that government has to pay in each period. The intertemporal budget constraint says that if a government has some existing debt it must run surpluses in the future so that it can ultimately pay off that debt.

Current debt outstanding discounted present value of future primary surpluses. Government spending can be divided into two parts. Hybrid car purchase tax creditis it the governments best choice to reduce fuel consumption and carbon emissions.

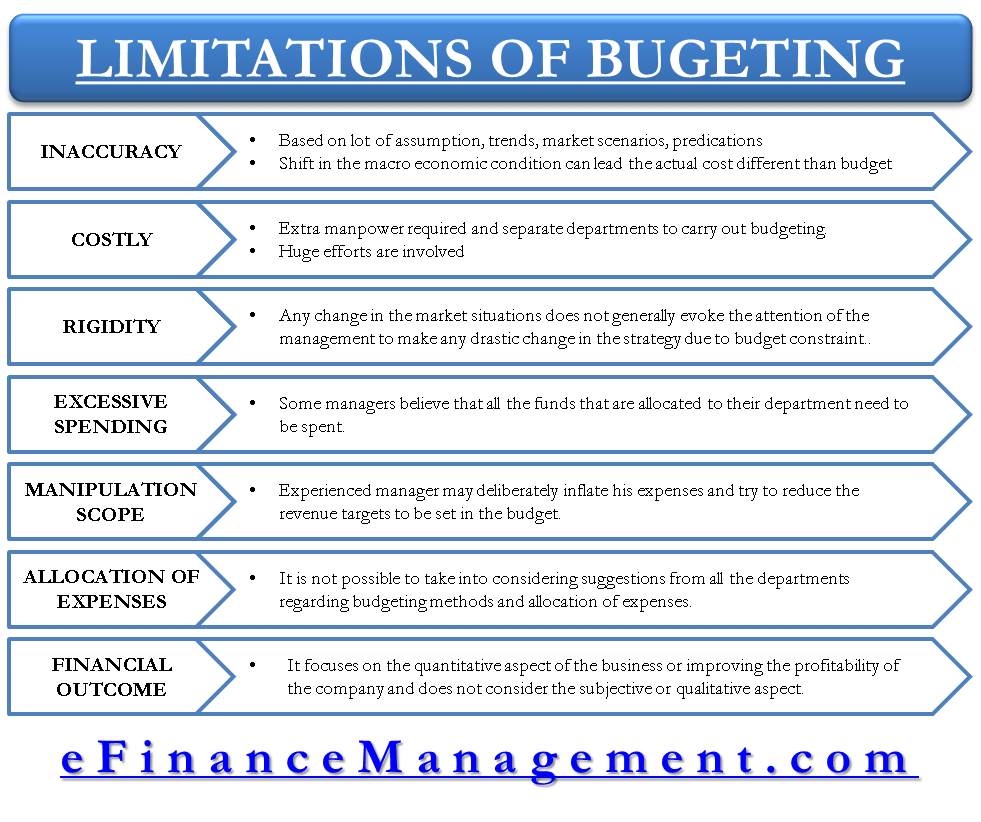

Government budget constraint is the requirement that the government budget deficit equals the sum of the change in the monetary base and the change in government bonds held by the public. The intertemporal links create a rich set of possible outcomes from standard macro policy. However with the rise of the phillips curve the return of the quantity theory the development of the notion of a government budget constraint and accelerating inflation at the end of the 1960s functional finance fell out of favor.

Specifically it is the requirement that. A budget constraint is a representation of the quantities and prices of various goods that can be purchased within a specified budget. A government budget is a financial statement presenting the governments proposed revenues and spending for a financial yearthe government budget balance also alternatively referred to as general government balance public budget balance or public fiscal balance is the overall difference between government revenues and spendinga positive balance is called a government budget surplus and.

The paper compares and contrasts the evolution of the views of minsky and lerner over the postwar period. The government budget constraint is an accounting identity linking the monetary authoritys choices of money growth or nominal interest rate and the fiscal authoritys choices of spending taxation and borrowing at a point in time and across time. The government budget constraint is an accounting identity linking the monetary authoritys choices of money growth or nominal interest rate and the fiscal authoritys choices of spending taxation and borrowing at a point in time.

Government policy of extending tax credits toward the purchase of electric and hybrid cars can have consequence beyond decreasing carbon emissions. This story explores the concept of budget constraint with examples. Module 3 budget constraint.

Government purchase pg and transfer payment pvin order to finance these spendings government relies on two income sources.

More From Self Employed Wage Subsidy Scheme

- Government Update Covid 19

- Self Employed Dental Insurance Reddit

- Self Employed Van Driver Long Distance

- Self Employed Help Ni

- Local Government Functions In Nigeria

Incoming Search Terms:

- Modern Monetary Theory Explained Simply Business Insider Local Government Functions In Nigeria,

- Deficits And Debt Local Government Functions In Nigeria,

- Cost Effectiveness Analysis In A Setting Of Budget Constraints Is It Equitable Nejm Local Government Functions In Nigeria,

- The Circular Flow Of Income Local Government Functions In Nigeria,

- Fiscal Policy Definition Types Objectives Tools Local Government Functions In Nigeria,

- The Government S Budget Constraint Principles Of Public Finance Local Government Functions In Nigeria,

:max_bytes(150000):strip_icc()/dotdash_Final_Ricardo_Barro_Effect_Apr_2020-013-e69df9ace8dc455ca5b824eff822861f.jpg)