Self Employed Claiming Child Tax Credit, Overpayments And Underpayments How Do Tax Credits Work Guidance Tax Credits

Self employed claiming child tax credit Indeed recently is being hunted by consumers around us, perhaps one of you personally. Individuals are now accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the name of the post I will talk about about Self Employed Claiming Child Tax Credit.

- A Guide To Self Employment Pdf Free Download

- Working Tax Credit Wtc A Guide To Self Employed Tax Benefits

- How Do Work Changes Affect Tax Credits Low Incomes Tax Reform Group

- Simple Paye Taxes Guide Tax Refund Ireland

- Self Employed

- Publication 929 2019 Tax Rules For Children And Dependents Internal Revenue Service

Find, Read, And Discover Self Employed Claiming Child Tax Credit, Such Us:

- 2020 Tax Changes For 1099 Independent Contractors Updated For 2020

- Chhor Tieng Yin Accounting And Taxation

- Self Assessment Tax Return A Guide For The Self Employed

- Self Employed Health Insurance Deduction Healthinsurance Org

- Tayabali Tomlin Successful Business Starter Pack 2010

If you are looking for Government Deficit 2020 you've arrived at the ideal place. We ve got 103 graphics about government deficit 2020 adding pictures, pictures, photos, backgrounds, and more. In these page, we additionally provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

You cant claim tax free childcare at the same time as working tax credit child tax credit or universal.

Government deficit 2020. To work this out look on your self assessment tax return for taxable profits then subtract any. Youll be asked how much you earned in the previous tax year the 12 months up to 5 april. Refundable credits are.

There are two tax credits offering financial support for families working tax credit and child tax credit. Tax free childcare and other benefits. If you are already getting child tax credit and start working you may be able to claim working tax credit.

Working tax credit can be claimed by anyone who is responsible for a. Work out your income. If you are already getting working tax credit you may be able to carry on getting tax credits if you become self employed.

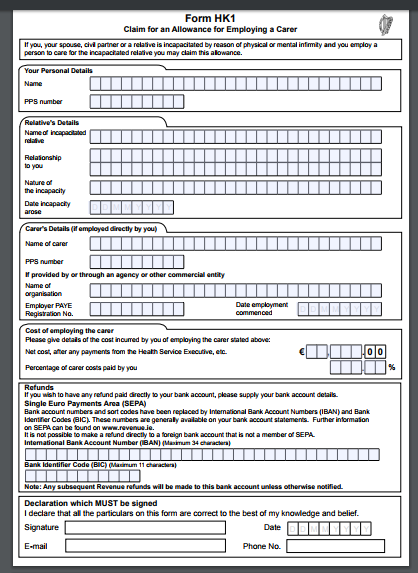

The child tax credit can be figured as a nonrefundable or refundable credit. Since you can claim the credit either way see if you qualify for any other nonrefundable credits to reduce your income tax as it may be more beneficial to take the child tax credit as a refundable credit to reduce your self employment taxes. You will need to let hm revenue and customs hmrc know you have become self employed.

Many self employed people are able to claim extra financial help in the form of tax credits. A tax credit guide for self employed parents 3 what are tax credits.

More From Government Deficit 2020

- Government Accounting System In India

- What Is An Emergency Furlough

- Government Laptop Keyboard Price

- Furlough Scheme Uk When Does It End

- Self Employed National Insurance Threshold 202021

Incoming Search Terms:

- Ways To Save Money On Kumon Fees You Kumon Wembley Central Study Centre Facebook Self Employed National Insurance Threshold 202021,

- Tax Tips For Self Employed Kiwis From A Self Employed Kiwi By James Mccarthy Medium Self Employed National Insurance Threshold 202021,

- Coronavirus Self Employed Small Limited Company Help Self Employed National Insurance Threshold 202021,

- Fbc 20 Page Ebook 7 Big Mistakes Small Business Owners Make At Tax Self Employed National Insurance Threshold 202021,

- A Guide To Self Employment Pdf Free Download Self Employed National Insurance Threshold 202021,

- Self Employed Self Employed National Insurance Threshold 202021,