Self Employed National Insurance Threshold 202021, Uk Payroll And Tax Information And Resources Activpayroll

Self employed national insurance threshold 202021 Indeed recently has been hunted by consumers around us, maybe one of you personally. People now are accustomed to using the net in gadgets to see video and image data for inspiration, and according to the name of the post I will discuss about Self Employed National Insurance Threshold 202021.

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqbetxgvi1wn Oq7pa1ik2iadeoprwql6 L3ktsjhoynw3yj 7b Usqp Cau

- National Insurance Thresholds To Rise In April 2020 Insights Bishop Fleming

- What National Insurance Do I Pay If I Am Self Employed Low Incomes Tax Reform Group

- Https Www Gov Im Media 1369208 2020 2021 Cf10 Small Earnings Exception From Self Employed National Insuranc 070520 Pdf

- Rates Thresholds 2020 21 Brightpay Documentation

- Nic Thresholds Rates Brightpay Documentation

Find, Read, And Discover Self Employed National Insurance Threshold 202021, Such Us:

- Rates Thresholds 2017 18 Brightpay Documentation

- How To Apply National Insurance Number Contributions In 2020 21 Dns Accountants

- Newly Self Employed Check Out Our Top 10 Tips To Manage Your Tax And National Insurance Low Incomes Tax Reform Group

- Resolution Foundation On Twitter 7 Some Trends Will Go Into Reverse Like The Growth In Self Employment This Crisis Has Thrown Into Sharp Relief The Risks Associated With Self Employment Especially If The

- National Insurance Contributions Threshold Rises How It Will Affect State Pension Personal Finance Finance Express Co Uk

If you re looking for Sri Lanka Government Gazette 2020 Sinhala you've arrived at the right place. We ve got 103 images about sri lanka government gazette 2020 sinhala adding pictures, photos, pictures, backgrounds, and more. In these web page, we also provide number of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

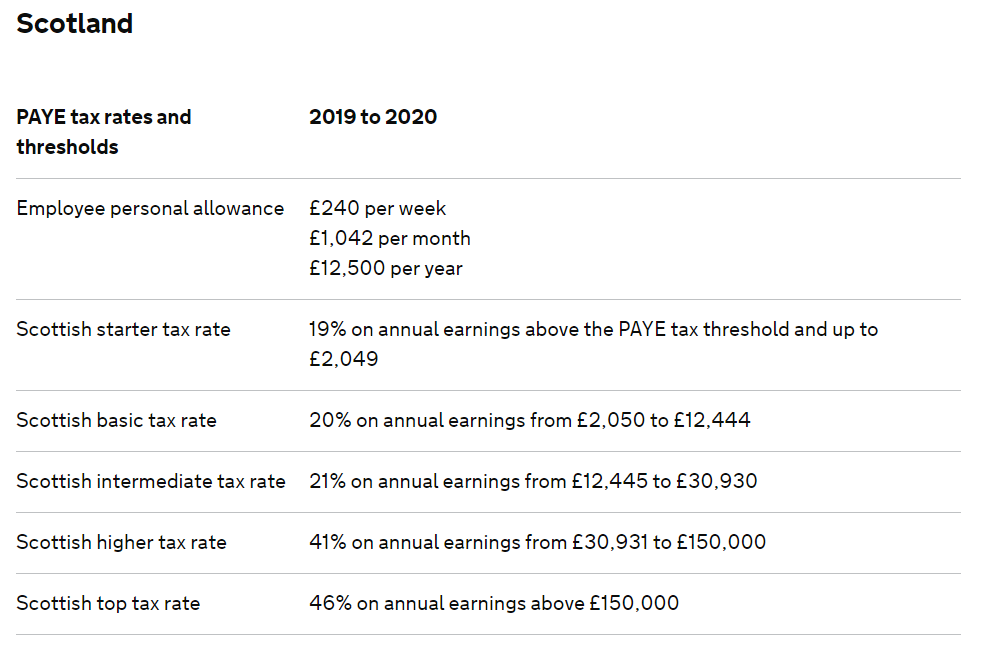

2020 21 tax cut as national insurance threshold rises.

Sri lanka government gazette 2020 sinhala. The national insurance contribution nic threshold will rise on 6 april 2020 as part of the governments commitment to reduce contributions by the low paid. 9 on profits between 9501 and 50000 2 on profits over 50000. The national insurance threshold has increased to 9500 up from 8632 in 2019 20.

The small profits thresholds increases from 6365 to 6475 per annum and. For the self employed in 202021. Its a welcome tax cut that 31 million people will benefit from with self employed workers expected to save 78 a year.

For 202021 the threshold at which taxpayers start to pay nics will rise to 9500 per year for both employed class 1 and self employed class 4 people. As part of the 2020 budget chancellor rishi sunak announced that the national insurance contribution nic thresholds for the 2020 21 tax year will rise. This means youll start paying class 4 national insurance on profits above 9500.

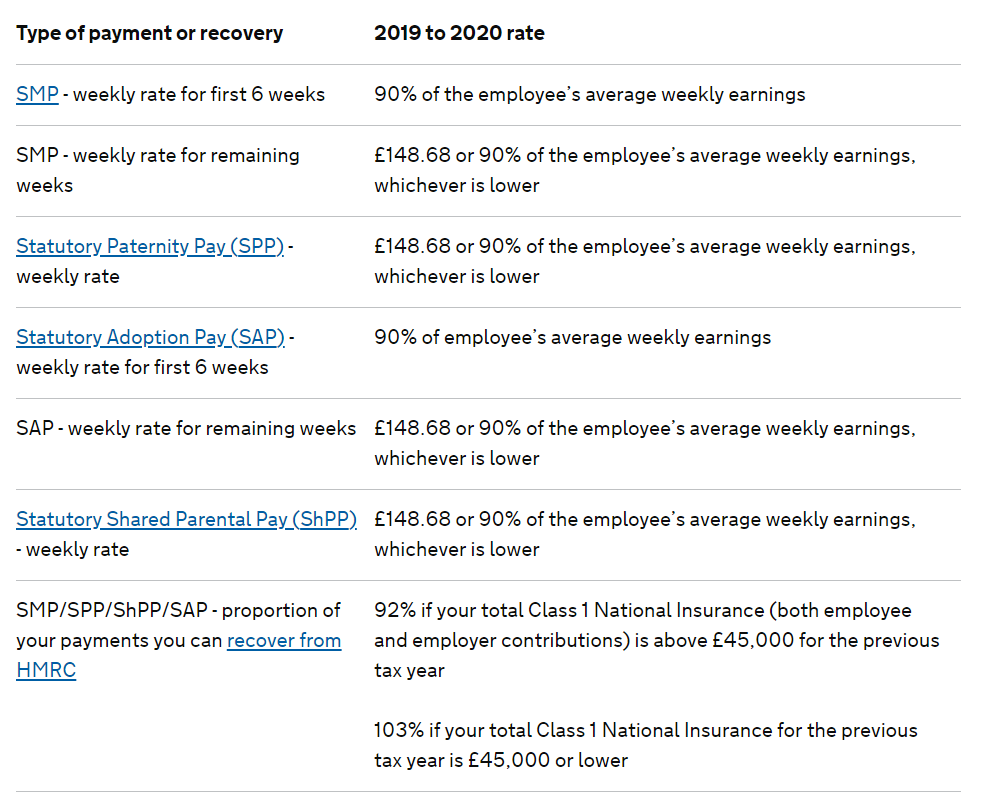

The weekly rate increases from 300 to 305 per week. From 6th april 2020 the threshold for national insurance is increasing. Ahead of the new tax year which is only two months away the government has announced the 202021 national insurance contributions nics thresholds.

For the self employed you pay class 4 national insurance contributions at 9 above the threshold on up to 50000 a year. Youll pay two percent on any. The national insurance threshold.

There are also some key changes to the employment allowance. Self employed national insurance threshold rise. Both employed workers and self employed workers who pay class 4 contributions will be able to earn up to 9500 in 2020 21 up from 8632 in 2019 20 before they have to pay.

This is the class of national insurance contributions that can be used to fill in any national insurance gaps that may exist. National insurance contributions for 202021. The government says this works out on average as a 78 cut in self employed tax.

Per week 2020 to 2021 2019 to 2020 2018 to 2019 2017 to 2018. The new threshold will be 9500 and will apply to both the self employed as well as employees. Class rate for tax year 2020 to 2021.

Lower earnings limit lel employees do not pay national insurance but get the benefits of paying. If you earn more youll pay 12 percent of your earnings between 9500 and 50000.

More From Sri Lanka Government Gazette 2020 Sinhala

- Self Employed Uk Invoice Template

- Furlough Scheme Extended Until June

- Voluntary Sss Payment Slip Form For Self Employed

- Difference Between Furlough And Layoff For Unemployment

- Self Employed Relief Payout Date

Incoming Search Terms:

- Uk Payroll And Tax Information And Resources Activpayroll Self Employed Relief Payout Date,

- National Insurance Contributions Threshold To Rise From April 2020 Knights Lowe Self Employed Relief Payout Date,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctjchivpxsgityvdude I8wnqah0beborzudgrkjqr8bh4ayiwb Usqp Cau Self Employed Relief Payout Date,

- Candxbvvf8cwdm Self Employed Relief Payout Date,

- Rates Thresholds 2020 21 Brightpay Documentation Self Employed Relief Payout Date,

- How To Apply National Insurance Number Contributions In 2020 21 Dns Accountants Self Employed Relief Payout Date,