Self Employed Vat Refund, 9 Self Employment Tax Deductions To Optimize Your Tax Return Tax Deductions Savings Planner Deduction

Self employed vat refund Indeed recently is being sought by users around us, perhaps one of you personally. Individuals now are accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the title of this article I will talk about about Self Employed Vat Refund.

- Self Assessment Tax Return A Guide For The Self Employed

- 3 Reasons Why A Big Income Tax Refund Is A Horrible Thing

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqpqt Vyooh83b70zudldx5dvml5a2yjw5rq9gsknqudjwy4lf6 Usqp Cau

- 5 Lessons From The Obamas Tax Return Cbs News

- Filing A Self Assessment Tax Return Yogatax

- Self Employment Tax Calculator Estimate Your 1099 Taxes

Find, Read, And Discover Self Employed Vat Refund, Such Us:

- Uk Treasury To Require Digital Tax Returns Every Quarter Financial Times

- Irish Tax News Irish Finance News Itas Accounting

- Tips For Filing Your Tax Return To Qualify For Seiss Which News

- Do I Need To Complete A Tax Return Low Incomes Tax Reform Group

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

If you are searching for Is Furlough Scheme Live you've come to the right place. We have 104 graphics about is furlough scheme live including images, photos, pictures, wallpapers, and more. In such page, we also provide number of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

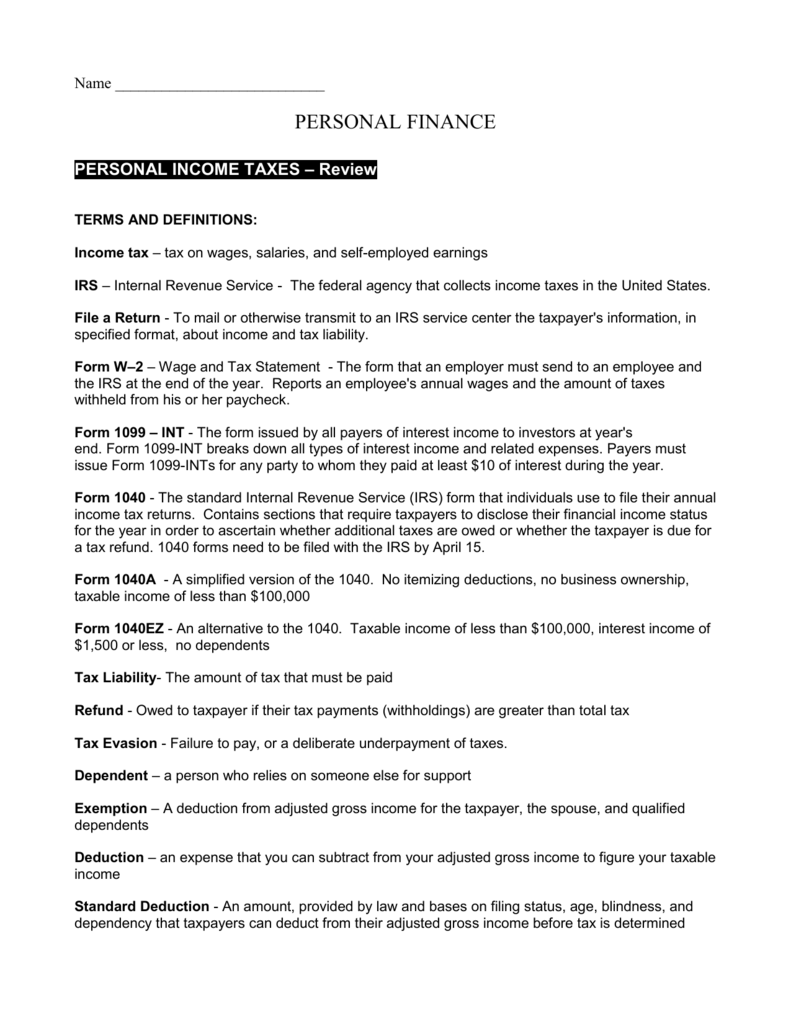

Once you are vat registered you can begin to claim vat back on expenses every time you complete a vat return.

Is furlough scheme live. Most people are aware that foreigners can reclaim value added tax vat on purchased items that they intend to carry out of the eu territory. This guide aims to inform self employed professionals about vat tax filing obligations how and when to file as well as how to register for vat. If youve paid too much tax for example because you made a mistake on your tax return you may be entitled to some money back.

Businesses pay vat on a quarterly basis by filling in a vat return. Reclaiming vat isnt always straightforward with exceptions exemptions and split transactions. Self employed people can claim tax refunds just like regular employees.

If your self employed business profits exceed the vat threshold youll have to register for vat and regularly make a vat return. They are not registered for vat and have had no obligation to register for vat in the country of purchase. The guide includes a summary of the common questions for vat.

A guide to vat for self employed professionals has been published by bambridge accountants. This is usually for new owners of small and medium size businesses. However hmrc deals with tax refunds for self assessment taxpayers differently.

This guide explains what the vat threshold is what the pros and cons are of voluntarily registering for vat. Please note we give no more than an overview here. Many self employed people do not receive any tax refund.

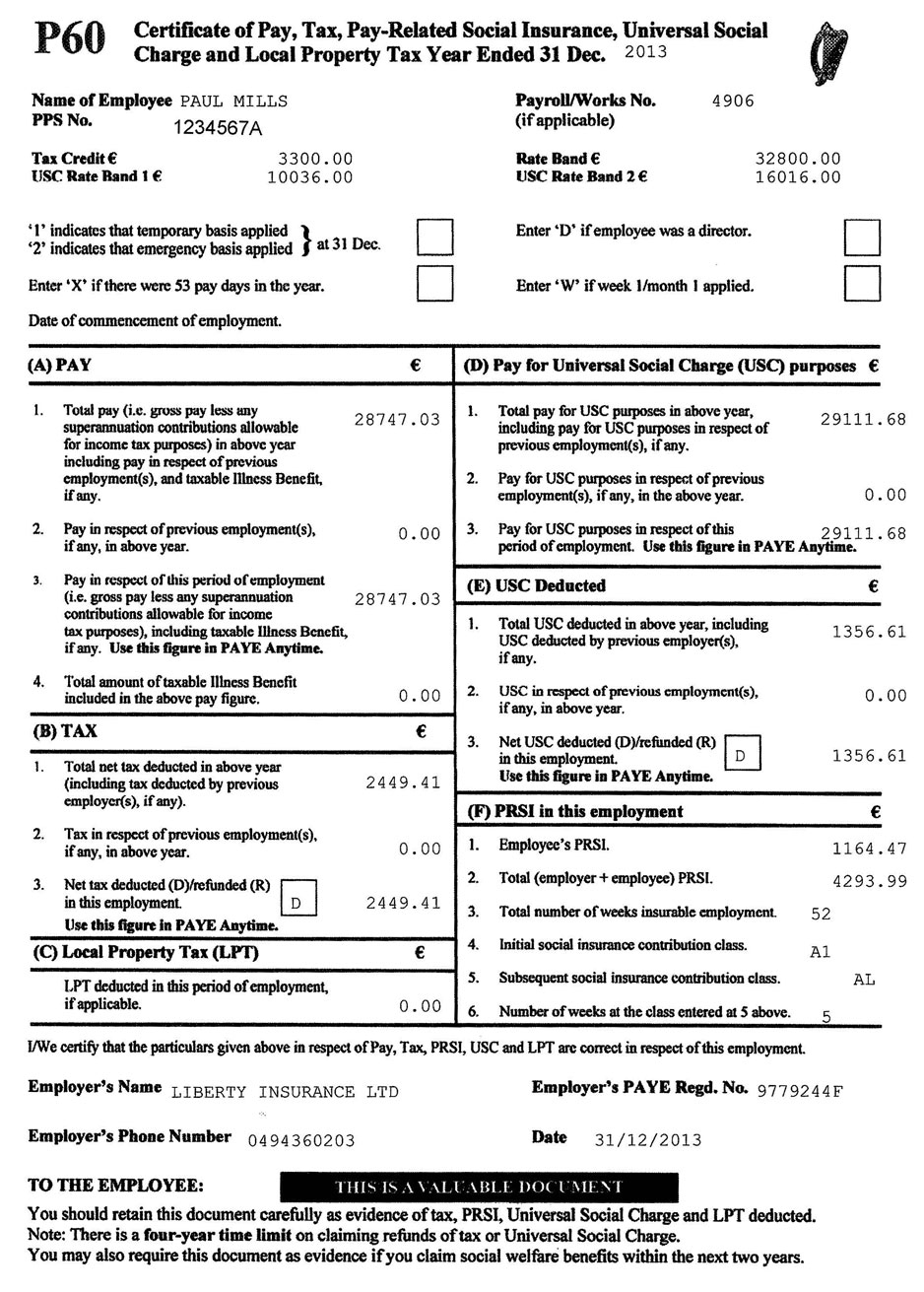

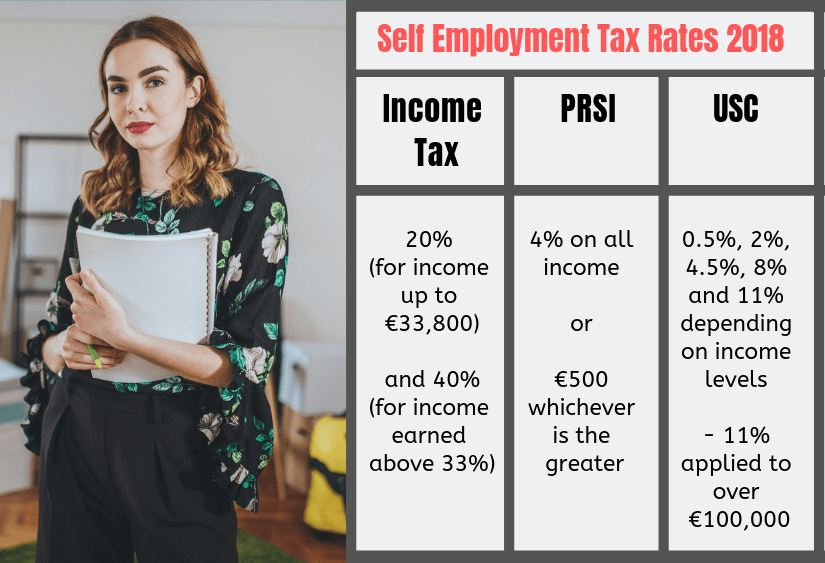

What many business owners dont know however is that they can also reclaim vat on the goods and services that they sell. On this page we take you through some of the various vat related issues you may have as a self employed person. Universal social charge prsi and vat.

If you are self employed however taxes may not be withdrawn from your pay which limits the amount of your refund. Not all self employed businesses need to be registered for vat. Vat is a complex tax that attracts strict penalties.

When you work for an employer you often get a tax refund based on the overpayment of taxes withdrawn from your regular paycheck. This means that self employed people pay a total of 11 usc on any income over 100000. Everyone is liable to pay the universal social charge usc if their gross income is over 13000 in a year.

An extra charge of 3 applies to any self employed income over 100000 regardless of age. Finnish self employed individuals can request a vat refund on goods and services bought in another eu country and on goods imported to another eu country if the following requirements are met. The information can be used by all tax filers.

Self employment taxes explained learn what taxes youll pay how much.

More From Is Furlough Scheme Live

- Furlough Scheme Uk Self Employed

- Us Government Publishing Office Pueblo Distribution Center

- Functions Of Federal Government In Nepal

- Is The Furlough Scheme A Loan

- Government Cheese Caves Adam Ruins Everything

Incoming Search Terms:

- 14 Tax Tips For The Self Employed Taxact Blog Government Cheese Caves Adam Ruins Everything,

- Not Fit For Purpose Tax Glitch Putting Pensions Of Self Employed At Risk Money The Guardian Government Cheese Caves Adam Ruins Everything,

- A Guide To Unique Tax Reference Numbers What Is A Utr Government Cheese Caves Adam Ruins Everything,

- 21 Costly Vat Mistakes Businesses Make On Their Vat Returns Bytestart Government Cheese Caves Adam Ruins Everything,

- What Is Self Employment Tax With Pictures Government Cheese Caves Adam Ruins Everything,

- Wc4xk 3p5q74wm Government Cheese Caves Adam Ruins Everything,