Self Employed Claiming Universal Credit, Understanding Universal Credit How Earnings Affect Universal Credit

Self employed claiming universal credit Indeed lately is being sought by users around us, maybe one of you personally. People now are accustomed to using the net in gadgets to view video and image information for inspiration, and according to the title of this article I will talk about about Self Employed Claiming Universal Credit.

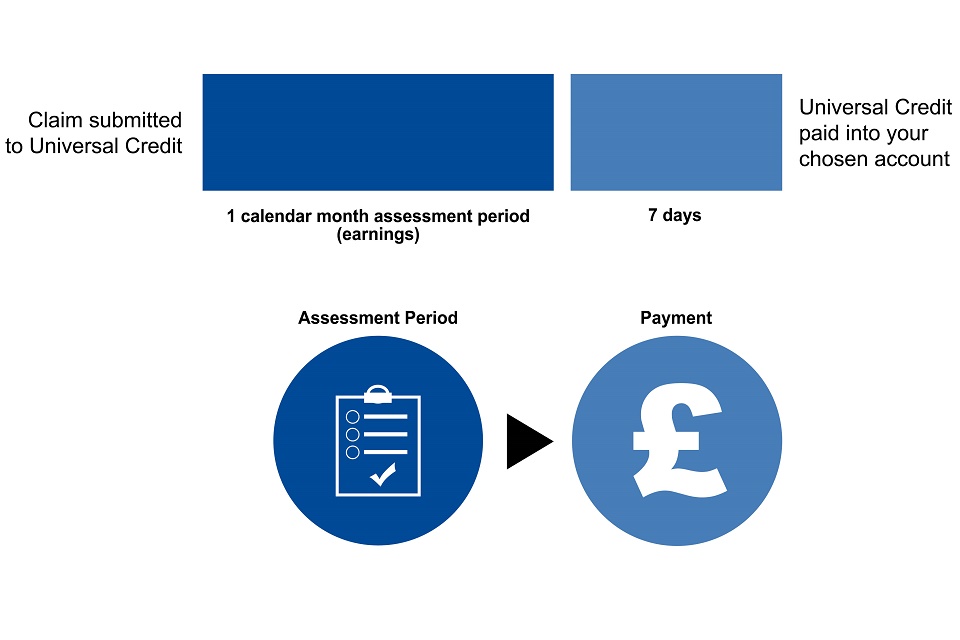

- Universal Credit Different Earning Patterns And Your Payments Payment Cycles Gov Uk

- How To Claim Universal Credit If You Re Self Employed Or Have Lost Your Job

- 2

- Understanding Universal Credit How Much Universal Credit Can I Get

- Universally Complex Taxation

- Https Www Elmbridge Gov Uk Easysiteweb Gatewaylink Aspx Alid 1314

Find, Read, And Discover Self Employed Claiming Universal Credit, Such Us:

- Will The Self Employment Emergency Grant Affect My Universal Credit Payments

- 2

- Universal Credit For The Self Employed Gov Uk

- Universal Credit And The Self Employed Survey

- Your Income And Coronavirus Covid 19 Policy In Practice

If you re searching for Government Shutdown 2020 October 1 you've arrived at the right location. We ve got 101 images about government shutdown 2020 october 1 including pictures, photos, pictures, wallpapers, and more. In such webpage, we also provide number of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

If you are self employed and claiming tax credits or housing benefit and you have a change in circumstances you may move to universal credit.

Government shutdown 2020 october 1. If youve been gainfully self employed for less than 12 months you may be classed as being in the start up period and the minimum income floor wont apply for up to 12 months. Self employed people can claim universal credit as long as their income and capital are low enough. If you move onto universal credit and have been gainfully self employed for 12 months or more the minimum income floor will apply to your earnings.

Self employment and universal credit universal credit is a monthly payment to help with your living costs. You will need to be able to show that you are gainfully self employed by proving. Alamy you can apply for a self employed government grant of up to 7500 from.

The suns welfare expert explains all you need to know about claiming universal credit and self employed grants credit. 28 march at 1029am in coronavirus support and help. Universal credit includes a minimum income floor mif if you are gainfully self employed and your business has been running for more than 12 months.

You may be able to get it if youre on a low income out of work or you cannot work. Self employed people can claim universal credit. Its important to understand that universal credit is only available to those who are deemed gainfully self employed.

The mif is an assumed level of earnings. However the process for claiming universal credit and the amount you may get is different. Claiming universal credit self employed.

If you are self employed and claiming universal credit earnings or losses from one month can be taken into account when working out how much universal credit you receive in a later month. This means that self employment must be your main form of employment and that you are receiving earnings from it.

More From Government Shutdown 2020 October 1

- Government College University Lahore Admission 2020 Merit List

- Furlough Scheme Ending

- Self Employed Quarterly Tax Schedule

- Self Employed Australiacomau

- Government Accounting Millan Solution Manual Chapter 2

Incoming Search Terms:

- Martin Lewis Big Cut In Universal Credit For Many Self Employed Coming On 13 November Contact Your Mp If Hit Government Accounting Millan Solution Manual Chapter 2,

- Self Employed Avoid Big Cut To Universal Credit After Return Of The Minimum Income Floor Delayed Until April Government Accounting Millan Solution Manual Chapter 2,

- Universal Credit Can You Claim Universal Credit If You Are Self Employed Personal Finance Finance Express Co Uk Government Accounting Millan Solution Manual Chapter 2,

- Six Things You Need To Know About Universal Credit This Is Money Government Accounting Millan Solution Manual Chapter 2,

- Self Employed Can Claim Universal Credit Here S What You Need To Know Government Accounting Millan Solution Manual Chapter 2,

- How To Claim Universal Credit If You Re Self Employed Or Have Lost Your Job Government Accounting Millan Solution Manual Chapter 2,