Self Employed Quarterly Tax Schedule, Self Employed Calculate Your Quarterly Estimated Income Tax Xendoo

Self employed quarterly tax schedule Indeed lately has been sought by consumers around us, maybe one of you personally. Individuals are now accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the title of this post I will talk about about Self Employed Quarterly Tax Schedule.

- Self Employed Tax Tips Paying Quarterly Taxes Gordon Law Group

- Ecommerce Tax Time Primer

- Important 2020 Tax Dates For Freelancers And Independent Contractors

- How To Report And Pay Taxes On 1099 Income

- Self Employment Tax Calculator 1099 Schedule C Estimated Taxes

- Self Employed Estimated Tax Payments Explained

Find, Read, And Discover Self Employed Quarterly Tax Schedule, Such Us:

- Do You Owe Estimated Tax Payments To The Irs Or Ohio Department Of Taxation Gudorf Tax Group Llc

- Uj Dw4kh3uo7cm

- How Do I Pay Quarterly Taxes In 2020 Quarterly Taxes Small Business Finance Self Employment

- The Ultimate Self Employment Guide To Filing Estimated Taxes

- How To File Quarterly Taxes In An Instant

If you re searching for Government Island you've come to the ideal place. We ve got 104 graphics about government island including images, pictures, photos, backgrounds, and more. In these webpage, we additionally provide variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

What are the quarters.

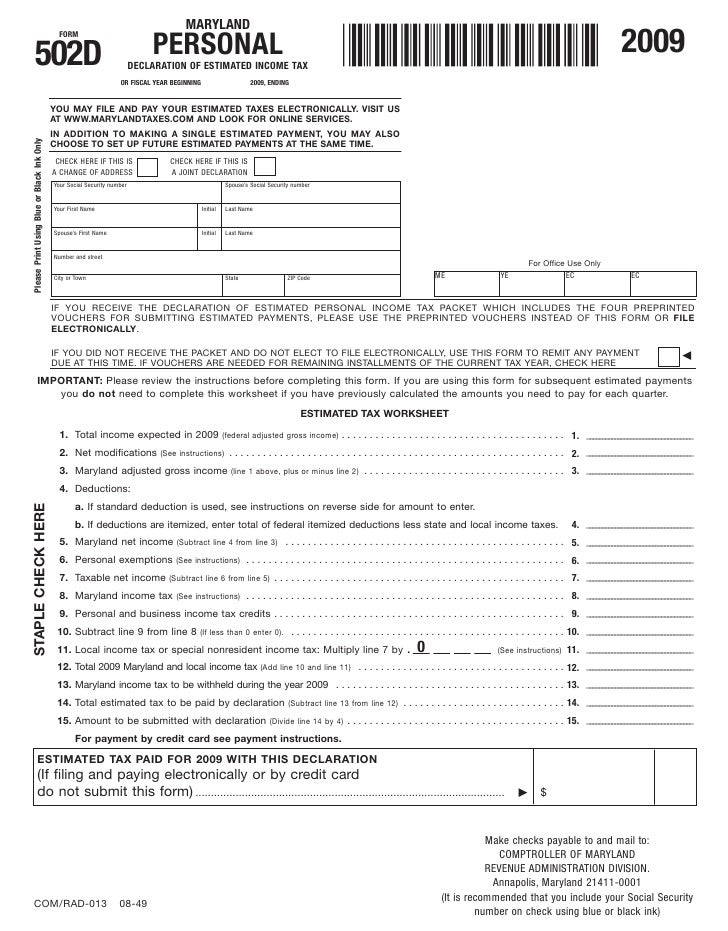

Government island. As a self employed individual you file an annual return but usually pay estimated taxes on a quarterly basis. Submit your feedback to irstaxcalendaratirsgov. As a self employed individual you may have to file estimated taxes on a quarterly basis.

Self employed individuals generally must pay self employment tax se tax as well as income tax. This mailbox is for feedback to improve the tax calendar. In taking care of your self employment tax you need a schedule se otherwise known as a form 1040.

First quarter the first quarter of a calendar year is made up of january february and march. Duplicate emails will delay or prevent a response. So for example if your schedule se says you owe 2000 in self employment tax for the year youll need to pay that money when its due during the year but at tax time 1000 would be.

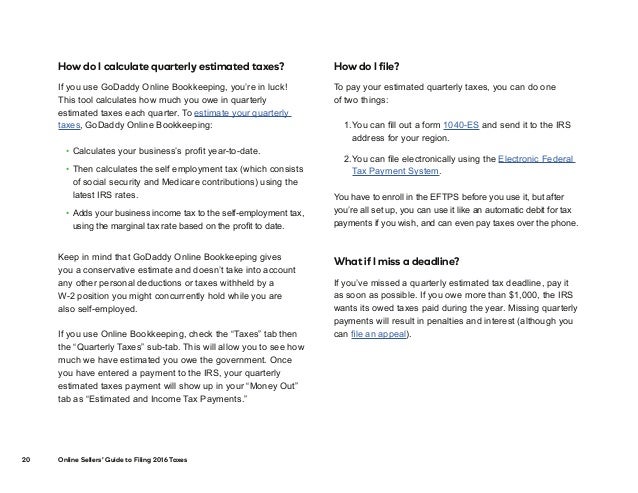

You can check on this by computing for your net profit or your net loss. Your quarterly estimated taxes are made up of income taxes which you calculated in step 2 above and self employment se taxes which are comprised of social security and medicare taxes. Se tax is a social security and medicare tax primarily for individuals who work for.

The only way to avoid this penalty is if you owe less than 100000. Second quarter the second quarter of a calendar. The self employment se tax rate is 153 124 goes towards social security and 29 goes to medicare.

Email your questions or comments about the irs tax calendar for businesses and self employed. Please dont share your social security number taxpayer identification number or address. Under the semiweekly deposit schedule deposit employment taxes for payments made on wednesday thursday andor friday by the following wednesday.

The self employment tax social security and medicare income tax on the profits that your business made and any other income. As a self employed individual generally you are required to file an annual return and pay estimated tax quarterly. Note find 2020 quarterly estimated tax due dates here self employed individuals typically must pay quarterly estimated taxes on a schedule established by the irs.

Report your deposits quarterly or annually only by filing form 941 or form 944. If you earned 200000 this. Before trying to figure out how much your self employed taxes are make sure you are subject to it.

Deposit taxes for payments made on saturday sunday monday andor tuesday by the following friday. What are my self employed tax obligations. In the 2020 tax year for example the self employment.

Taxes must be paid as you earn or receive income during the year either through withholding or estimated tax payments.

More From Government Island

- Government Hospital Inside Images

- Self Employed Ppp Loan Forgiveness Calculator

- Highest Paying Government Jobs In India For Engineers

- Government Website Examples

- Self Employed Limited Company Tax Calculator

Incoming Search Terms:

- Self Employment Tax Everything You Need To Know Smartasset Self Employed Limited Company Tax Calculator,

- What Are Quarterly Taxes Daveramsey Com Self Employed Limited Company Tax Calculator,

- How To Become A Freelancer Part 2 Freelance Taxes Avant Youth Self Employed Limited Company Tax Calculator,

- Self Employed Quarterly Taxes Know What You Owe Stride Blog Self Employed Limited Company Tax Calculator,

- Hhm Finance Night Tax Form Schedule C Self Employed Limited Company Tax Calculator,

- Taxes For Bloggers How To Do Taxes On Blog Income 2020 Self Employed Limited Company Tax Calculator,