Self Employed Sss Contribution Payment, Sss Payment Deadline For Voluntary Members Sss Inquiries

Self employed sss contribution payment Indeed recently is being sought by users around us, perhaps one of you. People now are accustomed to using the net in gadgets to view video and image information for inspiration, and according to the title of the article I will talk about about Self Employed Sss Contribution Payment.

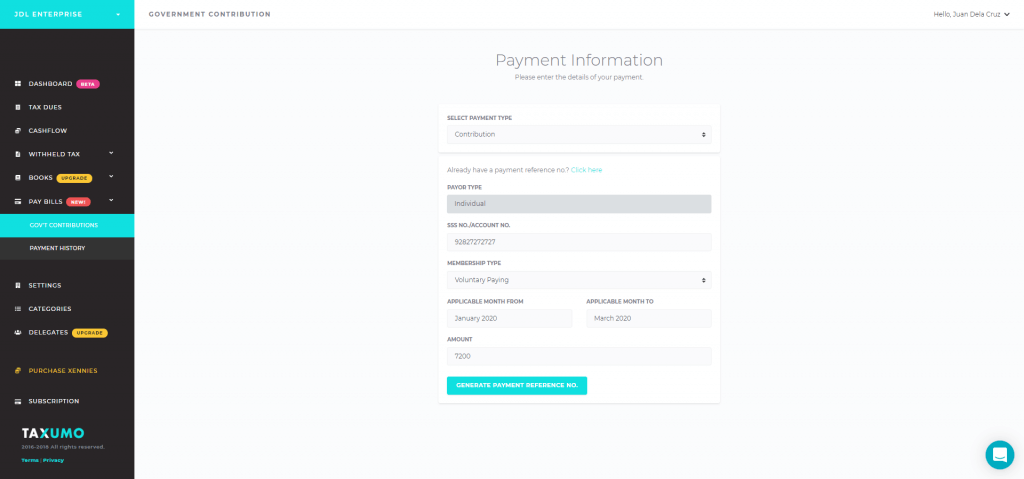

- 11 Easy Steps To Pay Your Sss Contributions Online And Generate Prns Too Taxumo File Pay Your Taxes In Minutes

- Updated Sss Contribution Table 2019 Employee Employer Share

- Sss Monthly Contribution Table Schedule Of Payment 2020 The Pinoy Ofw

- Sss Contribution Table 2020 Sss Benefits For Filipinos

- Philippine Social Security System Contribution Table 2016 Auxbreak Com

- How To Pay Sss Contributions As A Voluntary Member A Guide For Filipino Freelancers The Ultimate Virtual Assistant Resource

Find, Read, And Discover Self Employed Sss Contribution Payment, Such Us:

- How To Pay Sss Contributions As A Voluntary Member A Guide For Filipino Freelancers The Ultimate Virtual Assistant Resource

- How To Pay And Post Philippine Social Security System Contributions

- Sss Contribution Table 2019 Tech Patrol

- 2019 New And Updated Sss Contribution Table For Ofw S And Other Sss Member

- How Much Is The Required Monthly Contributions For Voluntary Members Of The Sss

If you are looking for Self Employed Login Grant you've reached the right location. We ve got 104 graphics about self employed login grant adding pictures, photos, pictures, backgrounds, and more. In such web page, we additionally provide number of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

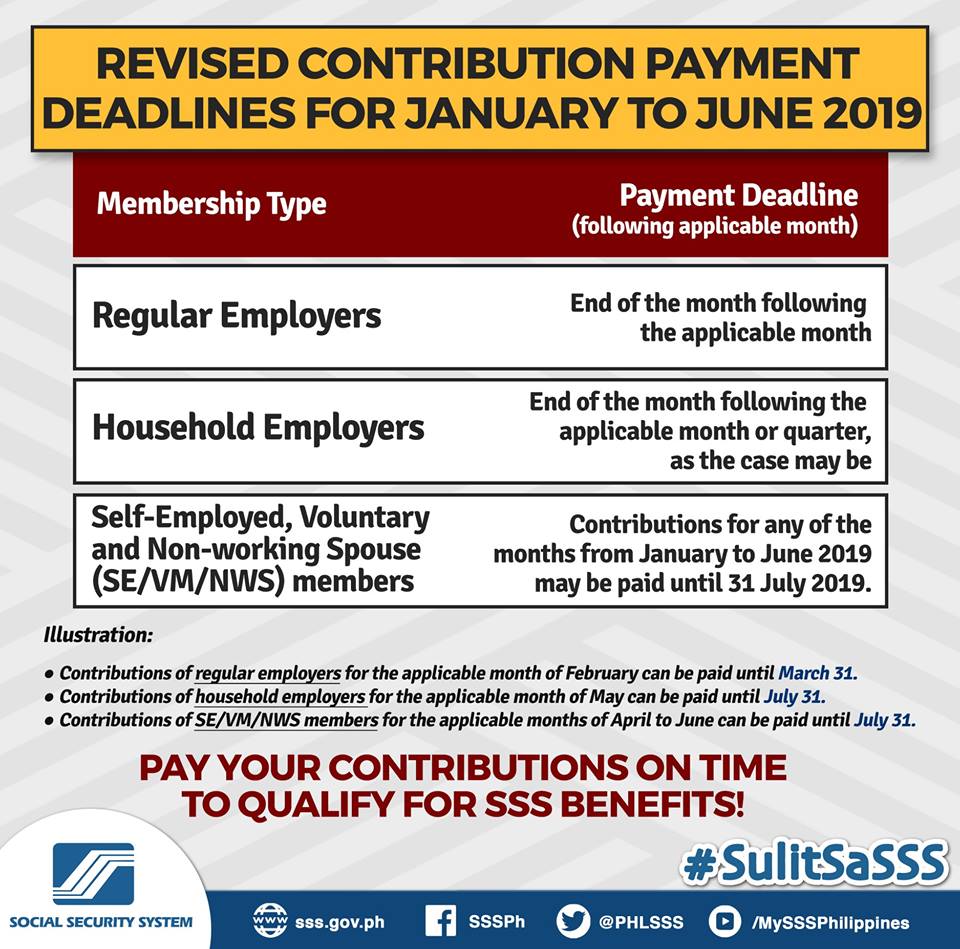

As many of the people are in their homes this is a reminder for sss contributions payment deadline for the second quarter of 2020.

Self employed login grant. For self employed voluntary and non working spouse for self employed voluntary and non working spouse members contributions for the applicable months of april may june or the second quarter of 2020 may be. So you can use it to enroll in online sss so you can check your records online. The prn is a unique number generated and used by each sss member when paying a contribution.

Then you can ask for the transaction no. Paid at least three 3 monthly contributions within the 12 month period preceding the semester of sickness. Sss benefits for self employed members.

You need to generate this number each time you make a payment so your contributions will be posted in your account in real time. Get a payment reference number prn. Confined for at least four 4 days.

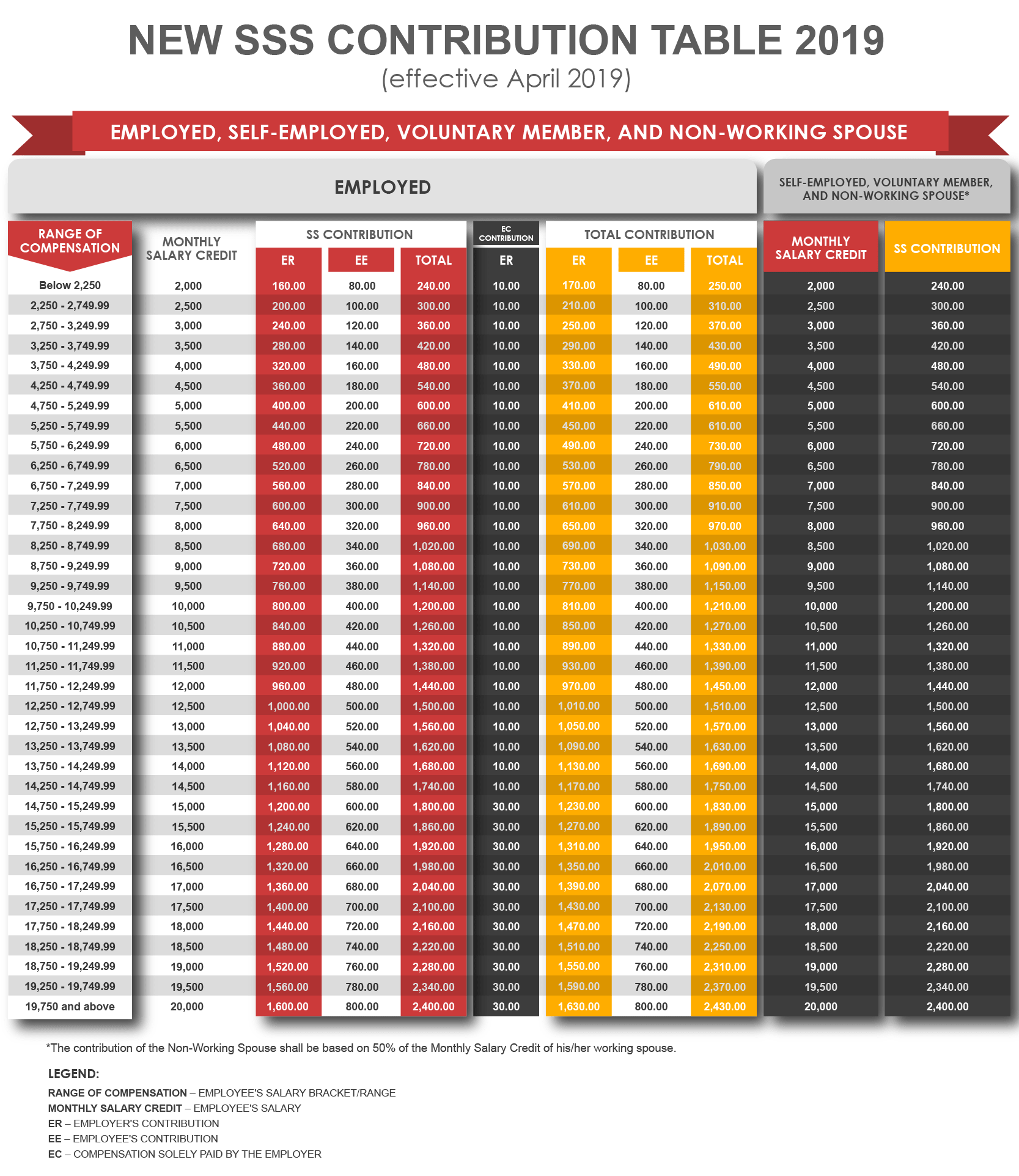

For voluntary and self employed. Effective april 2019 below is the new sss contribution table for employed self employed voluntary members and non working spouses. The employer pays 8 while the employee pays 4.

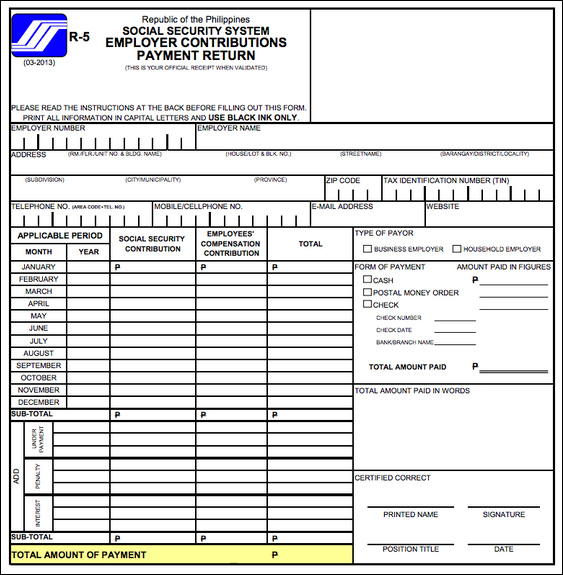

At bayad center your sibling can pay fill up the form your names sss nos check ofw month paid date paid. You can pay your sss contribution at the sss office cashier or at any accredited sss payment center like sm business center or bayad center. Fill out the following portions.

For self employed voluntary non working spouse farmerfisherman b. For overseas filipino worker ofw 3. Hi haydee yes your sibling can pay your sss contributions as ofws in your behalf.

If you want to download the sss contributions table 2020 then you may double click this image and save on your phone for your handy reference here is the new sss contributions table for employed self employed voluntary and non working spouse sss members for ofw members. For employed members the minimum monthly salary credit is php 2000 with a total contribution of php 250 while the maximum monthly salary credit is php 20000 with a total contribution of php 2430. Good news to all its regular household employers self employed voluntary and non working spouse members the social security system sss further extends the deadline of payment or remittance of all contributions.

Daily cash allowance paid to a member for the number of days heshe is unable to work due to sickness or injury. Pay your contributions following the payment deadline to avoid application of payments prospectively. Sss contribution table 2020.

You can pay until the 30th of november 2020. Where to pay your sss contribution. This is an aid to recovery from the damages done during the quarantine period.

Just fill out the sss payment form with your correct information and wait for a few days for your payment to be posted to your sss account.

More From Self Employed Login Grant

- Government Hospital Inside

- Self Employed Edd Benefits Covid 19

- Government College University Lahore Uniform

- Central Government Holidays In October 2020

- Government Govt Of Karnataka Logo Png

Incoming Search Terms:

- Sss Payment Deadline For Voluntary Members Sss Inquiries Government Govt Of Karnataka Logo Png,

- Sss Contribution Table 2020 With Detailed Computations Explanations Government Govt Of Karnataka Logo Png,

- New Sss Contribution Table 2017 Self Employed Overseas Filipino Workers And Voluntary Members Only Pinoywebz Government Govt Of Karnataka Logo Png,

- Philippine Social Security System Contribution Table 2016 Auxbreak Com Government Govt Of Karnataka Logo Png,

- Instruction For Sss Loan Online Payment Government Govt Of Karnataka Logo Png,

- How To Pay Sss Contributions For Freelancers And Self Employed Government Govt Of Karnataka Logo Png,