Government Accounting System In India, 2

Government accounting system in india Indeed lately is being sought by users around us, perhaps one of you. People are now accustomed to using the net in gadgets to see video and image information for inspiration, and according to the title of this article I will discuss about Government Accounting System In India.

- Government Accounting Accrual Is The Way To Go The Hindu Businessline

- E Gras Online Government Receipts Accounting System

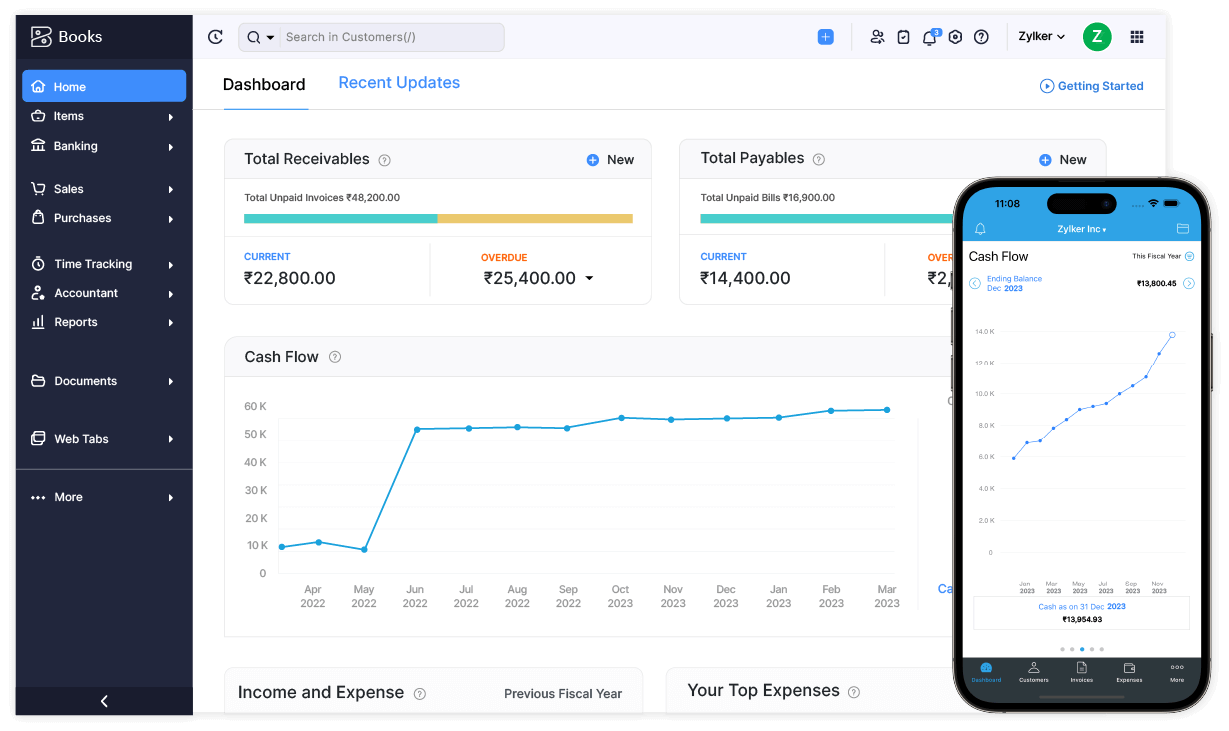

- Online Accounting Software Gst India Zoho Books

- Government Accounting Rules Chapter I Introductory Pdf Free Download

- Indian Trust Funds Improvements Made In Acquisition Of New Asset And Accounting System But Significant Risks Remain Ebook U S Government Accountability Office Amazon In Kindle Store

- Home National Institute Of Financial Management Government Of India

Find, Read, And Discover Government Accounting System In India, Such Us:

- Model Panchayat Accounting Manual Government Of India Ministry Of Panchayati Raj Part 1 Accounting System And Treatments Part Pdf Free Download

- Http Web Delhi Gov In Wps Wcm Connect Fffb5d004746630385b38f436768cb95 Chapter 1 Pdf Mod Ajperes Lmod 1392313014

- Green National Accounting System In India Conceptual Issues And

- Http Egyankosh Ac In Bitstream 123456789 19323 1 Unit 22 Pdf

- Session 4 5 Session Title Government Accounting

If you re looking for Self Employed Examples Philippines you've reached the ideal location. We ve got 101 images about self employed examples philippines including pictures, pictures, photos, wallpapers, and much more. In these webpage, we additionally provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

A well designed and well managed accounting system helps ensure proper control over funds.

Self employed examples philippines. It does not help in management of assets and cash. Reserve bank of india as its agent under the provisions of sub section i of section 45 of the reserve bank of india act 1934 2 of 1934. C chief accounting authority means the secretary of a ministry or department of the government of india in which the departmentalised system of accounting has been introduced.

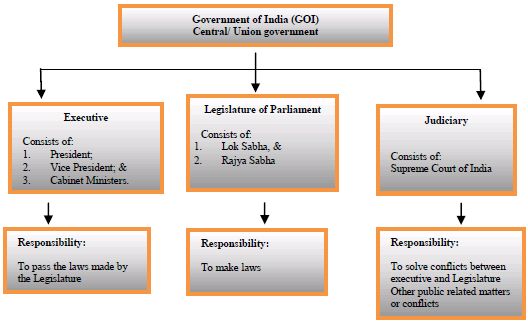

Later with entry of east india company had made a huge impact on trade and commerce of ind. Whilst the government entities have the primary responsibility of fiscal accountability in private sector the main. What is the accounting system followed by the government.

Several shortcomings in the functioning of the accounting system in the indian government are identified. Difference between private sector system of accounting and governmental accounting arises mainly because of the environment of the accounting system. In the government environment public sector entities have differing goals as opposed to the private sector entities one main goal of gaining profit.

Current accounting practice in india. Indian government accounting standards igass formulated by gasab are for cash system of accounting and become mandatory from the effective date after their notification by ministry of finance govt. The constitution of india envisages the accounts of the union and the states to be kept in such a form as the president may prescribe on.

The difference between private and government system of accounting arises mainly because of the environment of accounting system. Government accounts the financial management of any organization must have a prudent financial system backed by sound and effective accounting procedures and internal controls. The roots of accounting system in india had been evolved in early sixteenth century when india had built trade links with europe and central asia.

This chapter looks at the cash accounting system in the indian government to determine how it has worked and in particular how it has responded to the challenge of change in the nature of accountability. Asb is a committee under institute of chartered accountants of india icai which consists of representatives from government department academicians other. Indian accounting standard abbreviated as ind as is the accounting standard adopted by companies in india and issued under the supervision of accounting standards board asb which was constituted as a body in the year 1977.

Such exercise is undertaken by government it known as government accounting.

More From Self Employed Examples Philippines

- South African Government Gazette Death Notices

- New Furlough Scheme Self Employed

- Formal Letter To Government Malaysia

- Government Consulting Firms Dc

- Us Government Debt To Gdp Chart

Incoming Search Terms:

- Online Accounting Software Gst India Zoho Books Us Government Debt To Gdp Chart,

- Model Panchayat Accounting Manual Government Of India Ministry Of Panchayati Raj Part 1 Accounting System And Treatments Part Pdf Free Download Us Government Debt To Gdp Chart,

- Buy Surviving A Dcaa Audit The Accounting System For Small Government Contractors Working With The Dcaa And Other Government Agencies Book Online At Low Prices In India Surviving A Dcaa Audit Us Government Debt To Gdp Chart,

- Http Irastimes Org Article Pdf Enhancing 20transparency 20and 20accountability 20in 20indian 20railways Mission 20beynd 20book 20keeping Pdf Us Government Debt To Gdp Chart,

- Accounting Book B Com I Year Allahabad University Dr S M Shukla Us Government Debt To Gdp Chart,

- Ingaf Us Government Debt To Gdp Chart,