Self Employed Taxes Florida, Income Taxes What You Need To Know The New York Times

Self employed taxes florida Indeed recently is being sought by consumers around us, perhaps one of you. Individuals are now accustomed to using the net in gadgets to view video and image data for inspiration, and according to the name of the article I will talk about about Self Employed Taxes Florida.

- Self Employed

- How To File A Florida Sales Tax Return Youtube

- Affordable Individual Health Insurance By Bryan Winstanley Issuu

- An Obamacare Guide For Freelancers And The Self Employed

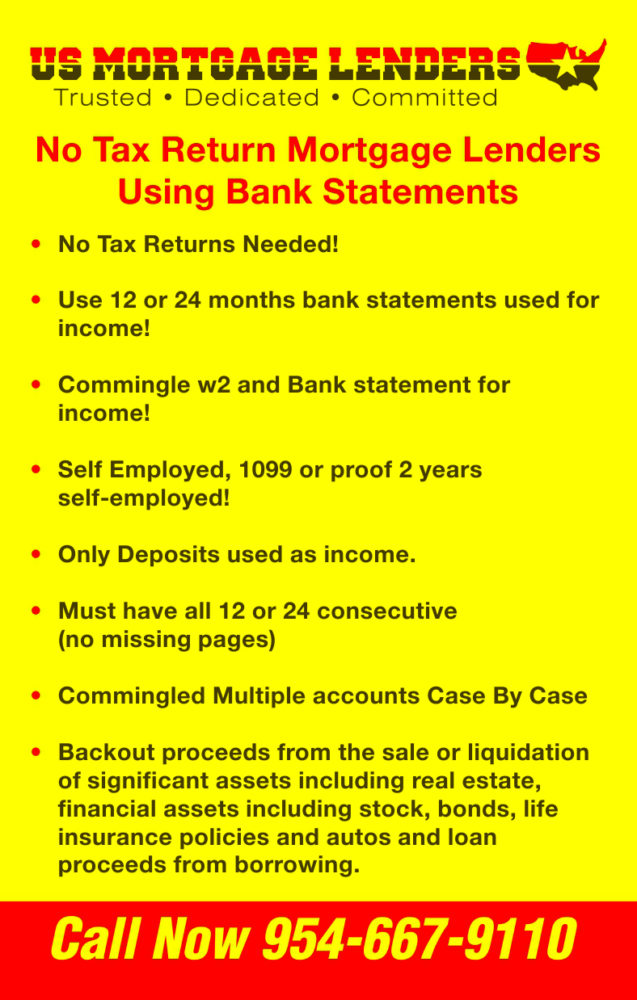

- No Tax Return Mortgage Lenders Stated Income

- What Is Tangible Personal Property Indian River County Florida

Find, Read, And Discover Self Employed Taxes Florida, Such Us:

- What Is Self Employment Tax And What Are The Rates For 2020 Workest

- How Estimated Taxes Work Safe Harbor Rule And Due Dates 2020

- Self Employment Form Fill Out And Sign Printable Pdf Template Signnow

- Tax Withholding For Pensions And Social Security Sensible Money

- State Income Tax Wikipedia

If you re searching for Self Employed Maternity Pay Male you've reached the perfect place. We have 103 images about self employed maternity pay male adding images, photos, pictures, wallpapers, and more. In such webpage, we also provide variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

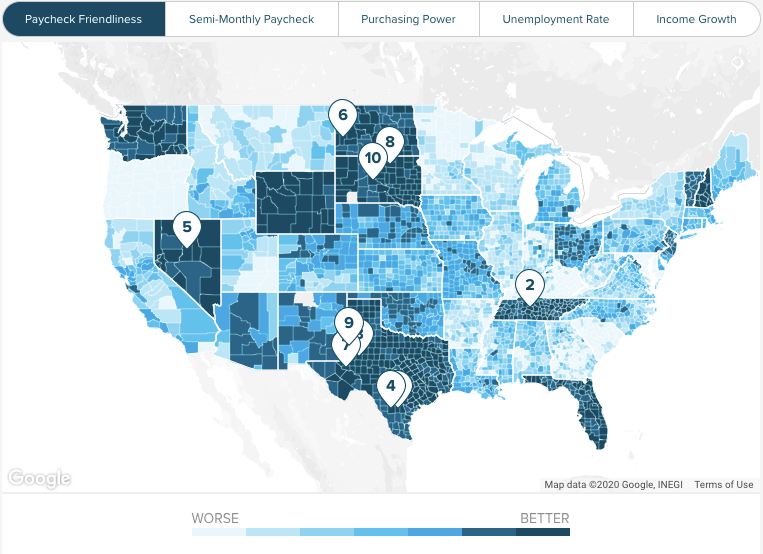

3 oversee property tax administration involving 109.

Self employed maternity pay male. The self employment tax applies evenly to everyone regardless of your income bracket. Self employment tax is made up of social security and medicare taxes. Florida has no state income tax on its residents who are individuals.

124 for social security tax and 29 for medicare. The biggest reason why filing a 1099 misc can catch people off guard is because of the 153 self employment tax. Corporations that do business in florida are subject to a 55 income tax.

As of 2019 the self employment tax rate is 153. However the taxable self employment earnings of 27705 are still subject to medicare taxes working out to self employment tax of 803 and a 402 deduction against your income tax liability. What is self employment tax.

That rate is the sum of a 124 for social security and 29 for medicare. Paying taxes on your self employment income. The self employment tax rate is 153.

Self employment tax applies to net earnings what. Florida department of revenue the florida department of revenue has three primary lines of business. Florida is a tax friendly state that does not impose an income tax on individuals and has a 6 sales tax.

The 1099 tax rate consists of two parts. In addition florida does impose income tax on. 1 administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually.

Small business administration florida state of florida agencies florida administrative code. Department of revenue businesses. An additional 09 medicare surtax applies to high income earners.

Youll also have to pay self employment tax which covers the amounts you owe for social security and medicare taxes for the year. While typical employees pay half the social security and medicaid taxes split with their employer self employment taxes take out the full lot altogether or 124 for social security and 29. 2 enforce child support law on behalf of about 1025000 children with 126 billion collected in fy 0607.

Department of economic opportunity reemployment tax formerly unemployment tax new hire reporting center. You can calculate your self employment tax using schedule se on form 1040.

More From Self Employed Maternity Pay Male

- Self Employed Universal Credit

- Government Number Plate India Online

- Government Office Worker

- Government Public Relations Adalah

- Government Guidelines Coronavirus Uk

Incoming Search Terms:

- 2021 State Business Tax Climate Index Tax Foundation Government Guidelines Coronavirus Uk,

- Self Employment Form Fill Out And Sign Printable Pdf Template Signnow Government Guidelines Coronavirus Uk,

- How Much Should I Set Aside For Taxes 1099 Government Guidelines Coronavirus Uk,

- The Definitive Guide To Paying Taxes As A Real Estate Agent Aceableagent Government Guidelines Coronavirus Uk,

- Freetaxusa Free Self Employed Income Tax Preparation Maximize Small Business Deductions Government Guidelines Coronavirus Uk,

- 5 Things 1099 Employees Need To Know About Taxes Glassdoor Government Guidelines Coronavirus Uk,