Furlough Scheme Uk Notice Period, Furlough Scheme How Can You Protect Your Finances When Support Ends Business Leader News

Furlough scheme uk notice period Indeed recently has been sought by consumers around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the title of the post I will discuss about Furlough Scheme Uk Notice Period.

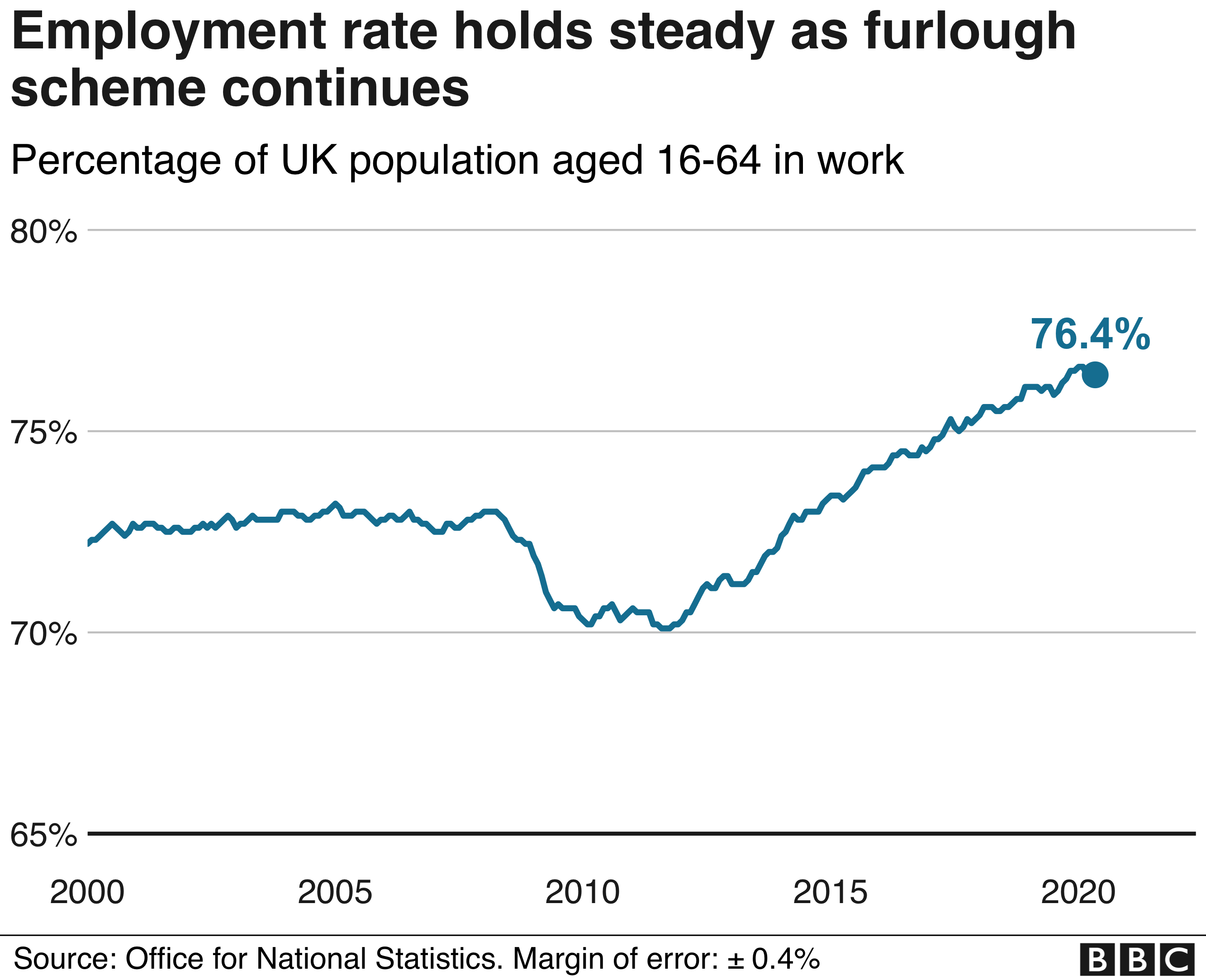

- Coronavirus Furlough Scheme To Finish At End Of October Says Chancellor Bbc News

- Notice Pay During Furlough Birkett Long Solicitors

- Covid 19 Furlough Under Job Retention Scheme Faqs Make Uk

- United Kingdom Updates And Faqs On The Uk Furlough Scheme Littler Mendelson P C

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcthbbbvipypoaur 0il4i Akciuydoer1qjg1rgt O3u9j23hga Usqp Cau

- Furlough To Redundancy Payfit Help Center

Find, Read, And Discover Furlough Scheme Uk Notice Period, Such Us:

- Urgent Clarification Needed Over Redundancy And Notice Period Rules During Furlough White Hart Associates

- Coronavirus Job Retention Scheme Every Furlough Question Answered Personal Finance Finance Express Co Uk

- Your Questions On Furlough Answered Amended Guidance In Depth Gateley

- Hmrc Update On Furlough Scheme Notice Periods

- Redundancy Notice Period And The Furlough Scheme Emphasis

If you re searching for Limited Government History Definition you've arrived at the perfect location. We have 104 graphics about limited government history definition including images, photos, pictures, wallpapers, and more. In such web page, we also provide number of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Five Updates On The Furlough Scheme From Purple Hr Dorset Chamber Of Commerce And Industry Limited Government History Definition

The Coronavirus Job Retention Scheme Faqs For Uk Employers Lawyers Solicitors London Limited Government History Definition

An employer spent on.

Limited government history definition. I will continue to demonstrate this using the above example. These include getting redundancy pay a paid notice period and any money your employer owes you for example unpaid wages. Accordingly unless the furlough agreement or employment contract says otherwise the employee is only be entitled to their 80 pay during their contractual notice period.

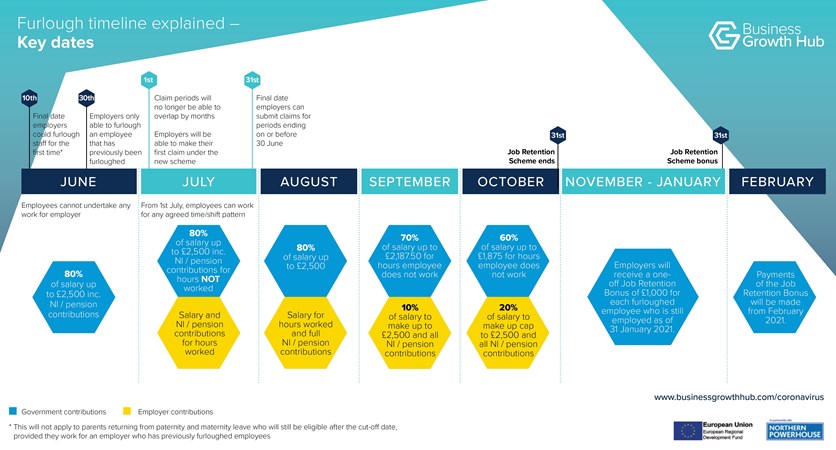

In an update to its furlough guidance today hm revenue customs clarified that contractual notice periods for example those that last three or six months rather the statutory. Funds claimed from the governments coronavirus job retention scheme can be used to pay for notice periods that go above and beyond the statutory minimum. Guidance updated by hm revenue and customs hmrc confirms that employers can still claim for furlough payments if an employee has been put on a full notice period.

This means that the employer will be able to reclaim some or quite possibly all of the notice pay under the furlough scheme. You still have these rights even though you were furloughed when you. Furlough and notice pay.

The confusion and concern created by paragraph 22 of the third iteration of the treasury direction which stated that a claim should only be made where the payment will be used to continue employment has hopefully been alleviated by hmrc after this mornings update to the guidance. So during furlough leave we believe there are three options. Changes will mean those furloughed under the coronavirus job retention scheme are not short changed if they are made redundant.

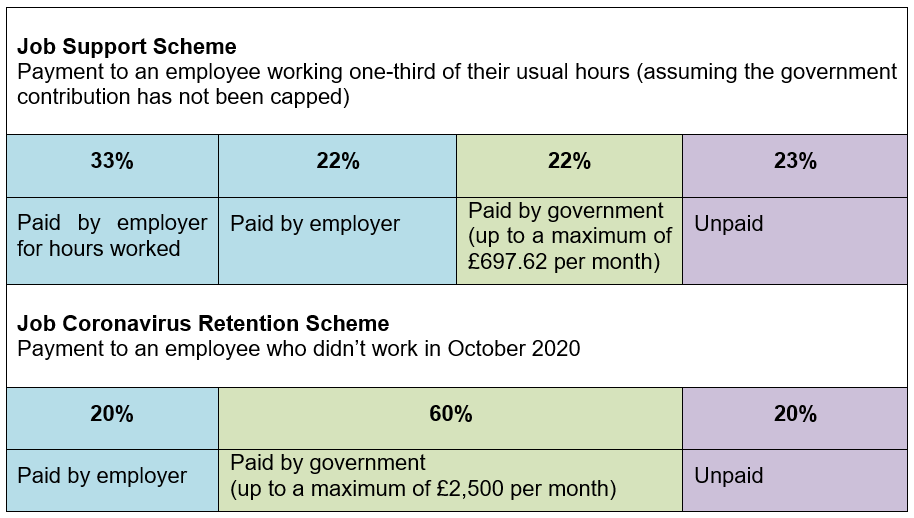

Furlough scheme and notice periods posted many readers will have watched with some bemusement the panic on twitter over the last fortnight caused by a sentence in hmrc guidance which said that employers can use the coronavirus job retention scheme to pay statutory notice. If an employees dismissed while theyre on furlough temporary leave their employer can still claim payments from hmrcs coronavirus job retention scheme during the notice period. Under the coronavirus jobs retention scheme to give furlough its official title employees placed on leave receive 80 of their pay up to a maximum of 2500 a month.

Pay the notice pay at 100 of contractual pay and recover the 80 2500 cap while it is available for all of the contractual notice period ie. If they have a statutory notice period notice pay must be the employees full normal pay even if theyve been getting paid. This is deemed the no risk strategy.

How Should Employers Approach Redundancies Over The Coming Months Limited Government History Definition

More From Limited Government History Definition

- Government Housing

- Self Employed Vs Freelance Uk

- Government Furlough Scheme Tax

- Government Contractor Resume

- Government Jobs Near Me Part Time

Incoming Search Terms:

- What S Happening With Furlough We Explain What Sunak S New Flexible Furlough Means For Workers This Is Money Government Jobs Near Me Part Time,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcthbbbvipypoaur 0il4i Akciuydoer1qjg1rgt O3u9j23hga Usqp Cau Government Jobs Near Me Part Time,

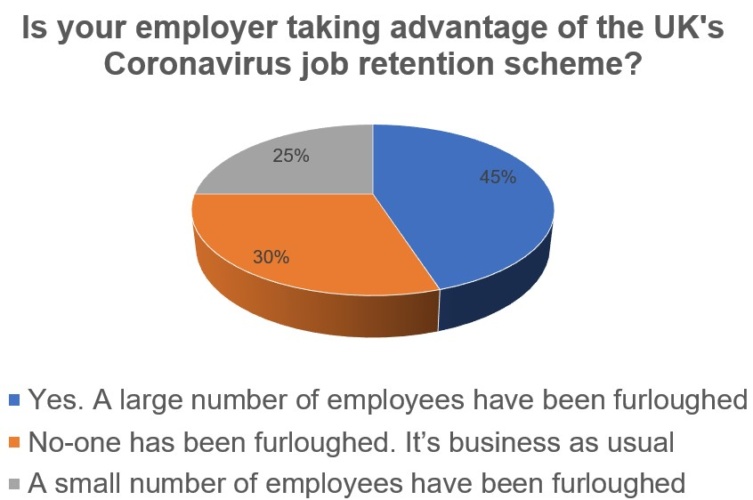

- Last Week S Poll Has Your Employer Furloughed Any Workers The Engineer The Engineer Government Jobs Near Me Part Time,

- Coronavirus Furlough Scheme To Finish At End Of October Says Chancellor Bbc News Government Jobs Near Me Part Time,

- Caronavirus Furlough An Update On The Job Retention Scheme Government Jobs Near Me Part Time,

- Furlough Scheme Updated Guidance 1 May 2020 Bhayani Law Government Jobs Near Me Part Time,