Self Employed Vs Freelance Uk, Contract Types And Employer Responsibilities Freelancers Consultants And Contractors Gov Uk

Self employed vs freelance uk Indeed recently is being sought by users around us, maybe one of you. Individuals are now accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the title of the post I will talk about about Self Employed Vs Freelance Uk.

- Top 10 Trending Countries For Freelancing In 2019

- Rise Of The Freelancer Key Demographics Leading Uk S Self Employed Sector Only Marketing Jobs

- What Is The Difference Between Self Employed And Freelance Uk News Express Co Uk

- Petition Allow Paye Freelancers To Receive The Uk Government S Covid 19 Self Employed Grant Change Org

- How To Register As Self Employed Uk Startups Co Uk

- 750 000 Self Employed Miss Out On Uk Coronavirus Support Study Enterprise Research Centre

Find, Read, And Discover Self Employed Vs Freelance Uk, Such Us:

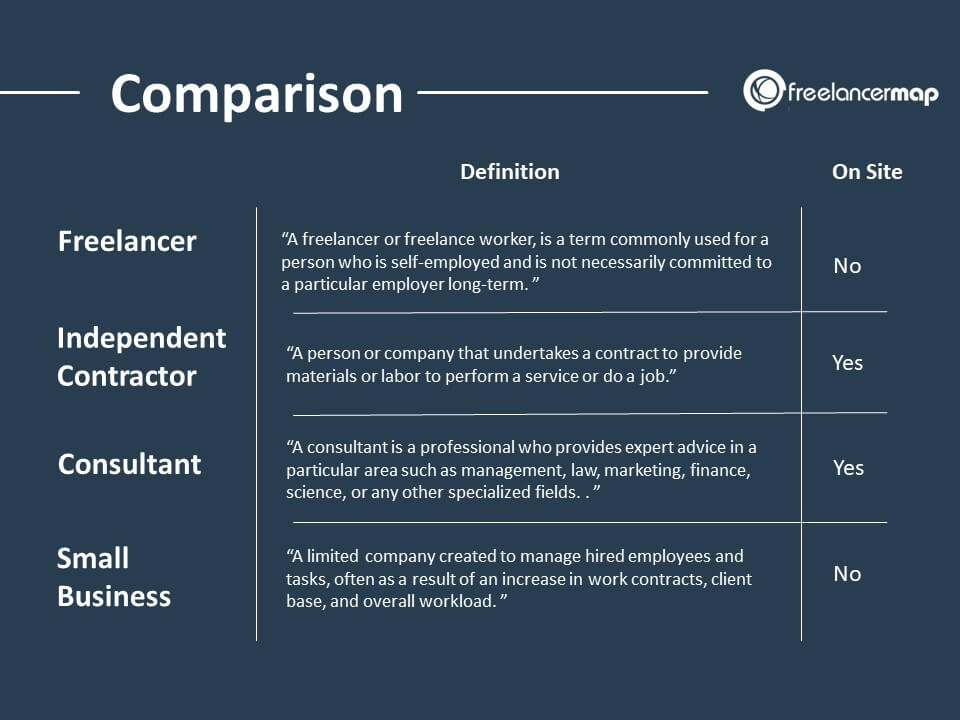

- Differences Between Contractors Freelancers Locums And Consultants Nixon Williams

- What S The Difference Between Self Employed And Sole Trader

- How To Avoid Debt If You Re Freelance Or Self Employed Metro News

- General Election 2019 What Self Employed Freelancers Are Promised Freelance Uk

- More British People Are Working For Themselves Indeed Blog

If you are searching for Furlough Scheme Sky News you've arrived at the right location. We ve got 102 images about furlough scheme sky news adding pictures, photos, pictures, wallpapers, and more. In such web page, we additionally have number of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

From a uk tax point of view freelancers come under the self employed umbrella and so theyre responsible for registering with hmrc as self employed and completing a self assessment tax return each year.

Furlough scheme sky news. There are countless different ways to be self employed. Being self employed or a freelancer is as different as apples and oranges. Its important to understand that freelance isnt a formal legal status but a way for you to describe how you work.

Self employed is there a need to choose between the two. If you start working for yourself youre classed as a sole trader. Now well dive into the differences between these two types of workers.

Freelance workers are always self employed but self employed workers arent always freelancers. For some workers freelancing is a gateway to being self employed. Novel coworking breaks down the main differences.

Think of it this way. People will be able to receive up to 2500 a month from the government for. This means youre self employed even if you havent yet told hm revenue and customs hmrcrunning a business.

Freelance work is a type of self employment that is carried out on a flexible basis and provided to a variety of different businesses. Under the new self employed income support scheme 95 percent of the uks self employed workers will now be covered. Thats never been the way that ive thought about myself.

Not that theres anything wrong with being a freelancer some of my best friends are freelancers. To answer this question there are many different factors to consider but the one major factor that is likely to attract freelancers is the tax saving that can be made by trading through a limited company as opposed to becoming self employed. Ive been self employed and giving business advice since 2000 but ive never called myself a freelancer.

Freelancers could work on big or small projects both short term and long term depending on what suits their skills availability and the employers needs. Thats because self employed or sole traders usually run their own startup businesses and focus.

More From Furlough Scheme Sky News

- China Government Debt To Gdp 2019

- Self Employed Limited Company

- Self Employed Workers Comp Exemption

- Government Expenditure Indonesia

- New Furlough Rules From November Calculator

Incoming Search Terms:

- General Election 2019 What Self Employed Freelancers Are Promised Freelance Uk New Furlough Rules From November Calculator,

- Uk Has 2 Million Freelancers And The Number Will Continue To Rise New Furlough Rules From November Calculator,

- The Female Freelance Fightback How To Raise Your Pay In 2020 The Young Money Blog New Furlough Rules From November Calculator,

- Contract Types And Employer Responsibilities Freelancers Consultants And Contractors Gov Uk New Furlough Rules From November Calculator,

- Petition Allow Paye Freelancers To Receive The Uk Government S Covid 19 Self Employed Grant Change Org New Furlough Rules From November Calculator,

- Self Employed Call For Coronavirus Help The Week Uk New Furlough Rules From November Calculator,